Trade Analysis and Advice on Trading the British Pound

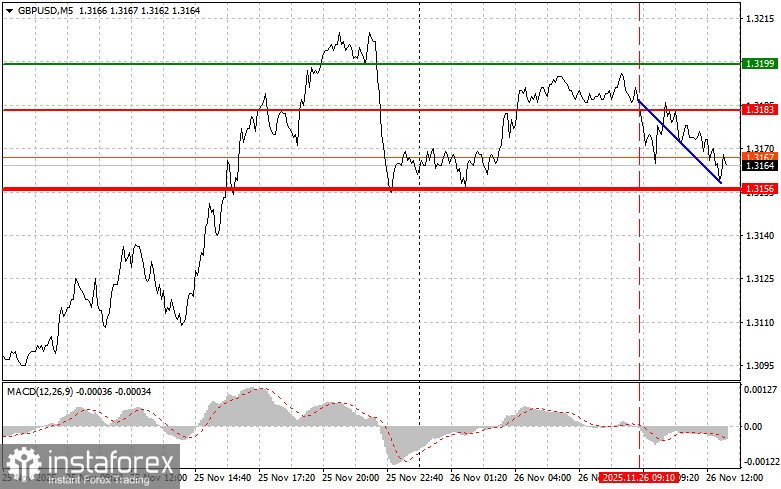

A price test of 1.3183 occurred at the moment when the MACD indicator had just begun moving down from the zero line, confirming the correct entry point for selling the pound. As a result, the pair declined by more than 20 points.

Market expectations ahead of the budget release are always associated with elevated volatility. Traders evaluate the potential consequences of the announced measures for the economy, inflation, and, of course, the British pound. This time, the situation is complicated by uncertainty over how the UK Treasury plans to close the budget gaps created by very high government spending. The budget may include both stimulus measures aimed at supporting economic growth and austerity measures intended to curb inflation. The market's reaction will depend on the balance of these measures and how they are perceived in terms of the long-term sustainability of the UK economy.

During the US session, data on weekly initial jobless claims, changes in durable goods orders, and the Chicago PMI index are also expected. These indicators may influence investor expectations regarding the future path of Federal Reserve monetary policy. Weaker-than-expected labor market and manufacturing data could push the Fed toward a more dovish stance, while strong data may restore confidence in the economy's resilience and encourage more aggressive action by the regulator.

In terms of intraday strategy, I will primarily rely on scenarios #1 and #2.

Buy Signal

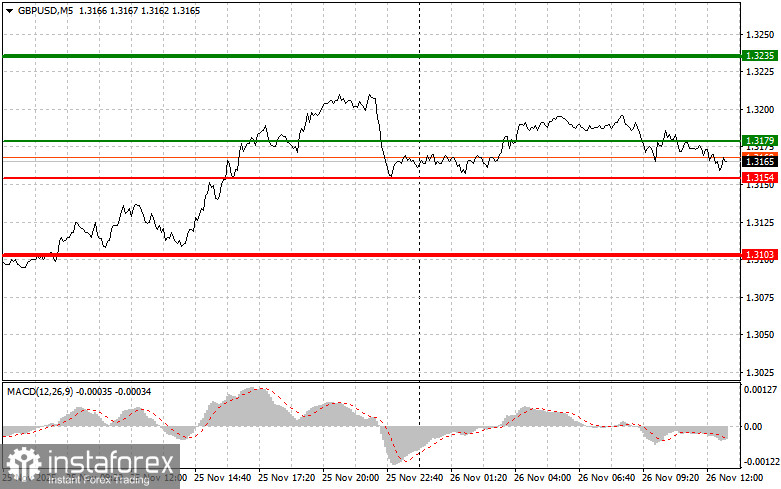

Scenario #1: I plan to buy the pound today when the price reaches the entry point around 1.3179 (green line on the chart), targeting 1.3235 (the thicker green line). Around 1.3235, I will close long positions and open short ones (expecting a 30–35-point move in the opposite direction). Pound growth today is likely only after weak US data. Important! Before buying, ensure the MACD indicator is above the zero line and has just begun rising from it.

Scenario #2: I also plan to buy the pound today if the price tests 1.3154 twice in a row while MACD is in oversold territory. This will limit the pair's downward potential and trigger a reversal upward. Growth toward 1.3179 and 1.3235 can then be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout below 1.3154 (red line on the chart), which should trigger a rapid decline in the pair. The key target for sellers will be 1.3103, where I will close short positions and open long ones (expecting a 20–25-point rebound). Selling pressure on the pound will return if the data is strong. Important! Before selling, ensure that the MACD indicator is below the zero line and has just begun declining from it.

Scenario #2: I also plan to sell the pound today if the price tests 1.3179 twice in a row while MACD is in overbought territory. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 1.3154 and 1.3103 can then be expected.

Chart Guide

- Thin green line – entry price for buy positions

- Thick green line – suggested Take Profit or manual exit level, as further growth above it is unlikely

- Thin red line – entry price for sell positions

- Thick red line – suggested Take Profit or exit level, as further decline below it is unlikely

- MACD indicator – when entering the market, rely on overbought/oversold zones

Important for Beginners

Beginner Forex traders should be extremely cautious when choosing entry points. Before major economic releases, it is best to stay out of the market to avoid sudden volatility. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you neglect money management and trade with large volumes.

Remember: successful trading requires a clear, structured trading plan—like the one presented above. Spontaneous decisions made based on the current market situation are, from the outset, a losing strategy for an intraday trader.