Analysis of Trades and Trading Tips for the British Pound

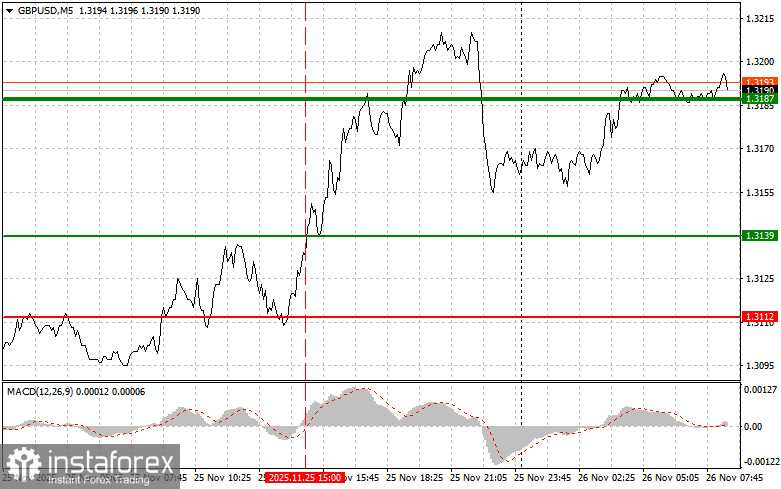

The price test at 1.3139 coincided with the MACD indicator just beginning its upward movement from the zero mark, confirming the correct entry point for buying the pound and resulting in a rise towards the target level of 1.3187.

The pound surged sharply on news that the UK will increase the minimum wage by 4.1%. Investors now assess the likelihood of the Bank of England maintaining interest rates unchanged in the coming months as quite high. However, opinions among experts are divided. Some argue that raising the minimum wage will undoubtedly increase inflationary pressures, as businesses will be forced to pass on higher labor costs to consumers, thereby raising prices. Others believe the impact will be limited, since the minimum wage increase will affect only a portion of the workforce and will have a minor effect on overall inflation. Nonetheless, the BoE is likely to take a cautious stance, closely monitoring developments and preparing to take measures to curb inflation.

Today, the contentious UK budget for the next financial year is expected to be presented. It is anticipated that the budget will provoke strong reactions from both political opponents and the general public. A key point of contention will be the proposed cuts to essential public services, such as healthcare and education, amid rising inflation and economic downturn. The government, in turn, will insist on the necessity of these measures to stabilize the economy and reduce public debt. The Autumn Treasury forecast, published simultaneously with the budget, will provide a more comprehensive picture of the UK's economic situation. Experts expect pessimistic assessments of growth rates, inflation, and unemployment levels. There will be particular attention on the inflation forecast, which many analysts believe will remain high over the next year, despite government measures.

Regarding the intraday trading strategy, I will focus more on implementing scenarios №1 and №2.

Buy Scenarios

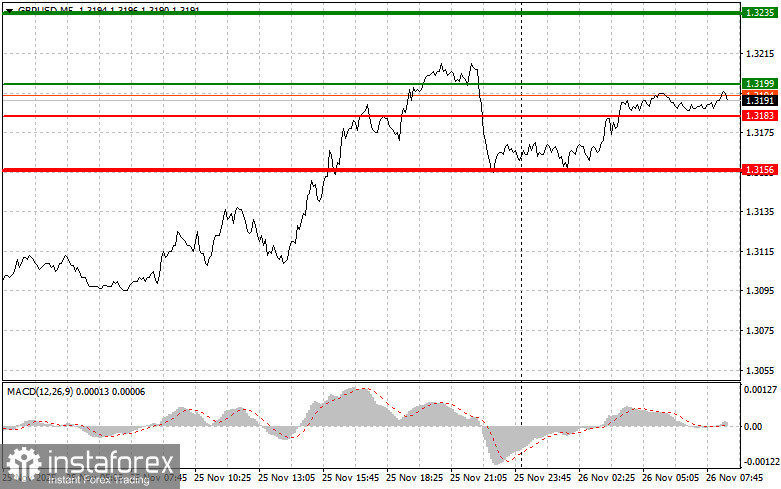

Scenario #1: I plan to buy the pound today when the entry point reaches around 1.3199 (green line on the chart), with a target at 1.3235 (thicker green line on the chart). At around 1.3235, I plan to exit the market and open short positions in the opposite direction (anticipating a 30-35-pip move in the opposite direction from the level). Expecting the pound to rise is feasible if the new upward trend continues. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from there.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the price at 1.3183 while the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upwards. A rise to the opposite levels of 1.3199 and 1.3235 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3183 level is updated (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 1.3156 level, where I intend to exit the shorts and open immediate longs in the opposite direction (anticipating a 20-25-pip move in the opposite direction from the level). Pound sellers will likely emerge if difficulties arise regarding the budget. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting to decline.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3199 while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downwards. A decline to the opposite levels of 1.3183 and 1.3156 can be anticipated.

What the Chart Shows:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where Take Profit can be set or where profit can be secured, as further increases above this level are unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where Take Profit can be set or where profit can be secured, as further decreases below this level are unlikely.

- MACD Indicator: When entering the market, it is important to be guided by the overbought and oversold zones.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.