Why isn't EUR/USD rising? The Federal Reserve will be one of the few central banks to lower rates in 2026. The influence of Hassett is pressuring the U.S. dollar, while hopes for peace in Ukraine should support all European currencies, including the euro. Nevertheless, the main currency pair is moving in a "two steps forward, one step back" mode. Perhaps the crux lies in the greenback's ability to confront its fears?

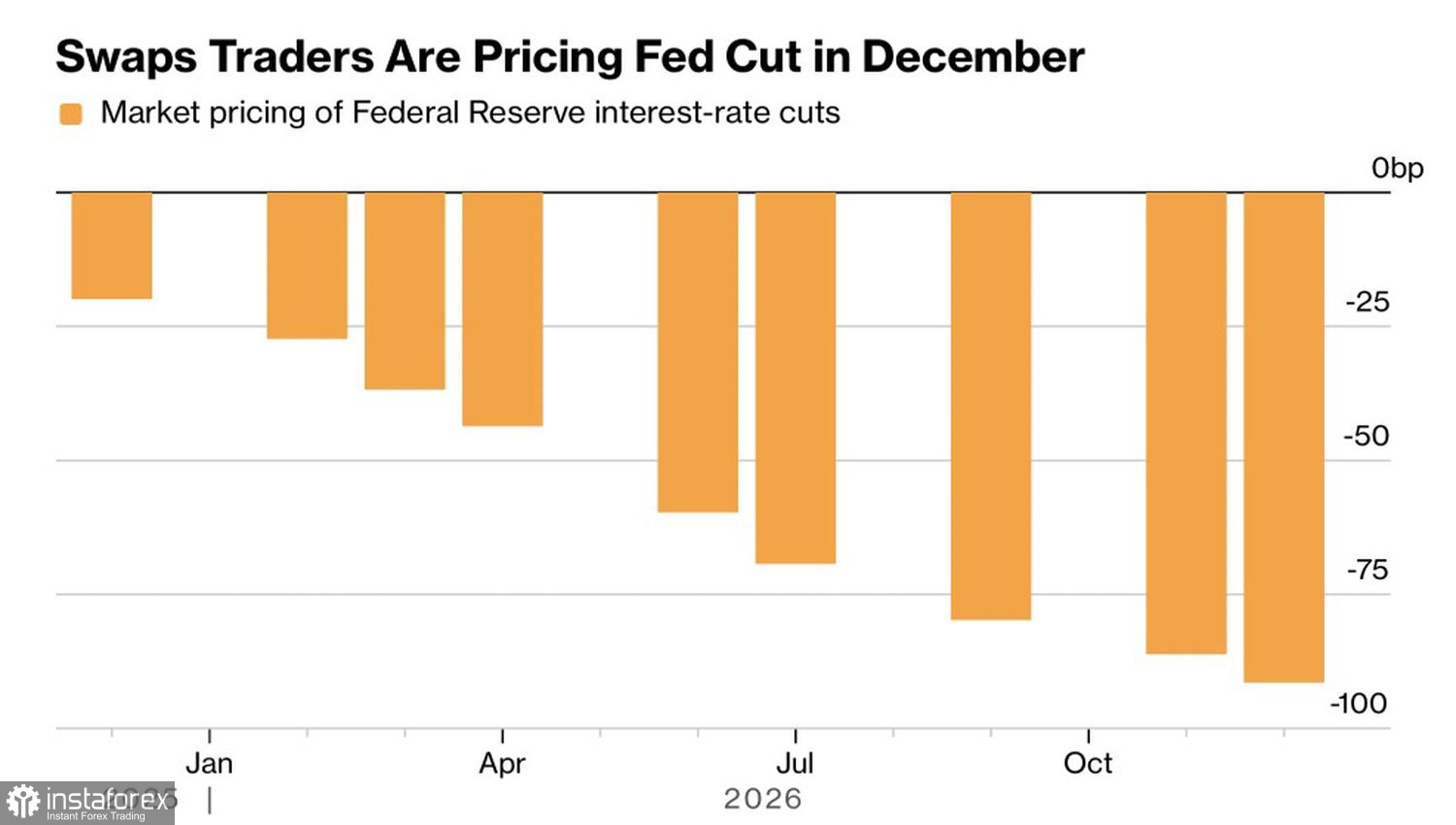

Dynamics of Swap Rate Expectations for the Fed

After the Reserve Bank of New Zealand lowered the cash rate, it adopted "hawkish" rhetoric. Most likely, the cycle of monetary expansion is over. The same can be said for the European Central Bank. The acceleration of Australian inflation to 3.3% provides grounds for speculation about tightening monetary policy by the Reserve Bank of Australia. The Bank of Japan is also not backing down from normalization. Rachel Reeves' budget proposal reduces the likelihood of major actions by the Bank of England at the end of 2025.

The Fed will have to lower rates almost in isolation, while other central banks will either hold them steady or even raise them. This is unpleasant news for the U.S. dollar. Moreover, the futures market is increasing the anticipated scale of monetary expansion as the chances grow that Kevin Hassett will lead the Fed. If another "dove" like Stephen Miran joins the FOMC, it's game over.

