Monday Trade Analysis:

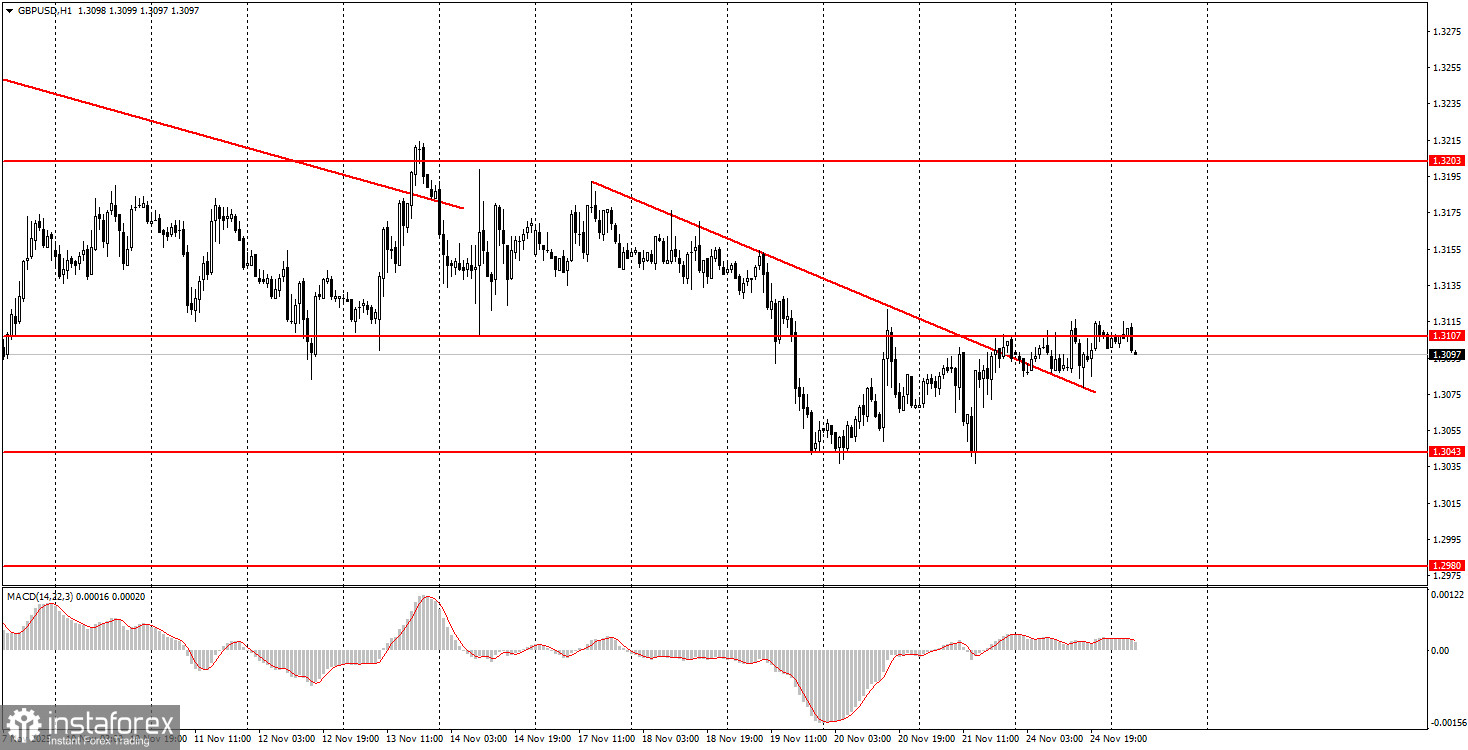

1H Chart of the GBP/USD Pair

The GBP/USD pair did not trade on Monday. Of course, this could not have been the case in reality, but in terms of market movements in the British pound, there was a noticeable absence, clearly visible on any timeframe. Thus, there is essentially nothing to analyze based on yesterday's data. We could write a bunch of unnecessary information about the speeches of various officials or geopolitical events, but what is the point if the market shows no interest in this information and does not react? Overall, the British pound has been trading within another sideways channel for three consecutive days. This time, it is between 1.3043 and 1.3107. Another descending trend line has been broken, but we have seen this phenomenon about five times in recent months. In all previous cases, the market found no grounds for further purchases of the pair. The macroeconomic background on Monday was absent, and it will be very limited throughout the week. Thus, nothing indicates an increase in market volatility.

