Analysis of Trades and Tips for Trading the Euro

The price test at 1.1521 coincided with the MACD indicator just beginning to move down from the zero mark, confirming the correct entry point for selling the euro. As a result, the pair only fell by 10 pips.

Demand for the euro returned, while the dollar plummeted after news that the US unemployment rate rose to 4.4% in September. Job loss, wage reductions, and loss of health insurance all significantly impact consumer purchasing power and, consequently, slow economic growth. Therefore, it is not surprising that average hourly earnings are also declining. Now, the Federal Reserve faces a tough decision, as there will be no new labor market data before the December interest rate decision.

In the first half of the day, data on the manufacturing PMI index for the Eurozone, the services PMI index, and the composite PMI index are expected. Shortly afterward, European Central Bank President Christine Lagarde will give a speech. The PMI index, or Purchasing Managers' Index, is a leading indicator of the region's economic health. A drop in the index below the 50 mark signals a contraction in business activity, while exceeding this mark indicates growth. If the data exceed economists' forecasts, the euro could see growth at the end of the week. Lagarde's speech is unlikely to have a significant impact on market sentiment; however, traders will analyze her words carefully in an attempt to identify hints of possible changes in monetary policy in the future.

Regarding the intraday strategy, I will focus more on the implementation of scenarios #1 and #2.

Buy Scenarios

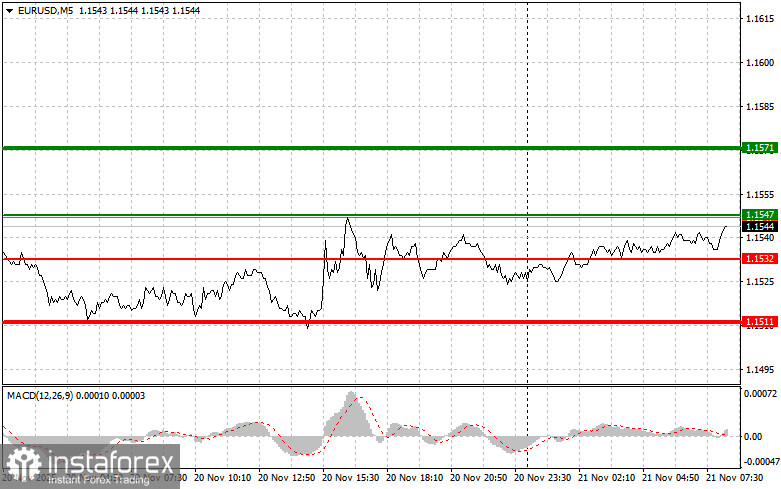

- Scenario #1: Today, I will consider buying the euro when the price reaches around 1.1547 (green line on the chart), with a target of 1.1571. At 1.1571, I plan to exit the market and also sell the euro in the opposite direction, anticipating a movement of 30-35 pips from the entry point. I can expect growth in the euro only after good data. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

- Scenario #2: I also plan to buy the euro today in case of two consecutive tests at 1.1532 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. One can expect a rise to the opposing levels of 1.1547 and 1.1571.

Sell Scenarios

- Scenario #1: I plan to sell the euro once it reaches 1.1532 (red line on the chart). The target will be the level of 1.1511, where I intend to exit the market and buy immediately in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). Pressure on the pair will return with weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just beginning its decline from it.

- Scenario #2: I also plan to sell the euro today if there are two consecutive tests at 1.1547 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downward. One can expect a decrease to the opposite levels of 1.1532 and 1.1511.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.