Yesterday, stock indices closed higher. The S&P 500 rose by 0.91%, while the Nasdaq 100 increased by 0.67%. The Dow Jones Industrial Average jumped by 1.43%.

Global indices continued their bullish run for the fourth consecutive day, as expectations for a Federal Reserve interest rate cut increased in light of weak consumer confidence data in the United States and the emergence of a central bank official supporting a proportionate rate reduction as a potential next Fed chair.

A rise in Asian stocks led to a 0.3% increase in the MSCI All Country World Index, reducing the index's losses after a sell-off to 1.3%. Treasury bonds generally maintained their upward trend compared to the previous session. Notably, the rise in prices was particularly evident in the technology sector, where investors, anticipating cheaper credit, eagerly invested in growth stocks. If the Fed indeed opts for further rate cuts, it could serve as a powerful catalyst for continued rallies in stock markets. However, some experts warn that an overly hasty rate reduction could trigger inflationary pressures. Additionally, uncertainty surrounding the global economic outlook makes the market vulnerable to sudden corrections.

Yesterday's news that Kevin Hassett, director of the White House National Economic Council, emerged as a frontrunner for the Fed chair position contributed to bond growth. The dollar weakened against most currencies, with the New Zealand dollar strengthening by more than 1%. Gold, which typically benefits from interest rate cuts, rose by 0.9% to $4,166 per ounce.

The rally in global stocks resumed after concerns about the overvaluation of the AI sector prompted investors to sell stocks in early November, pushing them away from more risky market segments. Sentiment is now improving as lagging economic data indicates some slowing in the US economy, while more Federal Reserve officials signal support for interest rate cuts.

Ahead of the October monetary policy meeting, investors had deemed a rate cut in December to be inevitable. However, the odds sharply declined after a spike in hawkish sentiment. Traders now again view a rate cut as nearly inevitable.

Yesterday's data showing a sharp decline in consumer confidence in the US for November further underscores the need for economic support. It also indicates a decrease in consumer spending after several months of high growth.

Regarding other markets, oil prices stabilized after closing at their lowest level in a month amid signs of progress in achieving a peace agreement regarding Ukraine.

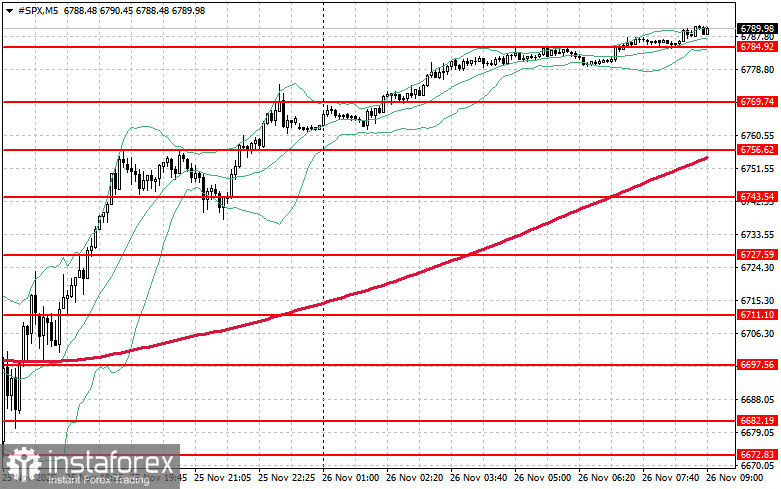

In terms of the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,801. This would help the index gain value and pave the way for a potential rally to a new level of $6,819. Another priority for bulls will be to maintain control over $6,837, which would strengthen buyer positions. In the event of a downturn amid reduced risk appetite, buyers must assert themselves around $6,784. A break below this level would quickly push the trading instrument back to $6,769 and open the way to $6,756.