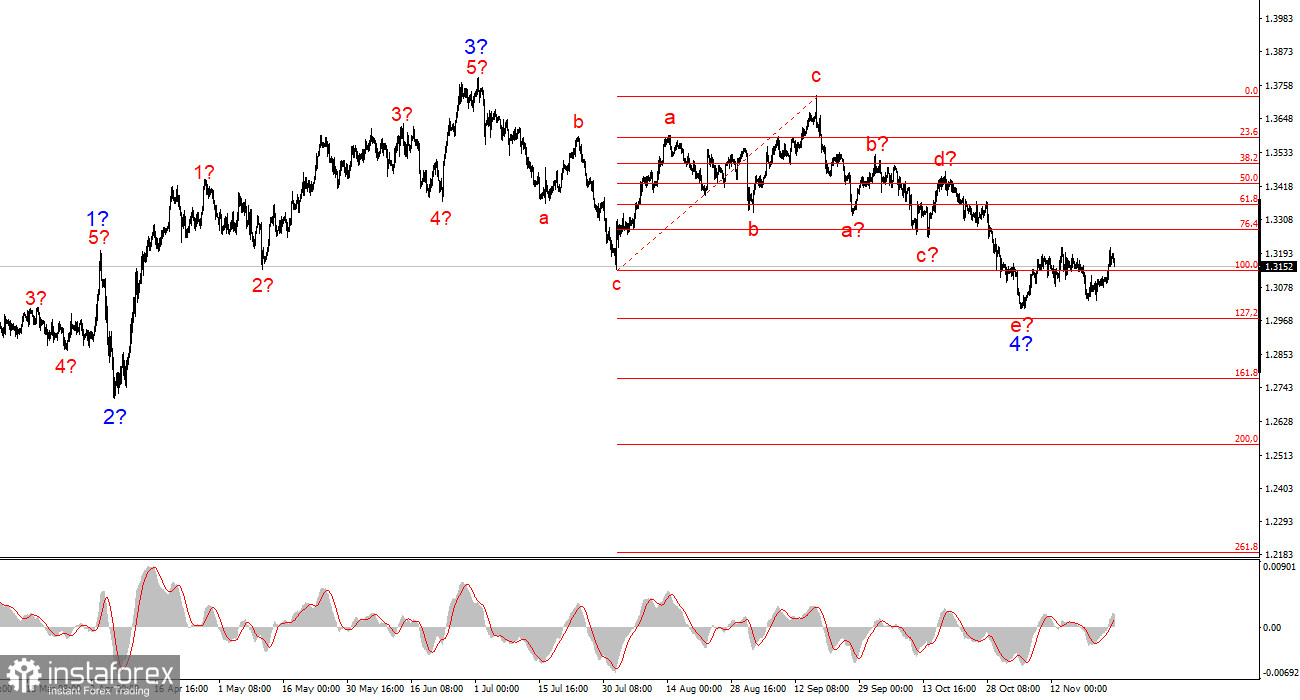

In the GBP/USD pair, the wave pattern continues to indicate the formation of an upward trend segment (bottom chart), but in recent weeks it has taken on a complex and extended form (top chart). The trend segment that began on July 1 can be considered wave 4—or any major corrective wave—since it has a corrective rather than impulsive internal wave structure. The same applies to its subwaves. Therefore, despite the prolonged decline of the pound, I believe the upward trend remains intact.

The downward wave structure that began on September 17 has formed a five-wave pattern a-b-c-d-e and may now be complete. If this is indeed the case, the pair is currently at the very beginning of forming a new upward set of waves.

Of course, any wave structure can become more complex at any time and extend further. Even the presumed wave 4, which has been forming for almost five months, may still evolve into a full five-wave structure, in which case we could see a continuation of the correction for several more months. However, at this moment, an upward set of waves may already be starting to form. If this assumption is correct, we have already seen its first wave, and the second wave may be nearing completion.

The GBP/USD exchange rate barely changed during Wednesday's session, but today the pound may be in for turbulence. In just a few hours, the budget for the 2026 fiscal year is expected to be released—and let me remind you that problems with drafting this budget have cost the pound heavily in recent months. Virtually every public appearance by UK Chancellor Rachel Reeves has been accompanied by selling pressure on the pound in the currency market. Ms. Reeves, with a somber expression, has repeatedly stated that the government will be forced to raise several taxes because the budget "holes" cannot otherwise be patched. Naturally, she faced heavy criticism both from Parliament and British consumers, as the Labour Party promised not to raise taxes during the last election. But time passes, circumstances change, the money is gone, and therefore the British must follow in America's footsteps and willingly agree to contribute more to the budget.

To avoid the righteous anger of British voters in the next elections and retain at least some chance of victory, Labour has begun to come up with such creative tax-raising ideas that they evoke nothing but a smile. For example, Health Secretary Wes Streeting announced that all milkshakes containing sugar will now be taxed. The sugar tax has been in effect in the UK since 2018 as part of a nationwide campaign against obesity. As we see, in 2025 the British government is still dissatisfied with how much the average Brit weighs, and under the noble pretext of caring for public health, it is ready to force people to pay more for sweet drinks. Meanwhile, no one seems to be in a hurry to close McDonald's, and Coca-Cola is still sold without restrictions.

Conclusions

The wave picture for GBP/USD has changed. We are still dealing with an upward, impulsive trend segment, but its internal wave structure has become more complex. The downward corrective structure a-b-c-d-e within wave 4 appears to be fully complete. If this is indeed the case, I expect the main trend segment to resume with initial targets near the 1.38 and 1.40 levels. In the short term, we may see the development of wave 3 or wave c with targets around 1.3280 and 1.3360, corresponding to the 76.4% and 61.8% Fibonacci levels.

The higher-level wave structure looks almost perfect, even though wave 4 went above the top of wave 1. However, let me remind you that perfect wave counts exist only in textbooks. In practice, things are much more complicated. At this time, I see no grounds for considering alternative scenarios to the upward trend segment.

My Key Analysis Principles:

- Wave structures should be simple and easy to understand. Complex structures are difficult to trade and often shift or transform.

- If you are not confident in what is happening in the market, it is better to stay out of it.

- Absolute certainty about market direction does not exist and never will. Always use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.