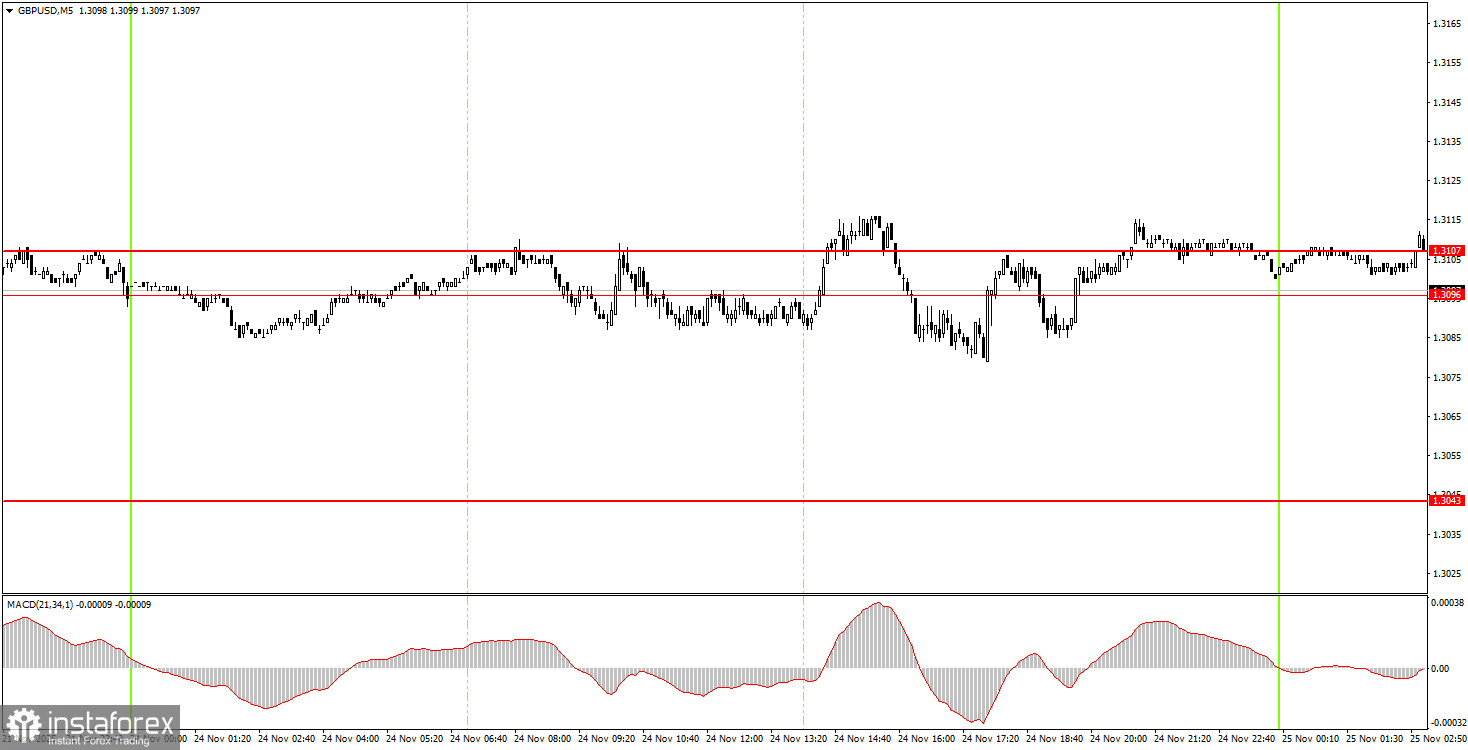

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, the nature of the pair's movement on Monday is clearly visible. The price generated several trading signals in the 1.3096-1.3107 area, which serves as the upper boundary of the sideways channel. However, as we can see, it neither bounced off nor broke through this level. On Monday, we observed a range-bound market within a range-bound market.

How to Trade on Tuesday:

On the hourly timeframe, the GBP/USD pair is trying to complete another downward trend but is currently trading within another range. As we can see, even from a technical standpoint, the pair's movements lately are hardly logical. As we mentioned, there are no global grounds for prolonged dollar growth, so in the medium term, we expect movements only to the North. However, the daily timeframe correction/range is incomplete, and the local macroeconomic backdrop regularly affects the British pound.

On Tuesday, novice traders can expect new trading signals to form in the area of 1.3096-1.3107. A bounce from this area would allow short positions targeting 1.3043, while a consolidation above it would enable long positions targeting 1.3203.

On the 5-minute timeframe, trading can currently occur at 1.2913, 1.2980-1.2993, 1.3043, 1.3096-1.3107, 1.3203-1.3211, 1.3259, 1.3329-1.3331, 1.3413-1.3421, 1.3466-1.3475, 1.3529-1.3543, 1.3574-1.3590. No interesting events are scheduled in the UK for Tuesday, while three reports will be released in the U.S., which may provoke slight volatility: the Producer Price Index, ADP, and Retail Sales.

Key Principles of My Trading System:

- The strength of the signal is considered based on the time taken to form the signal (bounce or breach of a level). The less time taken, the stronger the signal.

- If two or more trades have been opened around a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can create numerous false signals or may not form them at all. In any case, it's best to stop trading at the first signs of a flat.

- Trading deals are opened during the period between the start of the European session and the middle of the American session, after which all deals should be closed manually.

- On the hourly timeframe, it is preferable to trade based on signals from the MACD indicator only when there is good volatility and a trend that is confirmed by a trend line or trend channel.

- If two levels are too close to each other (between 5 and 20 pips), they should be treated as an area of support or resistance.

- After a 20-pip move in the right direction, a Stop Loss should be set to breakeven.

What the Charts Show:

- Support and resistance price levels are targets for opening buy or sell positions. Take Profit levels can be placed around them.

- Red lines indicate trend channels or trend lines, reflecting the current trend and indicating the preferred trading direction.

- The MACD indicator (14,22,3) — histogram and signal line — is a supplementary indicator that can also be used as a source of signals.

Important announcements and reports (always available in the news calendar) can significantly impact the movement of the currency pair. Therefore, during their release, it is recommended to trade with maximum caution or to exit the market to avoid sharp reversals against the preceding movement.

Beginners trading on the Forex market should remember that not every trade can be profitable. Developing a clear strategy and money management is key to long-term success in trading.