The GBP/USD currency pair traded relatively calmly on Wednesday until the UK budget for the 2026 financial year was published. It is important to remember that the Labor Party faced a serious dilemma: "raise taxes and lose voter support" or "do not raise taxes and increase borrowing." To give a glimpse of the outcome, the Chancellor of the Exchequer, Rachel Reeves, opted for the first option.

At this point, the specifics of the new budget are not yet fully known, but it is already clear that total taxes will increase by £26 billion. While this may not seem like a large amount for the entire country when broken down per capita, British farmers protested by breaking through barricades and blocking central London against the tax increases. It has been revealed that the UK government has decided to increase taxes for farms valued over £1 million by 20%. Such a tax increase could bankrupt most farmers, prompting the protests.

Recall that the Labor Party promised British citizens not to raise taxes during the elections, which was a major sticking point. The government has decided not to cut expenses but to increase revenues, which was quite predictable. In the coming days, we may see protests by British consumers and businesses expand in response to the actions of Keir Starmer's government. How will the pound react to these events?

In our view, even given the UK's financial troubles, the pound sterling has already lost enough over the past few months. We also recall that the British currency has faced a wave of sell-offs since last summer due to Rachel Reeves' statements on tax increases, as well as her lamentations over high yields on government bonds, which are adding strain to the budget. Thus, we can confidently say that the market has already priced in this factor.

Recently, UK macroeconomic data have been disappointing, and the Bank of England may lower the key rate in December, as the Federal Reserve has done. However, the British pound has been gaining ground over the past two months, so we believe that factors contributing to its decline have already been accounted for. On the other hand, the dollar still faces numerous factors that could drive its decline. The market has not yet deemed it necessary to account for Trump's new tariffs, the "shutdown," and the two reductions in the Fed's key rate. Remember, the dollar began to strengthen on September 17, when the Fed resumed its monetary easing.

Thus, the market has shown once again that it anticipates many events in advance. If this is the case, all positive factors for the American currency have likely already been priced in. We continue to expect only growth for the GBP/USD pair in the medium term, considering any declines to be corrections. On the 4-hour timeframe, the price is above the moving average line, which is already encouraging.

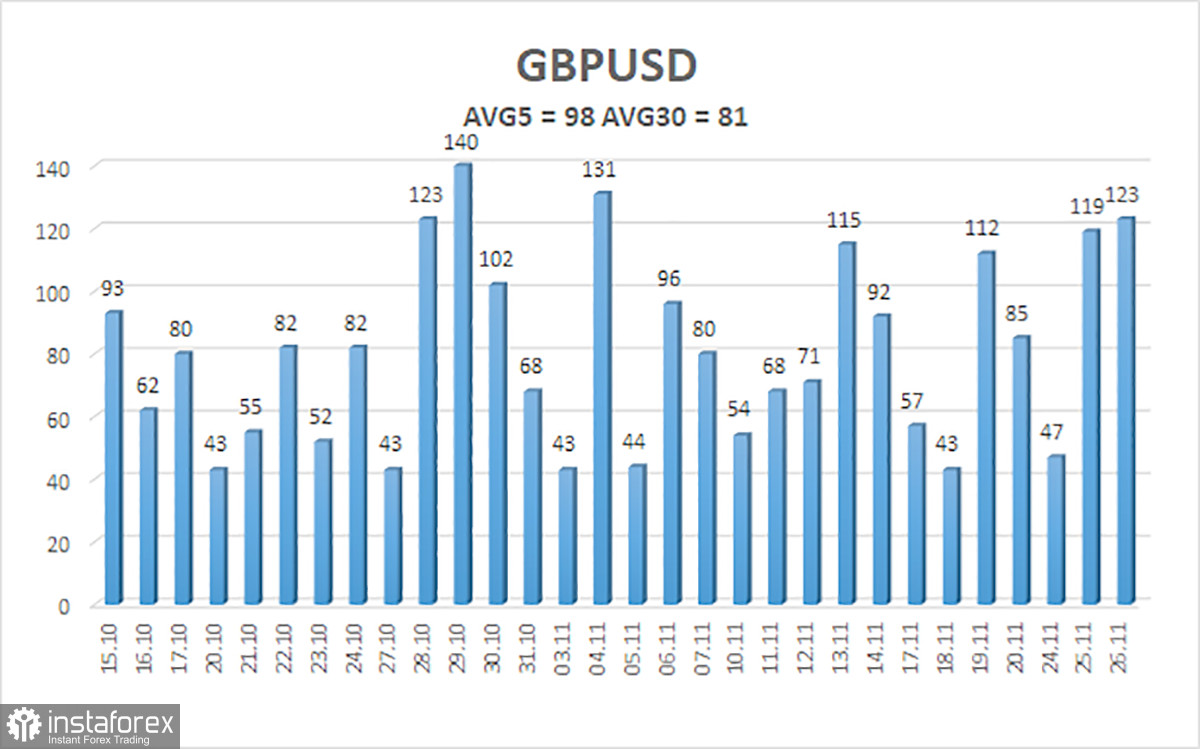

The average volatility of the GBP/USD pair over the last five trading days is 98 pips, which is considered "average" for this pair. On Thursday, November 27, we expect movements within a range limited by levels 1.3129 and 1.3325. The higher linear regression channel is directed downwards, but only due to a technical correction on higher timeframes. The CCI indicator has entered the oversold zone six times in recent months, forming another "bullish" divergence.

Nearest Support Levels:

- S1 – 1.3184

- S2 – 1.3123

- S3 – 1.3062

Nearest Resistance Levels:

- R1 – 1.3245

- R2 – 1.3306

- R3 – 1.3367

Trading Recommendations:

The GBP/USD currency pair is attempting to resume its upward trend for 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the dollar, so we do not expect the dollar to appreciate. Therefore, long positions with targets at 1.3306 and 1.3428 remain relevant for the near term when the price is above the moving average. If the price is below the moving average, small short positions targeting 1.3062 can be considered based on technical grounds. Occasionally, the American currency experiences corrections (in a global sense), but for a trend-based strengthening, it requires real signs of the end of the trade war or other positive global factors.

Explanations for Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, then the trend is currently strong;

- The moving average line (settings 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted;

- Murray levels are targeted levels for movements and corrections;

- Volatility levels (red lines) denote the probable price channel within which the pair will trade in the coming day, based on current volatility metrics;

- The CCI indicator entering the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.