Trade Analysis and Advice for Trading the European Currency

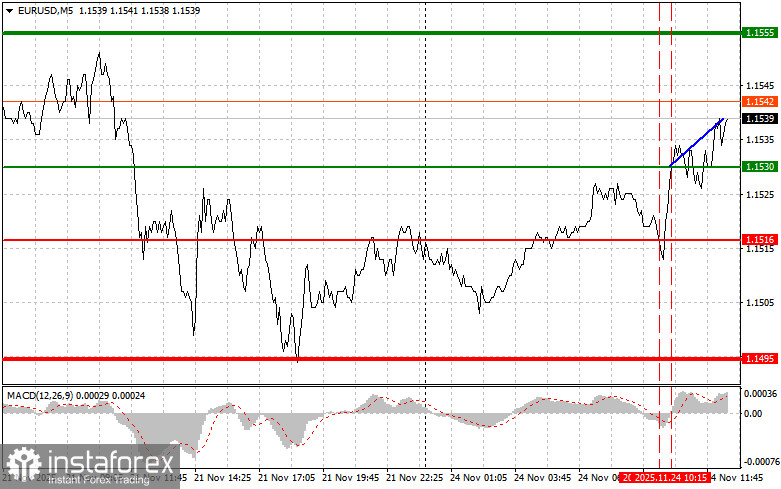

The price test at 1.1530 occurred when the MACD indicator had just started moving upward from the zero line, confirming a correct entry point for buying the euro. However, this did not lead to a significant rise in the pair.

Given fairly decent IFO data from Germany, demand for the euro persisted during the first half of the day. However, optimism remained cautious, as the overall economic picture in Europe is still uncertain. Investors are also closely monitoring geopolitical developments. Progress in resolving the Russia-Ukraine conflict could encourage purchases of risky assets, including the euro. Traders should also consider the long-term impact of Trump's tariffs on the financial system, so the euro's future dynamics will likely depend on multiple positive factors rather than a single one.

Unfortunately, in the second half of the day, there is no U.S. data. In the absence of fresh data from the States and Fed commentary, investors can only analyze the existing information and build forecasts based on it. This can lead to increased speculation and uncertainty in the market. Towards the close of trading, when European markets begin winding down and U.S. investors lack new guidance, volatility may increase. During such periods, even minor news or rumors can cause sharp price fluctuations. Currency pairs tied to the U.S. dollar are especially vulnerable.

For the intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

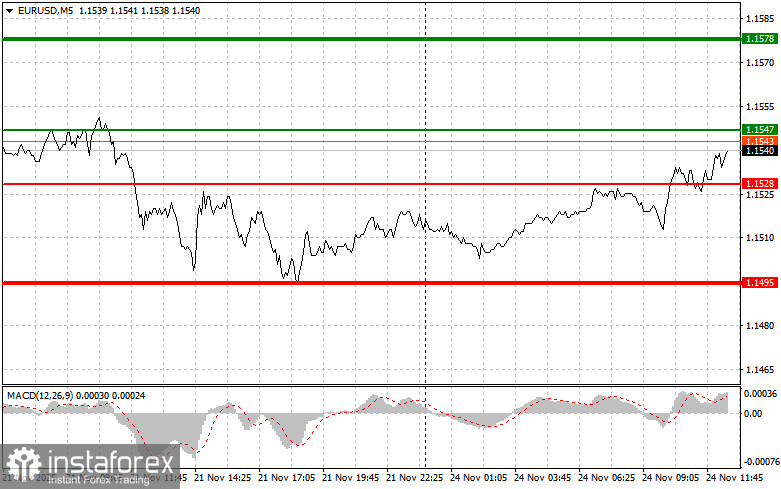

Scenario #1: Buy the euro at around 1.1547 (green line on the chart) with a target of 1.1578. Plan to exit the market at 1.1578 and also sell euros in the opposite direction, expecting a move of 30–35 points from the entry point. Today, euro growth is expected only within a small correction.

Important: Before buying, make sure the MACD indicator is above zero and just starting its upward movement.

Scenario #2: Buy the euro if the price tests 1.1528 twice consecutively while the MACD is in the oversold area. This limits the downward potential of the pair and triggers a market reversal upward. Growth can be expected to 1.1547 and 1.1578.

Sell Signal

Scenario #1: Sell the euro after it reaches 1.1528 (red line on the chart). The target is 1.1495, where you plan to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points). Pressure on the pair may return at any time today.

Important: Before selling, ensure the MACD indicator is below zero and just starting its downward movement.

Scenario #2: Sell the euro if the price tests 1.1547 twice consecutively while the MACD is in the overbought area. This limits upward potential and triggers a market reversal downward. Expect declines to 1.1528 and 1.1495.

What's on the Chart

- Thin green line: Entry price for buying the instrument.

- Thick green line: Suggested Take Profit or exit level, as further growth above this is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Suggested Take Profit or exit level, as further decline below this is unlikely.

- MACD indicator: Important to consider overbought/oversold zones when entering trades.

Important Notes for Beginners:

Beginner Forex traders must be very cautious when entering trades. It is best to stay out of the market before major fundamental reports to avoid sharp price fluctuations. If trading during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if trading large volumes without proper money management.

Remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on the current market situation are inherently a losing strategy for intraday traders.