Unfortunately, the only way to address this issue is through protectionist policies. Washington has already taken this path, and the European Union may follow suit in the near future. What does this mean for the average consumer? It translates to a compulsion to purchase domestically produced goods or to pay tariffs to the government when buying imported products. Ultimately, it all boils down to money, with consumers worldwide facing higher prices for the same goods.

Otherwise, European industry will continue to decline in volume and will eventually perish within the next 50 years. The situation in American industry is somewhat better, but Donald Trump is not unjustified in demanding that American companies bring production back home. The U.S. industrial sector is also not in the strongest position relative to China. Currently, it is difficult to say whether the industry has flourished under Donald Trump, as business laws take precedence over government demands. Why would Apple manufacture smartphones in America if production costs would increase 2-3 times, resulting in a corresponding decline in sales? Consumers will ultimately "sacrifice" and choose not to buy a trendy $3,000 iPhone but rather a Chinese smartphone for $600.

Another important consideration is the exchange rate. Trump frequently emphasizes that he needs a cheaper dollar. A weaker dollar would allow America to export more, which could somewhat balance the trade deficit. However, Europe also understands that the lower the national currency, the higher the exports and the lower the imports. Therefore, the ECB, along with the European Parliament, may begin conducting covert currency interventions to lower the euro's value. I wouldn't be surprised if these interventions have already been occurring over the past 4-5 months, as there are times when it is challenging to explain why the U.S. dollar is appreciating.

I also want to remind you that the Swiss National Bank conducts currency interventions quite openly. But Switzerland is a separate country and a different story. The European Union cannot boast of being the world's banking center. Therefore, what is permitted in Switzerland is not permitted in the EU. In simple terms, a "currency war" may soon break out globally, with each country striving to weaken its currency.

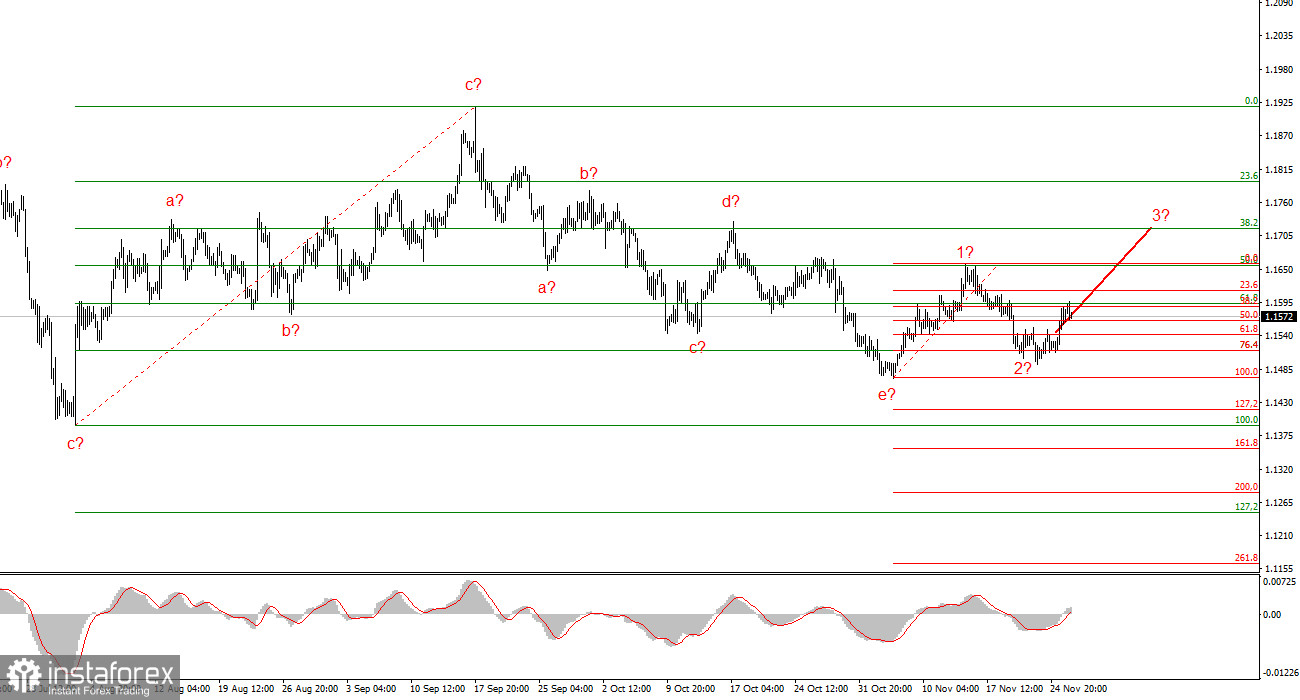

Wave Analysis for EUR/USD:

Based on my analysis of EUR/USD, I conclude that the instrument is continuing to build an upward trend segment. In recent months, the market has paused, but Donald Trump's policies and the Federal Reserve remain significant factors in the potential decline of the American currency. The targets for the current segment of the trend may extend to the 25th figure. Currently, the upward wave structure may continue to develop, and I expect that from the current positions, the third wave of this set will progress, which can be either "c" or "3." At this time, I remain in buying positions with targets around the 1.1740 mark.

Wave Analysis for GBP/USD:

The wave structure of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in "4" appears quite complete. If this is indeed the case, I expect the main trend segment to resume its progression, with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave "3" or "c," with targets around 1.3280 and 1.3360, corresponding to 76.4% and 61.8% on the Fibonacci scale.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade, as they often lead to changes.

- If there is uncertainty about what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget about protective orders like Stop Loss.

- Wave analysis can be combined with other types of analysis and trading strategies.