Analysis of Trades and Trading Tips for the Euro

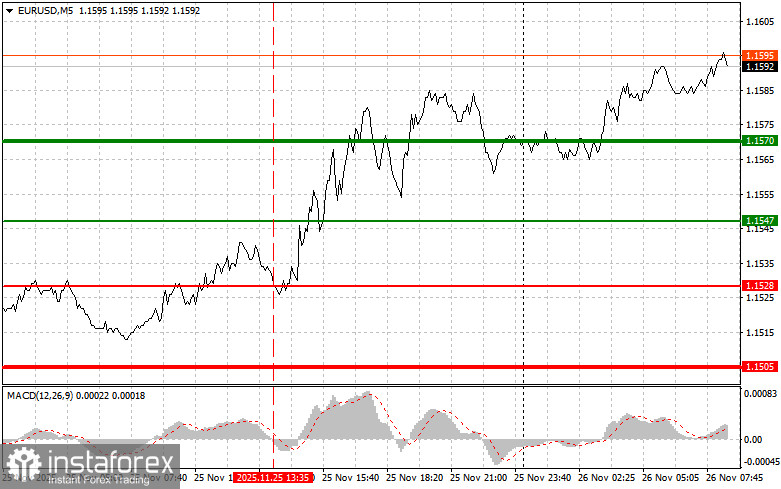

The price test at 1.1547 occurred when the MACD indicator had already risen significantly from the zero mark, which limited the pair's upward potential. For this reason, I did not buy euros. Selling at 1.1528 resulted in losses.

Weak macroeconomic data from the United States is obviously putting pressure on the dollar, undermining its position as an attractive safe-haven asset. Traders fear that the Federal Reserve's tight stance, coupled with the recent shutdown, might severely slow economic growth. However, despite current difficulties, the dollar should not be written off. The American economy remains one of the largest and most stable in the world. Additionally, the Fed possesses the necessary tools to support economic growth and stabilize the financial system.

Today, in the first half of the day, a financial stability report from the European Central Bank is expected, followed by a speech from ECB President Christine Lagarde. The report is anticipated to analyze key risks threatening the financial systems of eurozone countries, including new risks of rising inflation, trade tariffs, and geopolitical instability. After the report's release, Lagarde's speech will be another significant opportunity to gain additional insights into the central bank's stance. She is expected to comment on the current state of the economy, inflation forecasts, and the ECB's plans regarding further adjustments to monetary policy. Markets will closely monitor any signs indicating the ECB's readiness for a more decisive tightening or, conversely, easing its course.

Regarding the intraday trading strategy, I will rely more on the implementation of scenarios №1 and №2.

Buy Scenarios

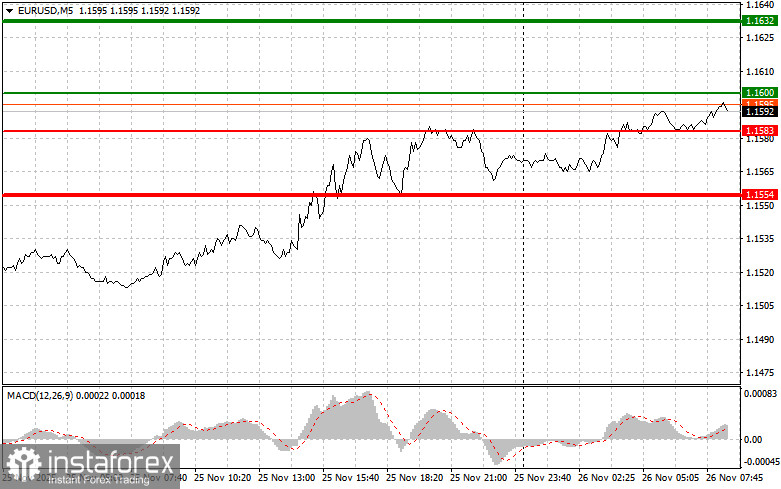

Scenario #1: I plan to buy euros today once the price reaches around 1.1600 (green line on the chart), with a target price of 1.1632. At the 1.1632 level, I plan to exit the market and sell euros immediately, anticipating a move of 30-35 pips from the entry point. Expecting the euro to rise can only happen after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from there.

Scenario #2: I also intend to buy euros today if there are two consecutive tests of the price at 1.1583 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.1600 and 1.1632 can be expected.

Sell Scenarios

Scenario #1: I plan to sell euros after reaching the level of 1.1583 (red line on the chart). The target will be 1.1554, where I intend to exit the market and buy immediately in the opposite direction (anticipating a 20-25-pip move in the opposite direction from the level). Pressure on the pair will return with weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also intend to sell euros today if there are two consecutive tests of 1.1600 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline to the opposite levels of 1.1583 and 1.1554 can be anticipated.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.