Analysis of Trades and Tips for Trading the British Pound

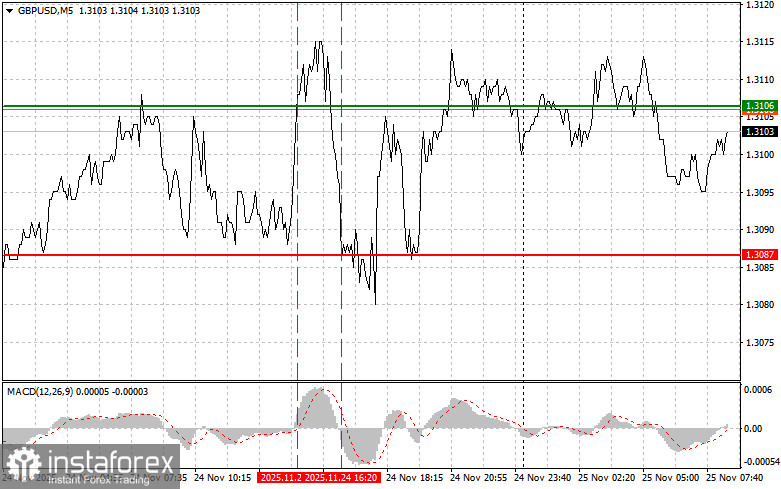

The test of the price at 1.3087 occurred when the MACD indicator had moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound.

The absence of U.S. data weighed on the dollar against the British pound, prompting traders to adopt a wait-and-see approach and keeping the pair within the channel. However, attention is now focused on the new UK budget, which will be presented tomorrow. Expectations for this event are so high that significant movements in the pound today are unlikely. Tomorrow's budget will be crucial for the UK's economy in the coming months. The markets will be closely monitoring the government's plans to stabilize the economy, reduce inflation, and support businesses. Especially important are measures to address the energy crisis and support households. The uncertainty surrounding the new budget adds additional pressure on the British pound.

Today, an important report on the state of retail trade prepared by the Confederation of British Industry will be published in the first half of the day. This report is a significant indicator of consumer sentiment and the health of the British economy. A thorough analysis of the data presented will help understand how retail companies are overcoming challenges related to inflation and overall economic instability. Based on surveys of retail businesses, the Confederation of British Industry regularly publishes reports containing important information about current trends and forecasts in this sector. Retail sales indices serve as a tool for measuring consumer activity, reflecting the population's willingness to make purchases. In conditions of inflation and high interest rates, this indicator takes on special significance. Weak figures will put pressure on the British pound, while a strong report is unlikely to help the GBP/USD pair rise for the reasons stated above.

Regarding the intraday strategy, I will rely more on the implementation of Scenarios #1 and #2.

Buy Scenarios

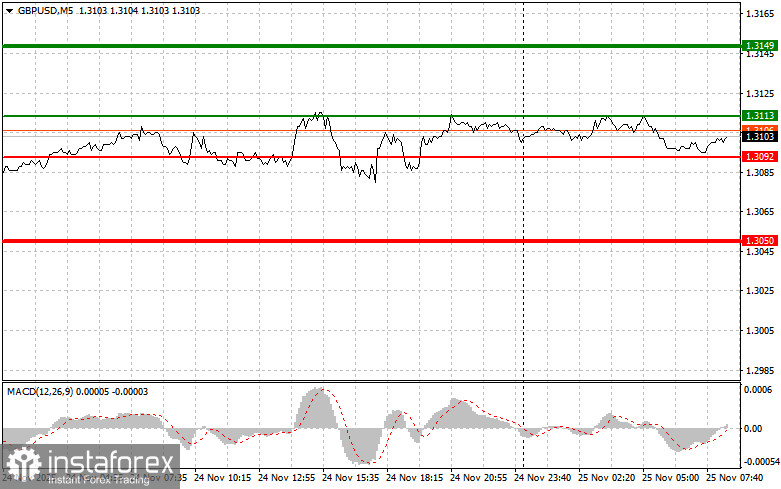

Scenario #1: I plan to buy the pound today upon reaching an entry point around 1.3113 (green line on the chart), targeting a move to 1.3149 (thicker green line on the chart). At around 1.3149, I intend to exit my long positions and open shorts in the opposite direction (anticipating a movement of 30-35 pips in the opposite direction from the level). Relying on the pound's growth is only realistic within the channel. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting an upward move from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3092 twice in a row while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposing levels of 1.3113 and 1.3149.

Sell Scenarios

Scenario #1: I plan to sell the pound today after updating the level to 1.3092 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the level of 1.3050, where I plan to exit my shorts and immediately open longs in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). Pound sellers will emerge if the data is weak. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting its downward move.

Scenario #2: I also plan to sell the pound today if the price tests 1.3113 twice in a row while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected towards the opposing levels of 1.3092 and 1.3050.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.