Yesterday, Bitcoin surprised with its persistence, rising to $89,200. Ethereum also performed well, stopping just one step away from $3,000.

Yesterday, the open interest in BTC showed the sharpest 30-day decline of the current cycle. The last time this occurred was during the 2022 bear market. This indicates that a serious "cleaning" of the market, which everyone has been anticipating, has partially taken place. Many investors closed losing trades after a week of declines and liquidations. Historically, all of this creates conditions for forming a bottom and the subsequent recovery of the long-term bullish trend.

Although the recovery will not be instantaneous, these signs indicate that the weakest hands have exited the market, leaving room for more confident and long-term investors. It is essential to note that bottom formation is a process, not an event. Further fluctuations and periods of uncertainty alongside significant pullbacks in Bitcoin and Ethereum are possible. It is unlikely that anyone can confidently say that the worst is behind us now.

Of course, the external macroeconomic background still plays an essential role. Inflation, interest rates, and geopolitical conditions can adjust BTC's trajectory. Nonetheless, internal stability and fundamental factors continue to support the long-term potential of cryptocurrencies.

Regarding the intraday strategy in the cryptocurrency market, I will continue to act on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of the bullish market in the medium term, which remains very much in place.

As for short-term trading, the strategy and conditions are outlined below.

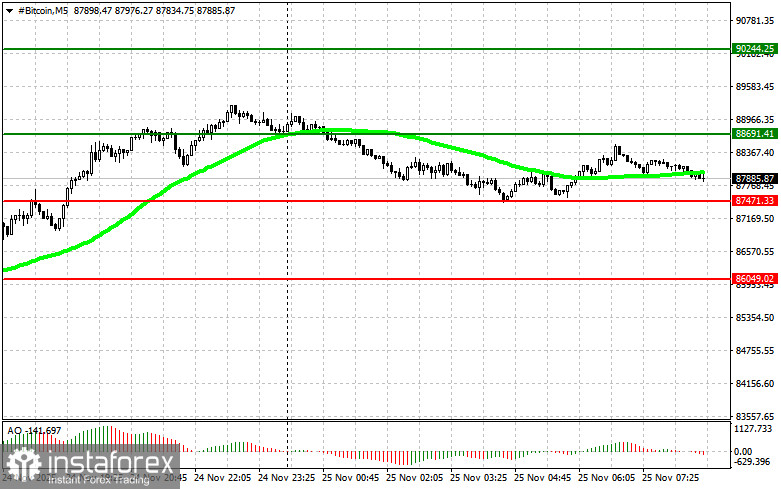

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin today upon reaching an entry point around $88,700, targeting a move to $90,200. Around $90,200, I will exit my purchases and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: I can buy Bitcoin from the lower boundary of $87,400 if there is no market reaction after breaking this level to the upside towards $88,600 and $90,200.

Sell Scenario

Scenario #1: I will sell Bitcoin today upon reaching an entry point around $87,400, targeting a decline to $86,000. Around $86,000, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: I can sell Bitcoin from the upper boundary of $88,700 if there is no market reaction after breaking this level to the downside towards $87,400 and $86,000.

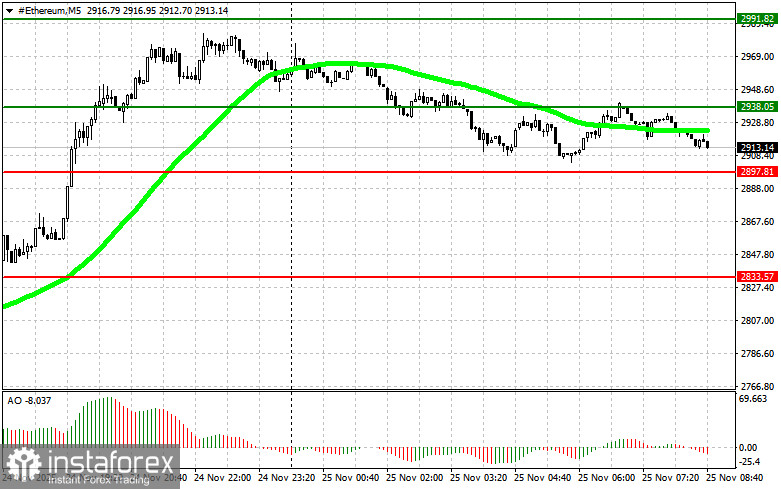

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum today upon reaching an entry point around $2,938, targeting a move to $2,991. Around $2,991, I will exit my purchases and sell immediately on the bounce. Before buying on a breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is above zero.

Scenario #2: I can buy Ethereum from the lower boundary of $2,897 if there is no market reaction after breaking this level to the upside towards $2,938 and $2,991.

Sell Scenario

Scenario #1: I will sell Ethereum today upon reaching an entry point around $2,897, targeting a decline to $2,833. Around $2,833, I will exit my sales and buy immediately on the bounce. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is below zero.

Scenario #2: I can sell Ethereum from the upper boundary of $2,938 if there is no market reaction after breaking this level to the downside towards $2,897 and $2,833.