Trade Analysis and Advice for Trading the British Pound

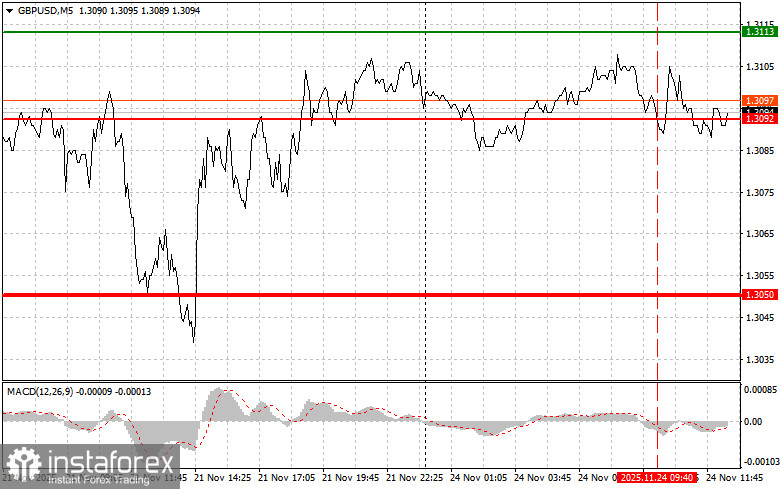

The price test at 1.3092 occurred when the MACD indicator had already moved significantly downward from the zero line, which limited the pair's downward potential. For this reason, I did not sell the pound.

With no major statistics released, the pound showed very low volatility. Market attention is focused on Rishi Sunak's new budget, which will be presented on November 26. The market expects the new budget to include measures to stimulate economic growth and plans for reducing public debt. Investors will carefully watch for any signals that might indicate future monetary policy from the Bank of England.

Unfortunately, in the second half of the day, there is no U.S. data, and no speeches or interviews from Federal Reserve officials are scheduled. Nevertheless, there is still some potential for the pound to strengthen. Investors continue to assess recent Fed statements about further rate cuts, which puts pressure on the U.S. dollar. Additionally, a reduction in geopolitical tensions worldwide, including the situation around Ukraine, also supports the pound.

For the intraday strategy, I will primarily rely on Scenario #1 and Scenario #2.

Buy Signal

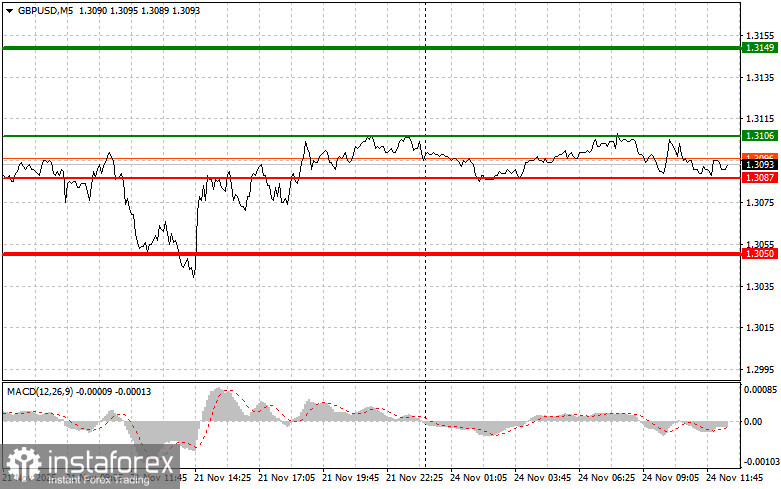

Scenario #1: Buy the pound at around 1.3106 (green line on the chart) with a target of 1.3149 (thicker green line). At 1.3149, plan to exit long positions and open short positions in the opposite direction, expecting a move of 30–35 points from the level. Pound growth today is expected only as part of a further correction.

Important: Before buying, make sure the MACD indicator is above zero and just starting to rise.

Scenario #2: Buy the pound if the price tests 1.3087 twice consecutively while the MACD is in the oversold area. This limits the downward potential and triggers a market reversal upward. Expected growth levels are 1.3106 and 1.3149.

Sell Signal

Scenario #1: Sell the pound after it reaches 1.3087 (red line on the chart), which will likely cause a quick decline in the pair. The key target for sellers is 1.3050, where you plan to exit the short position and immediately buy in the opposite direction (expecting a 20–25 point move). Pressure on the pound is unlikely to return today.

Important: Before selling, ensure the MACD indicator is below zero and just starting its downward movement.

Scenario #2: Sell the pound if the price tests 1.3106 twice consecutively while the MACD is in the overbought area. This limits upward potential and triggers a market reversal downward. Expected declines are 1.3087 and 1.3050.

What's on the Chart

- Thin green line: Entry price for buying the instrument.

- Thick green line: Suggested Take Profit or exit level, as further growth above this is unlikely.

- Thin red line: Entry price for selling the instrument.

- Thick red line: Suggested Take Profit or exit level, as further decline below this is unlikely.

- MACD indicator: Important to consider overbought/oversold zones when entering trades.

Important Notes for Beginners:

Beginner Forex traders must be very cautious when entering trades. It is best to stay out of the market before major fundamental reports to avoid sharp price fluctuations. If trading during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if trading large volumes without proper money management.

Remember: successful trading requires a clear trading plan, like the one outlined above. Spontaneous decisions based on the current market situation are inherently a losing strategy for intraday traders.