Analysis of Trades and Recommendations for Trading the European Currency

The test of the 1.1527 price level occurred at a moment when the MACD indicator had already moved far above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.1527 led to the implementation of scenario No. 2 for selling the euro; however, losses were recorded on the trade since the pair did not show any downward reversal.

Germany's economy posted zero GDP growth in the third quarter of this year. These expected data supported the euro's exchange rate and did not attract new sellers into the market. However, a warning sign is the slowdown in export growth, which the German economy traditionally relies on. Weakening global demand caused by geopolitical instability and trade wars is putting significant pressure on the competitiveness of German goods in global markets. In the context of GDP stagnation and weakening external trade positions, the German government will continue facing the difficult task of stimulating economic growth. However, the effectiveness of these measures may be limited by several factors, including high interest rates from the ECB.

In the second half of the day, our attention will be focused on the release of several U.S. economic indicators for September: price dynamics in the industrial sector, changes in retail sales, and the Richmond Fed manufacturing index. These reports are expected to clarify the current state of the American economy and will have a significant impact on market sentiment. The PPI index allows us to assess inflationary pressure by capturing fluctuations in the prices producers receive domestically. Actual PPI values exceeding forecasts may indicate further inflationary growth for consumers, which may, in turn, push the Federal Reserve toward tighter monetary policy. Retail sales dynamics reflect consumer activity. Steady retail growth signals a healthy economy, while a decline may point to weakening consumer demand and the approach of economic slowdown.

As for intraday strategy, I will rely primarily on implementing scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1:

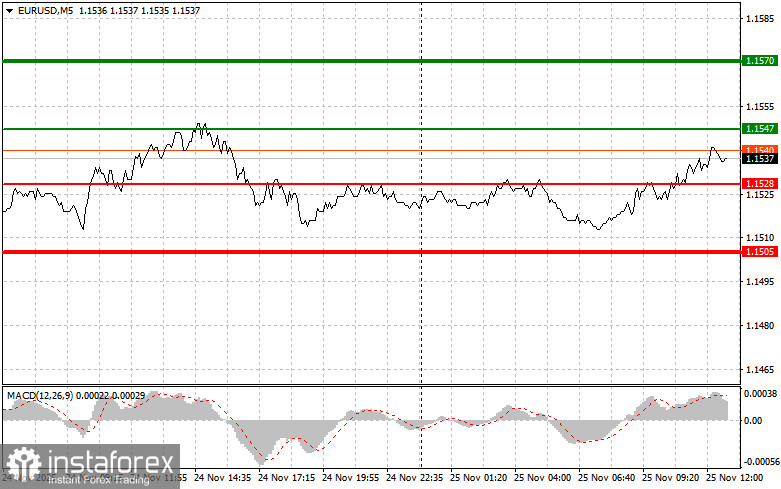

Today, buying the euro is possible when the price reaches the level of 1.1547 (green line on the chart) with the target of rising to 1.1570. At 1.1570, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. Counting on euro growth today will only be possible after weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2:

I also plan to buy the euro today in the case of two consecutive tests of the 1.1528 price level at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. A rise toward the opposite levels of 1.1547 and 1.1570 can be expected.

Sell Signal

Scenario No. 1:

I plan to sell the euro after reaching the 1.1528 level (red line on the chart). The target will be 1.1505, where I intend to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points from the level in the reverse direction). Pressure on the pair will return today if the statistics are strong.Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2:

I also plan to sell the euro today in the case of two consecutive tests of the 1.1547 level at a time when the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels 1.1528 and 1.1505 can be expected.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – the estimated price where you can place Take Profit or manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – the estimated price where you can place Take Profit or manually fix profit, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important. Beginner Forex traders must make market entry decisions very cautiously. Before the release of major fundamental reports, it is best to stay out of the market to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires having a clear trading plan—such as the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.