The dollar lost considerable ground against the euro, the pound, and other risk assets yesterday, and there were specific reasons for this. A sharp drop in the US consumer confidence index and retail sales volume weighed on the US dollar. Traders noted signs of slowing US economic growth, undermining confidence in the Federal Reserve's aggressive monetary policy. Conversely, the European currency received support from German inflation data.

As for the pound, it surged against the dollar. Additional support for the GBP/USD pair came from news that the UK will increase the minimum wage by 4.1%. Traders viewed this as a sign of growing inflationary pressure in the future. However, some experts are concerned that the wage increase may put pressure on businesses, particularly small businesses, and lead to job cuts. Others argue that higher wages will boost productivity and stimulate innovation. Meanwhile, the Bank of England is likely to monitor the situation closely and assess the potential impact of this move on inflation. If inflation rises too quickly, the BoE may consider returning to interest rate hikes, which are already at a relatively high level.

Regarding today, the European Central Bank's financial stability report is expected in the first half of the day, along with a speech by ECB President Christine Lagarde. The report is anticipated to address key risks to the eurozone financial system, including the impacts of inflation, trade tariffs, and geopolitical tensions. Special attention will likely be paid to the resilience of the banking sector to potential shocks, as well as the state of the real estate market and corporate debt. Lagarde's speech, which will follow the report publication, will provide another important opportunity to gain insights into the regulator's stance.

As for the pound, the UK budget for the next financial year will be presented today. There is a tense anticipation in Whitehall, as analysts and business leaders closely watch for any hints regarding the government's political priorities and their potential impact on the economy. Key themes of the budget are expected to include support for growth, productivity enhancement, and addressing high inflation issues. However, the most crucial aspect is how the treasury will address the budget gaps that have emerged this year.

If the data aligns with economists' expectations, it is advisable to employ a Mean Reversion strategy. If the data significantly exceeds or falls short of economists' expectations, a Momentum strategy is the best approach.

Momentum Strategy (Breakout):

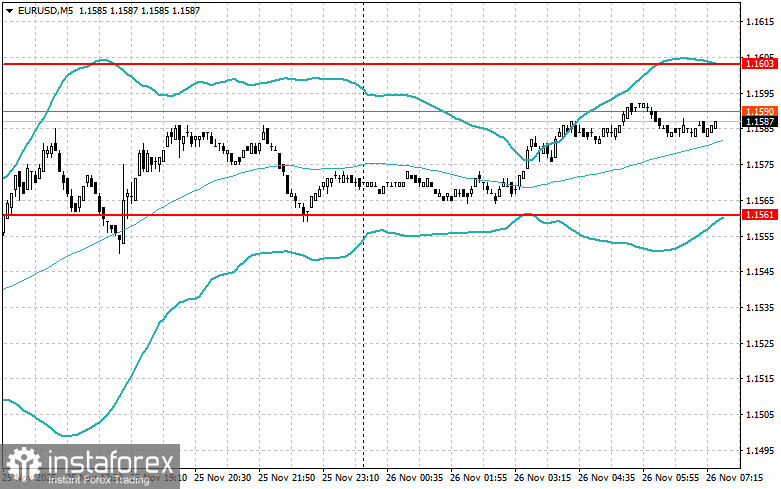

For the EUR/USD Pair

- Buying on a breakout at 1.1605 could lead to an increase of the euro towards 1.1532 and 1.1565.

- Sell on a breakout at 1.1585 could lead to a decline of the euro towards 1.1565 and 1.1525.

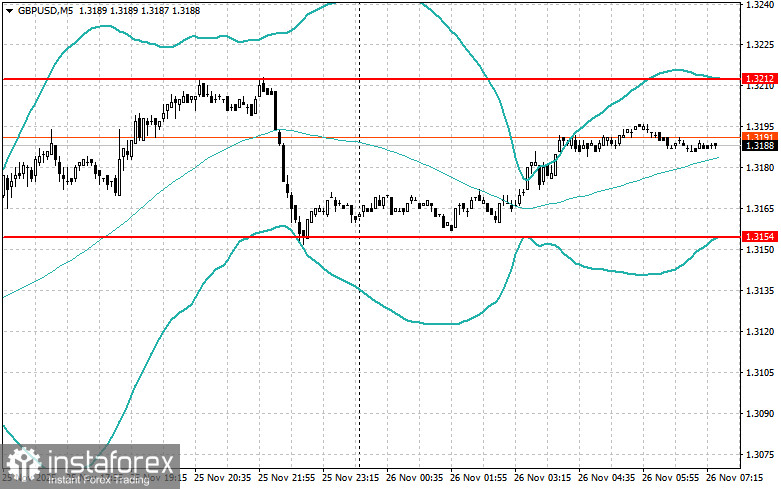

For the GBP/USD Pair

- Buying on a breakout at 1.3210 could lead to a rise of the pound towards 1.3245 and 1.3277.

- Sell on a breakout at 1.3182 could lead to a decrease of the pound towards 1.3154 and 1.3132.

For the USD/JPY Pair

- Buying on a breakout at 156.23 could lead to a rise of the dollar towards 156.67 and 157.06.

- Sell on a breakout at 156.00 could lead to a decline of the dollar towards 155.80 and 155.54.

Mean Reversion Strategy (Retracement):

For the EUR/USD Pair

- Short positions will be sought after a failed breakout above 1.1603 on a return below this level.

- Longs will be sought after a failed breakout above 1.1561 on a return to this level.

For the GBP/USD Pair

- Shorts will be sought after a failed breakout above 1.3212 on a return below this level.

- Longs will be sought after a failed breakout above 1.3154 on a return to this level.

For the AUD/USD Pair

- Shorts will be sought after a failed breakout above 0.6522 on a return below this level.

- Longs will be sought after a failed breakout above 0.6491 on a return to this level.

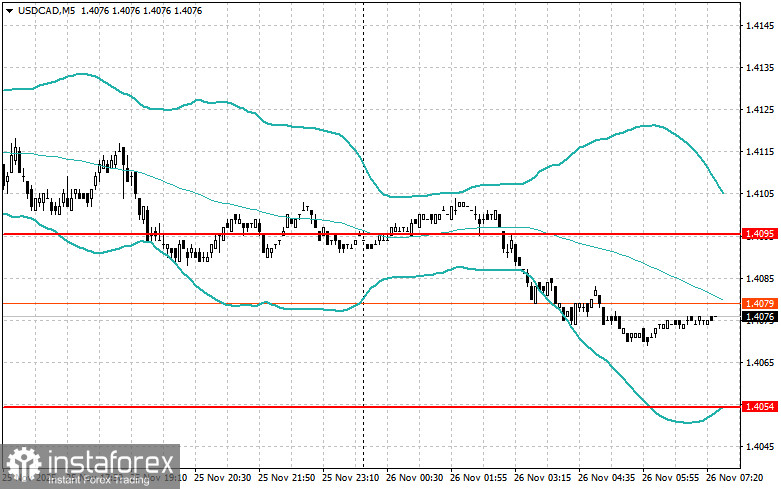

For the USD/CAD Pair

- Shorts will be sought after a failed breakout above 1.4095 on a return below this level.

- Longs will be sought after a failed breakout above 1.4054 on a return to this level.