However, the US dollar is also rising, judging by market movements over the last month and a half. A paradox? No. It's the objective reality at this time. Demand for the currency has been steadily increasing for almost two months. Let me remind you that one and a half months of this period coincided with the "shutdown" in America, which cannot be considered a positive for the American economy. In early October, Donald Trump imposed new tariffs on imports of trucks, pharmaceuticals, and certain types of furniture. As a result, a "shutdown" was added to the trade war, which had already put significant pressure on the US currency in the first half of the year.

Additionally, in September, the Federal Reserve resumed its cycle of monetary policy easing, and shortly before that, the labor market began to "cool" sharply amid new US immigration and trade policies. In my opinion, neither in October nor in November did the market have strong reasons to buy the dollar.

Now, at the end of November, the Fed is very likely to lower the interest rate for the third consecutive time in December, while demand for the US currency remains unchanged. I cannot say that demand is high; the dollar is not soaring like crazy. Nevertheless, the US currency is appreciating even as the news backdrop points in the opposite direction for the past two months.

Consider this: the Fed is preparing for another "dovish" decision, yet the dollar shows no signs of concern. Indeed, the Nonfarm Payrolls report for September allowed dollar advocates to breathe a little easier, but the unemployment rate rose to 4.4%, and the September data should not be considered relevant, despite all due respect.

Currently, according to the CME FedWatch tool, futures markets assign a 71% probability of easing in December. This is significantly more than just a week ago. It turns out that markets have paid more attention to the unemployment rate than to payroll data, but again, the question arises: why is demand for the US dollar almost unchanged? I also remind you that wave analysis has been consistently indicating a continuation of the upward trend for several months. Nearly all factors and types of analysis imply selling the dollar, but this is not happening. Or will it happen in the near future?

Wave Analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend. The market has paused in recent months, but the policies of Donald Trump and the Federal Reserve remain significant factors in the US currency's future decline. The targets for the current trend segment may extend to the 25-figure. Currently, wave formation in the upward series may continue. I expect that, from current positions, the third wave of this series will begin, which could be either wave 3 or an "impulse." In the coming days, I am considering buying with targets near the 1.1740 mark, and an upward reversal of the MACD indicator will confirm this signal.

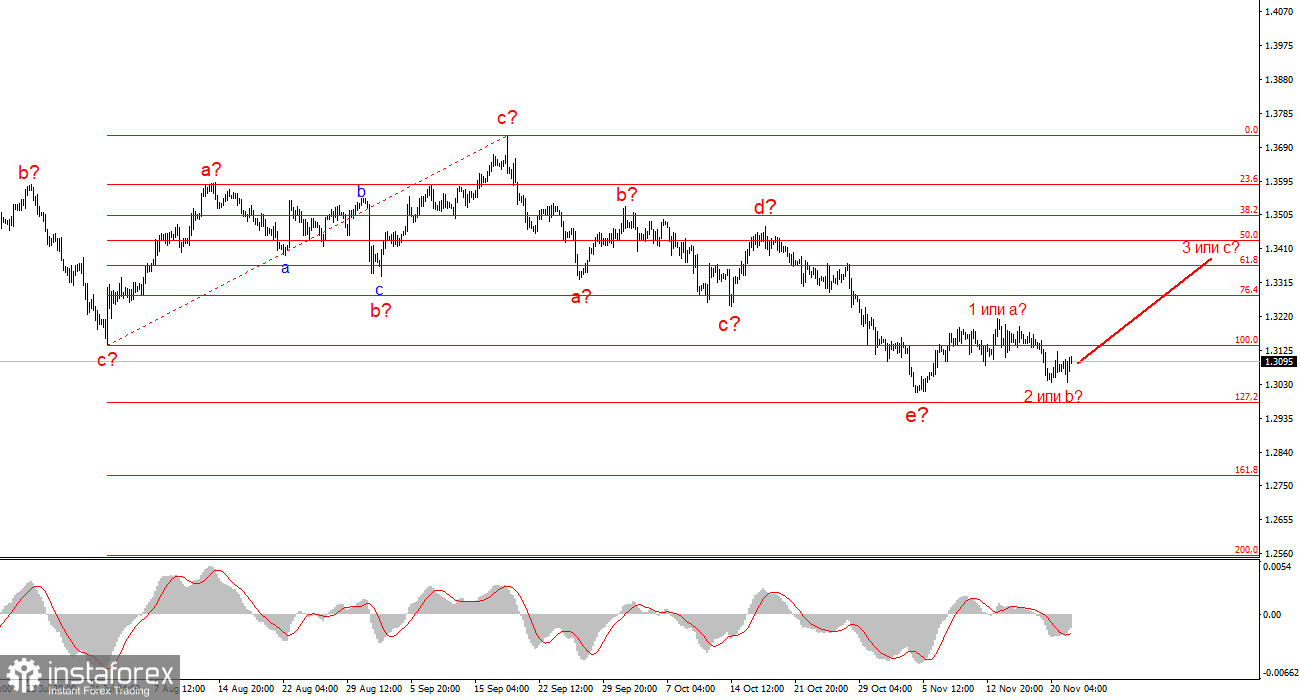

Wave Analysis for GBP/USD:

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive trend segment, but its internal wave structure has become complex. The downward correction structure a-b-c-d-e in a wave 4 appears to be quite complete. If this is indeed the case, I expect the main trend segment to resume construction, with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave 3 or an "impulse" with targets located around the 1.3280 and 1.3360 marks, which correspond to 76.4% and 61.8% Fibonacci retracements.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play back, and they often lead to changes.

- If there is no confidence in market movements, it is better not to enter.

- There is never 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other forms of analysis and trading strategies.