The Reserve Bank of New Zealand (RBNZ) lowered the interest rate by a quarter of a point to 2.25%, a decision that fully aligned with expectations. Expectations for further actions from the RBNZ have shifted to a more hawkish stance; not long ago, the market saw a relatively high probability of a 50-basis-point rate cut in November following a disappointing GDP report. However, after the release of third-quarter data and inflation rising to 3%, sentiments changed. As indicated in the meeting minutes, the discussion regarding the appropriateness of lowering the rate no longer involved a 50-basis-point step; rather, the probability of keeping the rate unchanged increased. This turnaround is clearly a bullish signal for the market.

RBNZ Governor Adrian Orr made a relatively hawkish statement after the meeting, declaring that further rate cuts face a "high barrier." According to him, such a move would require a significant revision of forecasts, and current projections support keeping the rate at its current level. The market has taken this statement into account, and it is now believed that the easing cycle is over, with the rate remaining at 2.25% until the end of next year. It is expected that inflation will slow to 2% by mid-2026.

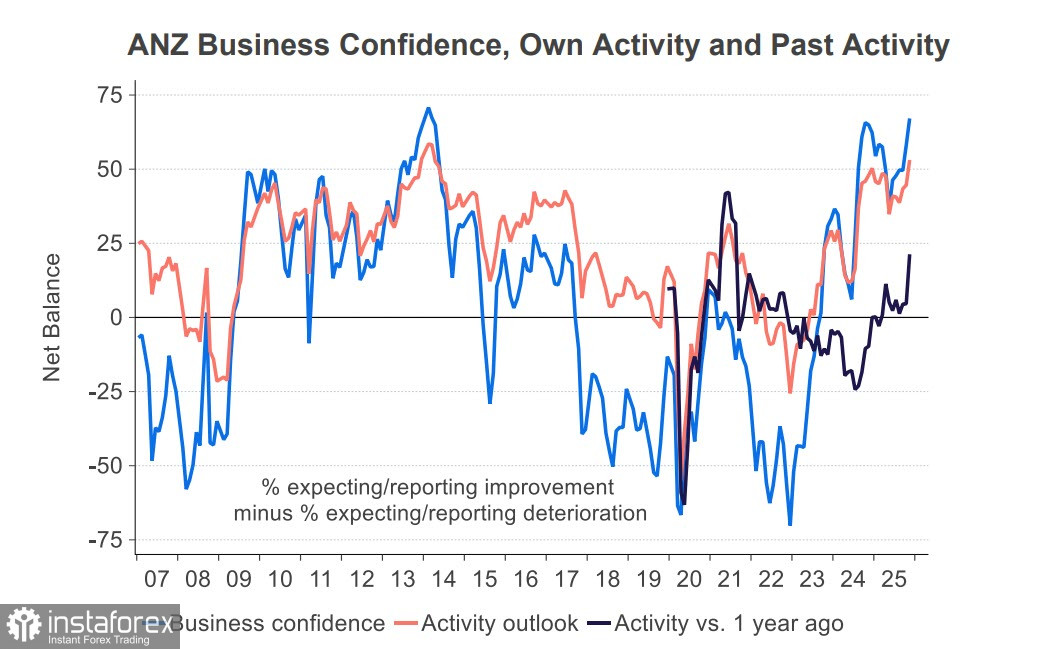

After the meeting, the ANZ Business Confidence report for November was published unexpectedly positively.

Business confidence rose by 9 points to 67, reaching the highest level in 11 years. Expected own activity also increased to 53, the highest level in ten years. The economic recovery is proceeding at a rapid pace, which is quite surprising following the disappointing second quarter, indicating that the current RBNZ rate does not hinder the recovery, particularly important in light of still-high inflation.

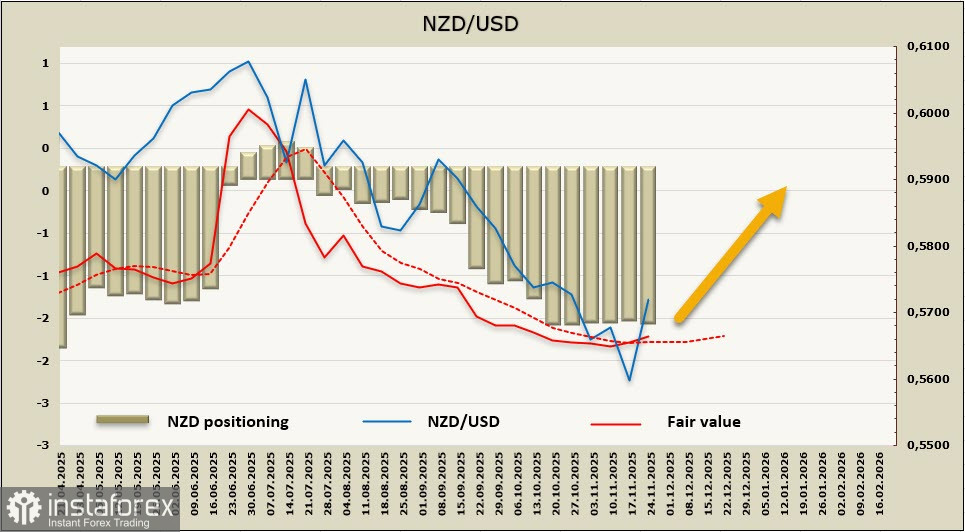

Thus, for the kiwi, most factors that pressured its exchange rate have suddenly disappeared, and focus shifts to what support the U.S. dollar will receive to predict the further dynamics of NZD/USD. The state of the U.S. economy is currently a significant mystery, and other uncertainties remain. In particular, inflation has yet to begin the predicted rise due to the new tariffs, and the situation will only clarify on December 16. The budget agreement is temporary, and the government's operations may again be interrupted at the end of January. Finally, the probability of a Federal Reserve rate cut has increased to 85% over the last day, a level the market cannot ignore, putting further pressure on the dollar.

The calculated price, based on the latest revision of forecasts for the Fed rate, has turned upward, but confidence in the continuation of this growth is still lacking.

A week ago, we noted that if the RBNZ signals the end of the rate-cutting cycle, the kiwi could begin a bullish reversal. This is more or less what happened; the kiwi easily surpassed the nearest resistance at 0.5687 but remains within the bearish channel. It needs to break through two more resistances at 0.5750 and 0.5800 for the bullish momentum to transform into a reversal. The likelihood of such a scenario is reasonable given the two signals. The first implies a return to confidence in a Fed rate cut in December, and the second is the hawkish tone from the RBNZ following Wednesday's meeting. The support at 0.5688—if the kiwi holds above this—will increase the chances for continued growth.