Dynamics of Candidates for the Fed Chair Position

In such circumstances, the U.S. dollar should be falling sharply. The USD index is indeed heading toward its worst week in the last four months. However, it is doing so with apparent reluctance. The dollar is supported by the fact that the major fears of 2025 have not materialized.

Indeed, the White House's decision to raise tariffs to levels not seen since the 1930s initiated a "Sell America" process. Investors rushed to unload U.S.-issued assets. However, the rally in the S&P 500 drew them back in. Capital outflows from the U.S. did not occur.

Similarly, a slowdown in the American economy due to import tariffs had not taken place. Many banks expected that all the burden of responsibility would fall on U.S. companies and ordinary citizens, significantly hampering consumer spending and GDP. Nothing of the sort! Thanks to advances in artificial intelligence, the U.S. economy is thriving. The leading indicator from the Atlanta Fed expects a 3.9% expansion in the third quarter.

It has endured trials by fire and copper pipes, and Credit Agricole expects the USD index to rise in early 2026 amid reduced political risks and resilience in the U.S. economy.

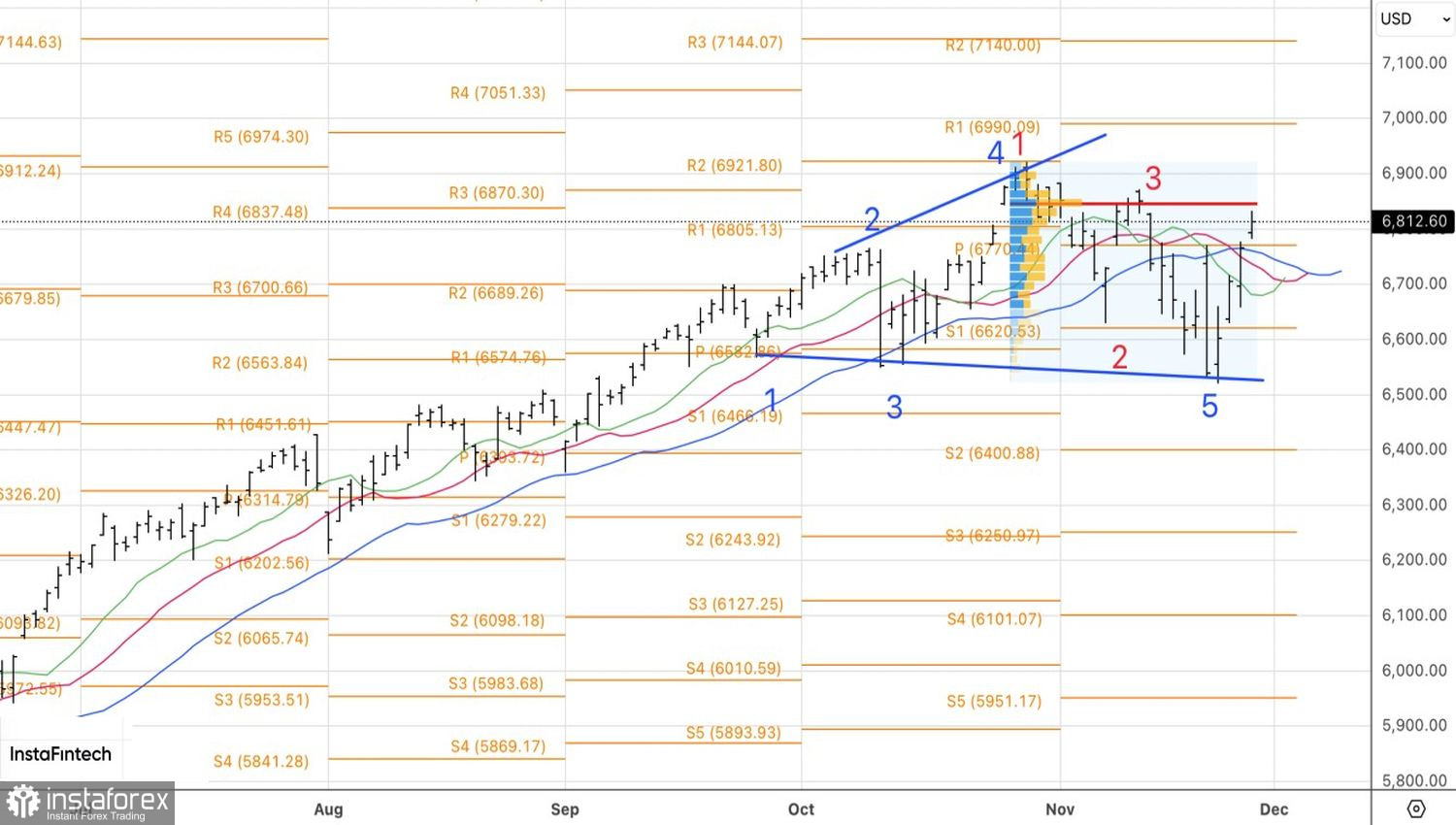

Technically, on the daily chart of EUR/USD, the first test of resistance via a trendline failed. The "bulls" were forced to retreat, but it is unlikely they will stop trying to play out the reversal pattern 1-2-3, gain operational space, and ultimately restore the upward trend. A repeated assault on $1.16 may provide a basis for euro purchases.