Trade Analysis and Tips for Trading the British Pound

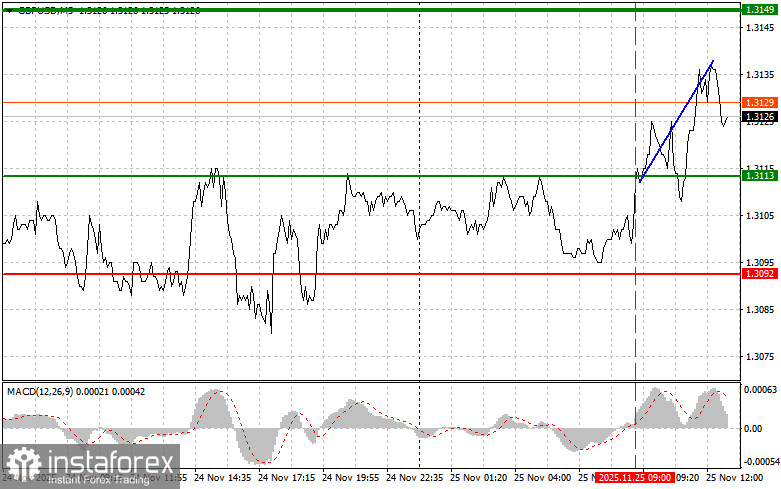

The test of the 1.3113 price occurred when the MACD indicator had just begun to move upward from the zero mark, which confirmed a correct entry point for buying the pound. As a result, the pair rose by more than 20 points.

The pound strengthened amid expectations that tomorrow's UK budget will still receive approval. Investors appear to be betting on Reeves's ability to convince both party colleagues and the broader public of the necessity of the proposed measures, despite the potential unpopularity of tough decisions. However, optimism regarding the budget is not universal. Complex geopolitical realities and domestic economic instability may offset any positive effects. Issues concerning inflation, interest rates, and the budget deficit remain relevant, and any disappointment in tomorrow's budget could quickly erase the pound's recent gains.

In the second half of the day, attention will shift to the release of several U.S. economic indicators. Investors will closely analyze U.S. producer inflation data to understand how persistent the pressure on price growth remains and whether the Federal Reserve can achieve its inflation-control goals. Retail sales, meanwhile, will provide insight into consumer demand, a key driver of the U.S. economy. A decline in retail sales may signal slower economic growth and potentially weaker corporate financial performance. The Richmond Fed Manufacturing Index will serve as an additional indicator of industrial sector conditions. An increase in the index will signal expanding manufacturing activity, while a decrease may indicate contraction. If the data are weak, the pound will continue rising against the dollar.

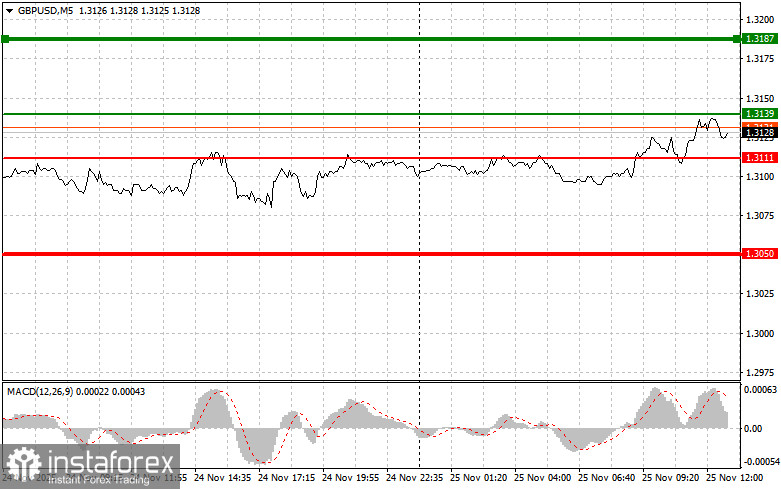

As for the intraday strategy, I will rely more on Scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3139 (green line on the chart) with a target of rising to 1.3187 (thicker green line on the chart). Near 1.3187, I will exit buy positions and open sell positions in the opposite direction (expecting a 30–35-point reversal from that level). A rise in the pound today can be expected only after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in case of two consecutive tests of the 1.3111 price at a time when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. Growth to the opposite levels of 1.3139 and 1.3187 may be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the 1.3111 level is broken (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the 1.3050 level, where I will exit sell positions and immediately open buy positions in the opposite direction (expecting a 20–25-point reversal from that level). Pressure on the pound will return today if the data are strong. Important! Before selling, make sure the MACD indicator is below the zero mark and is just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today in case of two consecutive tests of the 1.3139 price at a time when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a downward reversal. A decline to the opposite levels of 1.3111 and 1.3050 may be expected.

Chart Legend:

- Thin green line – entry price at which the instrument can be bought

- Thick green line – approximate price where Take Profit can be placed or profits manually locked in, since further rise above this level is unlikely

- Thin red line – entry price at which the instrument can be sold

- Thick red line – approximate price where Take Profit can be placed or profits manually locked in, since further decline below this level is unlikely

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones

Important

Beginner Forex traders must be very cautious when making entry decisions. Before important fundamental reports are released, it is best to stay out of the market to avoid sharp price swings. If you choose to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.