Analysis of Trades and Tips for Trading the Japanese Yen

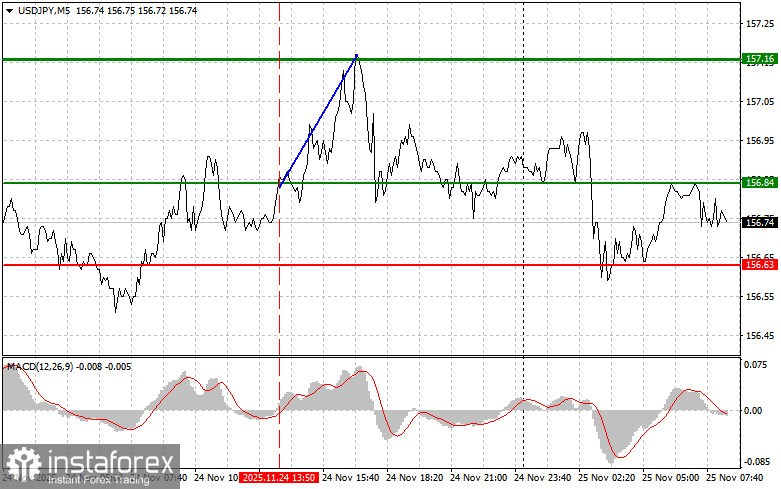

The test of the price at 156.84 coincided with the moment the MACD indicator was beginning to move upward from the zero mark, confirming the right entry point for buying the dollar. As a result, the pair rose towards the target level of 157.16.

The dollar only briefly rose against the Japanese yen, but there was no significant support from buyers. The USD/JPY pair continues to consolidate, with the bullish trend remaining intact. The temporary rise in the dollar against the yen can be seen as an attempt to sustain its climb amid broader upward momentum. The lack of a significant influx of buyers suggests traders are currently hesitant and prefer to remain in a wait-and-see stance. They may be anticipating new economic data or political statements that could provide a clearer picture of the currency pair's prospects. The consolidation of USD/JPY reflects a struggle between bulls and bears. On one hand, there is confidence in the ongoing strengthening of the dollar, supported by the difference in monetary policy between the U.S. Federal Reserve and the Bank of Japan. On the other hand, there are risks related to government intervention in the current exchange rate of the Japanese yen, which has reached serious lows against the dollar.

Regarding the intraday strategy, I will rely more on the implementation of Scenarios #1 and #2.

Buy Scenarios

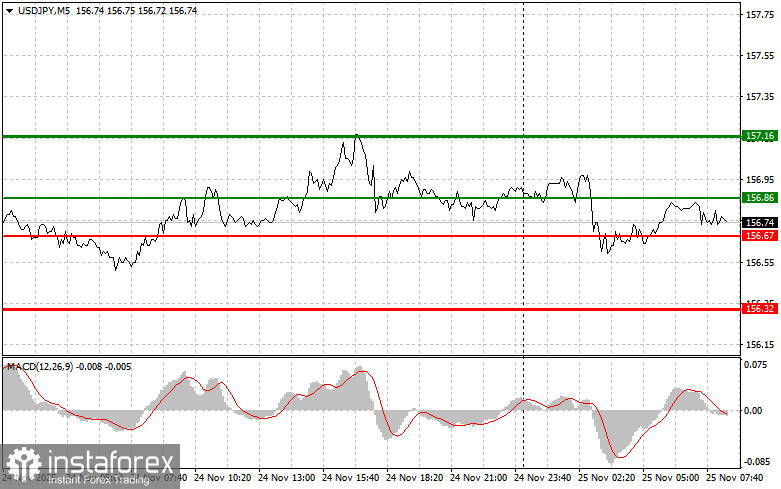

Scenario #1: I plan to buy USD/JPY today upon reaching an entry point around 156.86 (green line on the chart), targeting a move to 157.16 (thicker green line on the chart). At around 157.16, I intend to exit my long positions and open shorts in the opposite direction (anticipating a movement of 30-35 pips in the opposite direction from the level). It's best to return to the pair for purchases during corrections and serious pullbacks of USD/JPY. Important! Before buying, ensure the MACD indicator is above the zero mark and just beginning an upward move from it.

Scenario #2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price at 156.67 while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth can be expected towards the opposing levels of 156.86 and 157.16.

Sell Scenarios

Scenario #1: I plan to sell USD/JPY today only after updating the level to 156.67 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the level of 156.32, where I plan to exit my shorts and immediately open longs in the opposite direction (anticipating a movement of 20-25 pips in the opposite direction from the level). It's better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its downward movement from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 156.86 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline can be expected towards the opposing levels of 156.67 and 156.32.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.