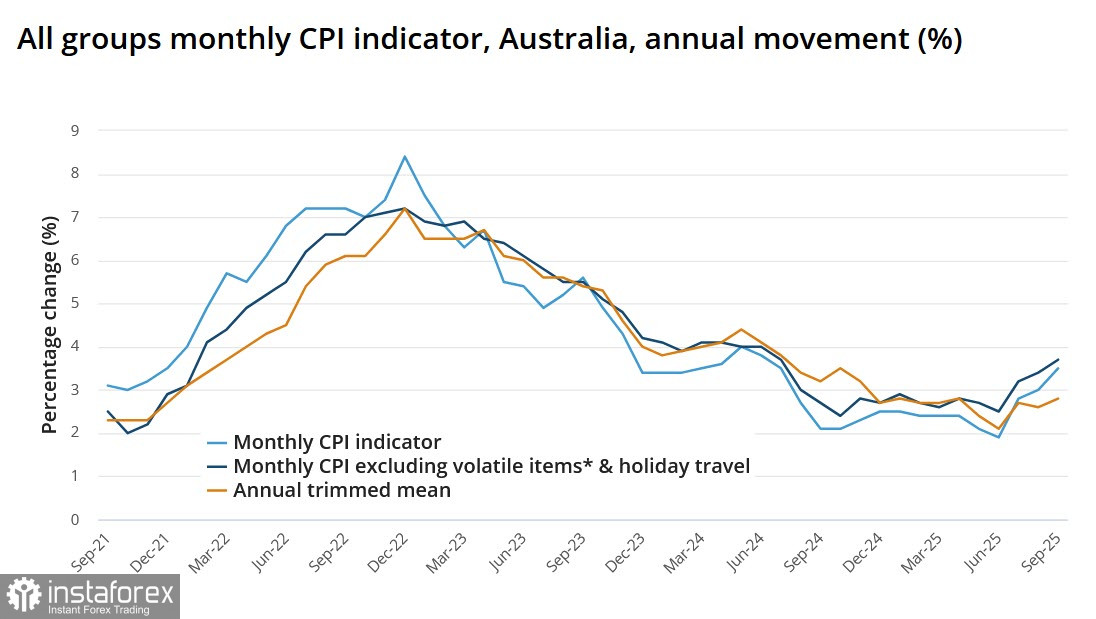

Inflation in Australia is on the rise again, and this is perhaps the most important news that will influence the Reserve Bank of Australia's stance on rates and the Australian dollar's exchange rate. After inflation rose to 3.2% in the third quarter, the highest level in more than a year, forecasts for the RBA's rate changed. Before the publication, the market confidently predicted further rate cuts, but afterward, the likelihood of such a move decreased.

The RBA did not disappoint—at the beginning of November, the rate was maintained at 3.6%, but this decision appeared to be only a temporary pause. However, on Wednesday, the October inflation index was published, showing an increase to 3.8% compared to 3.6% in September, providing grounds to assert that inflation will clearly remain above the target range in the fourth quarter.

Additionally, the wage index exceeds the inflation level, and the economy is recovering at a faster pace than anticipated.

What does all this imply? It suggests that until the end of January, meaning until the publication of the fourth-quarter inflation data, a rate cut by the RBA is ruled out. If other indicators support optimism about the state of the economy, the market will be forced to conclude that the rate cuts in this cycle may be over. It is unclear whether anyone in the RBA leadership will voice this thought, but we must proceed from the current realities—the current rate of 3.6% does not hinder economic growth, while inflation is rising —and the next step after the pause may not be a rate cut but an increase.

Essentially, the Aussie finds itself in a clearly bullish situation right now. There is no reason for the Australian dollar to continue falling, while there are increasingly more reasons for a resumption of growth. U.S. data could hinder the growth of AUD/USD, but that data is also contradictory. Durable goods orders in September increased significantly more than expected, a factor in favor of a recovery in the industrial sector and indicative of strong consumer activity. However, the latest regional indices of industrial activity have come in much worse than expected. The same is true for inflation—players have long awaited the effects of increased import tariffs to finally reach the consumer sector; data has yet to emerge due to the shutdown, but interestingly, the yield on 5-year TIPS bonds, which serve as a great indicator of inflationary sentiments in the business environment, has fallen to a 6-month low. This suggests that businesses are also not anticipating rising inflation. Consequently, the dollar does not have strong grounds to resume growth, at least not until the end of the year.

Two CFTC reports published since the last review have slightly improved the overall positioning for AUD, but the main factor driving the upward reversal in the calculated price is the change in current yields following the inflation data release. The dynamics of the calculated price increase the likelihood of further growth for AUD/USD.

The AUD/USD pair reached the resistance zone of 0.6530/50, as we had expected in the previous review. While we anticipated a resumption of declines after reaching this level, the overall picture now looks considerably different. A pullback to the support level of 0.6410/30 has become significantly less likely, and we anticipate attempts to break above the 0.6430/50 zone, targeting 0.6620/30.