Trade Analysis and Advice on Trading the Japanese Yen

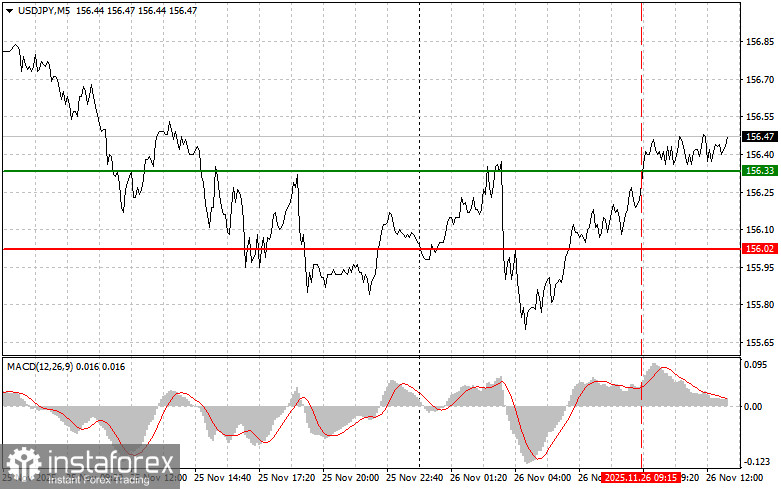

A price test of 156.33 occurred at the moment when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the dollar.

During the US trading session, attention will be focused on several important releases. The dynamics of initial jobless claims is a key indicator of labor market health. An increase in such claims may signal slowing economic activity and rising layoffs. Conversely, a decline in claims indicates a stable or expanding labor market, which is a positive sign for the economy. The volume of durable goods orders reflects companies' investment activity. Growth in this indicator suggests business confidence and readiness to invest in the future, as well as an expected increase in industrial production. The Chicago PMI index serves as a leading indicator of business activity in the Chicago manufacturing sector.

Traders will carefully analyze these indicators to assess the current state of the US economy. If the data is weak—especially labor market data—pressure on the USD/JPY pair could return quickly.

As for the intraday strategy, I will mainly rely on scenarios #1 and #2.

Buy Signal

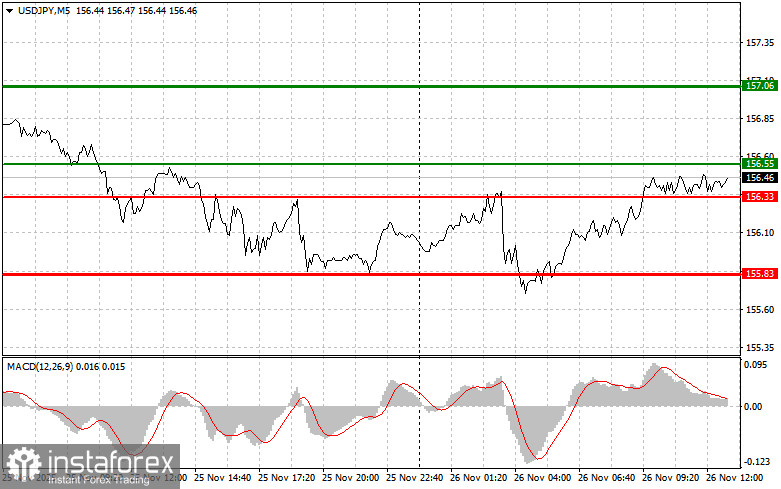

Scenario #1: I plan to buy USD/JPY today when the price reaches the entry point around 156.55 (green line on the chart), targeting 157.06 (the thicker green line). Around 157.06, I will close long positions and open shorts in the opposite direction (expecting a 30–35-point pullback). You can expect the pair to rise further if the bullish trend continues. Important! Before buying, ensure the MACD indicator is above the zero line and has just begun to rise from it.

Scenario #2: I also plan to buy USD/JPY today if the price tests 156.33 twice in a row while MACD is in the oversold area. This will limit the pair's downward potential and trigger a reversal upward. Growth toward 156.55 and 157.06 can then be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a breakout below 156.33 (red line on the chart), which should trigger a quick decline. The key target for sellers will be 155.83, where I will close short positions and open long ones immediately (expecting a 20–25-point pullback). Selling pressure will return if the data is very weak. Important! Before selling, ensure the MACD indicator is below the zero line and has just begun to decline from it.

Scenario #2: I also plan to sell USD/JPY today if the price tests 156.55 twice in a row while MACD is in the overbought zone. This will limit the pair's upward potential and trigger a reversal downward. A decline toward 156.33 and 155.83 can then be expected.

Chart Guide

- Thin green line – entry price for buy positions

- Thick green line – suggested Take Profit or exit level (further growth above this level is unlikely)

- Thin red line – entry price for sell positions

- Thick red line – suggested Take Profit or exit level (further decline below this level is unlikely)

- MACD indicator – when entering the market, rely on overbought/oversold zones

Important for Beginners

Beginner Forex traders must be extremely careful when choosing entry points. Before major fundamental reports are released, it is best to stay out of the market to avoid sudden price spikes. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

Remember: successful trading requires a clear, structured trading plan—like the one provided above. Spontaneous decisions based on the current market situation are, by default, a losing approach for an intraday trader.