Only the British pound did I try to trade today using the Mean Reversion strategy, but even there I did not wait for a strong downward reversal. Using the Momentum strategy, I traded the Japanese yen, which rose sharply against the U.S. dollar.

According to the report, Germany's GDP in the third quarter of this year remained unchanged compared to the second quarter. Although zero growth has increased the chances of a technical recession, the sense of industrial stagnation is causing more serious concern. Economists warn that without significant changes in policy and external factors, Germany may face a prolonged period of economic decline. The impact of this downturn may spread far beyond Germany's borders, affecting the entire European economy and global markets.

Later today we expect data on the U.S. Producer Price Index for September of this year, changes in retail sales volumes, and the Richmond Fed manufacturing index. These data will provide important information about the health of the American economy and will therefore have a noticeable impact on market sentiment. The Producer Price Index is a key indicator of inflationary pressure, reflecting changes in the prices producers receive for their goods. Higher-than-expected PPI readings may signal further price increases, which could in turn encourage the Federal Reserve to return to a wait-and-see stance.

Changes in retail sales, on the other hand, reflect consumer spending, which accounts for a significant share of U.S. GDP. Steady growth in retail sales indicates a strong economy, whereas a decline may indicate weakening consumer demand, which would put pressure on the dollar. Finally, the Richmond Fed manufacturing index is a regional economic indicator that evaluates conditions in the manufacturing sector. Although it does not have the same broad coverage as national data, it can still provide valuable insight into the state of U.S. manufacturing.

In the case of strong statistics, I will rely on implementing the Momentum strategy. If the market does not react to the data, I will continue using the Mean Reversion strategy.

Momentum Strategy (Breakout Trading) for the Second Half of the Day:

For EURUSD

- Buying on a breakout of 1.1551 may lead to euro growth toward 1.1584 and 1.1607;

- Selling on a breakout of 1.1522 may lead to a decline of the euro toward 1.1490 and 1.1440;

For GBPUSD

- Buying on a breakout of 1.3140 may lead to pound growth toward 1.3176 and 1.3205;

- Selling on a breakout of 1.3115 may lead to a decline of the pound toward 1.3080 and 1.3060;

For USDJPY

- Buying on a breakout of 156.60 may lead to dollar growth toward 157.06 and 157.40;

- Selling on a breakout of 156.23 may lead to dollar sell-offs toward 155.87 and 155.54;

Mean Reversion Strategy (Reversal Trading) for the Second Half of the Day:

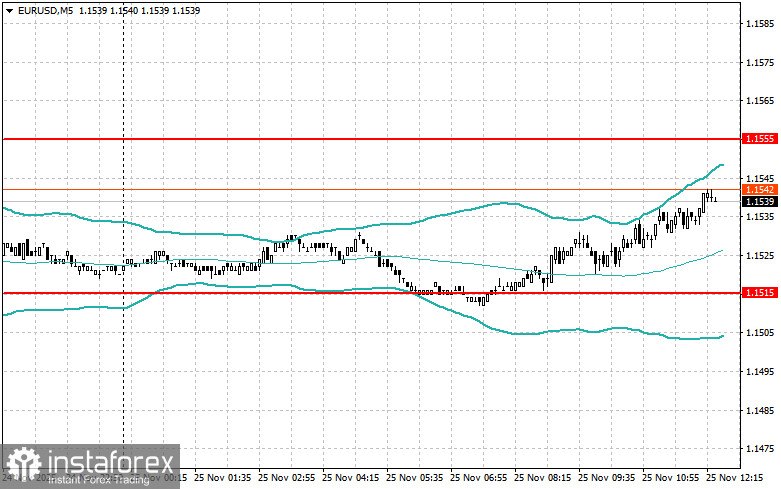

For EURUSD

- I will look for selling opportunities after a failed breakout above 1.1555 followed by a return below this level;

- I will look for buying opportunities after a failed breakout below 1.1515 followed by a return to this level;

For GBPUSD

- Selling opportunities will be sought after a failed breakout above 1.3152 followed by a return below this level;

- Buying opportunities will be sought after a failed breakout below 1.3098 followed by a return to this level;

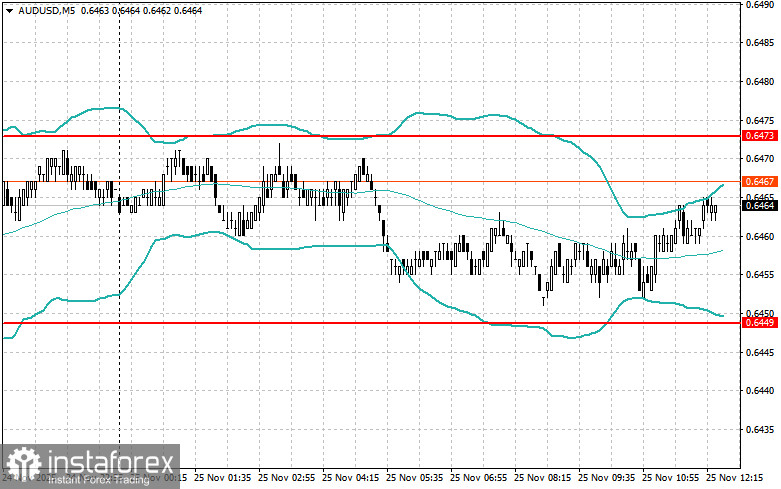

For AUDUSD

- Selling opportunities will be sought after a failed breakout above 0.6473 followed by a return below this level;

- Buying opportunities will be sought after a failed breakout below 0.6449 followed by a return to this level;

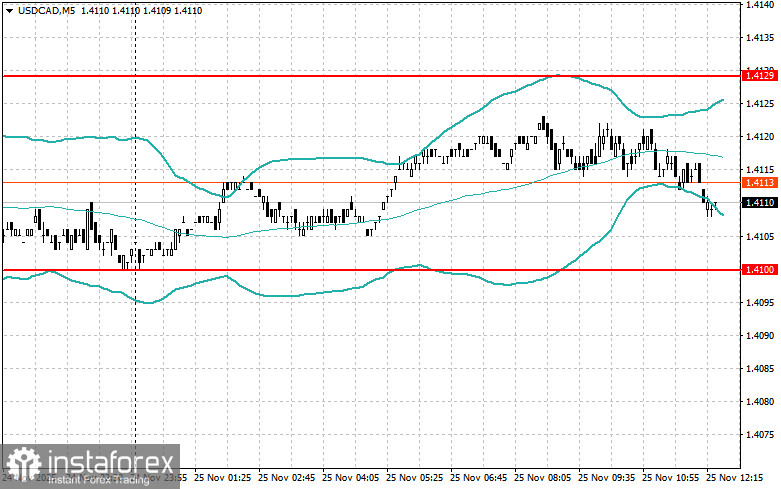

For USDCAD

- Selling opportunities will be sought after a failed breakout above 1.4129 followed by a return below this level;

- Buying opportunities will be sought after a failed breakout below 1.4100 followed by a return to this level;