Sellers of the dollar paused yesterday in the absence of new guidelines. Today, in the first half of the day, a considerable amount of important German data is expected, which could lead to a surge in volatility. The figures for changes in retail trade volume, the number of unemployed, the unemployment rate, and the Consumer Price Index (CPI) for October will be released.

These indicators will be key in assessing the state of the German economy and will determine short-term market sentiment. Retail trade figures are expected to provide insights into consumer activity, while unemployment data will shed light on the current employment situation. Inflation, as indicated by the CPI, will be closely monitored, as the European Central Bank is vigilant regarding price pressures in the Eurozone. Joachim Nagel's speech will also attract significant attention. Traders will be looking for hints regarding future monetary policy, especially in light of recent discussions about the end of the interest rate-cutting cycle.

Only very positive reports from Germany will help the euro return to growth today. Otherwise, pressure on risk assets may increase by the end of the week. If the data aligns with economists' expectations, it is advisable to rely on a Mean Reversion strategy. If the data is much higher or lower than economists' expectations, the Momentum strategy would be best.

Momentum Strategy (Breakout):

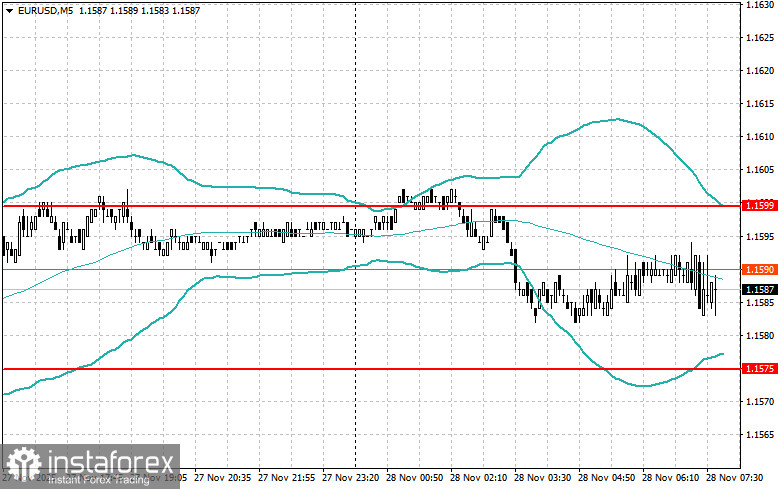

For the EUR/USD Pair

Buying on a breakout above 1.1591 may lead to an increase in the euro to the region of 1.1613 and 1.1635.

Selling on a breakout below the level of 1.1575 may lead to a decline in the euro to the region of 1.1550 and 1.1527.

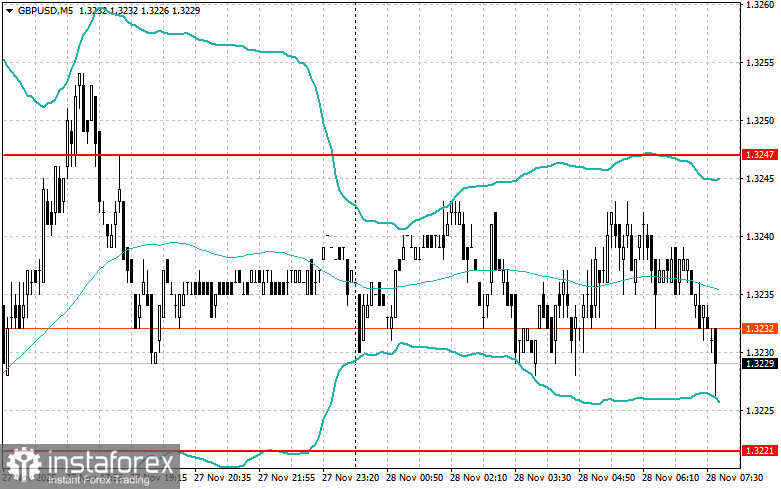

For the GBP/USD Pair

Buying on a breakout above the level of 1.3245 may lead to an increase in the pound to the region of 1.3277 and 1.3310.

Selling on a breakout below the level of 1.3220 may lead to a decline in the pound to the region of 1.3180 and 1.3150.

For the USD/JPY Pair

Buying on a breakout above the level of 156.55 may lead to an increase in the dollar to the region of 156.87 and 157.16.

Selling on a breakout below the level of 156.25 may lead to a sell-off of the dollar to the region of 155.80 and 155.54.

Mean Reversion Strategy (Return):

For the EUR/USD Pair

I will look for short positions after an unsuccessful breakout above 1.1599 on a return below this level.

I will look for longs after an unsuccessful breakout below 1.1575 on a return to this level.

For the GBP/USD Pair

I will look for short positions after an unsuccessful breakout above 1.3247 on a return below this level.

I will look for longs after an unsuccessful breakout below 1.3221 on a return to this level.

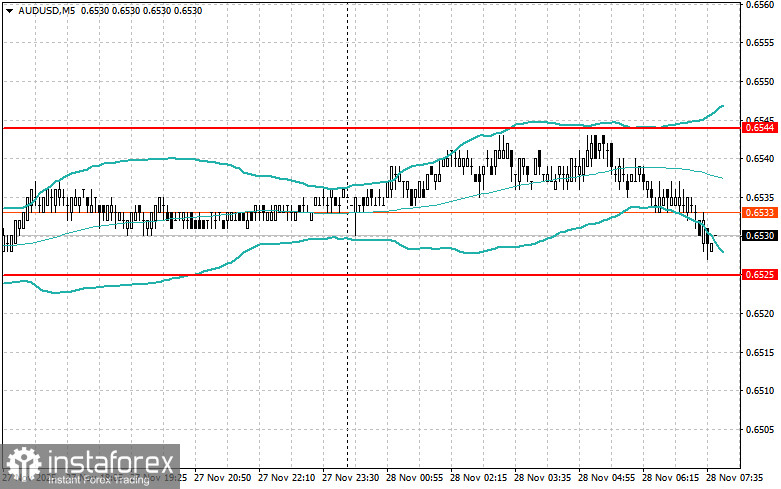

For the AUD/USD Pair

I will look for shorts after an unsuccessful breakout above 0.6544 on a return below this level.

I will look for longs after an unsuccessful breakout below 0.6525 on a return to this level.

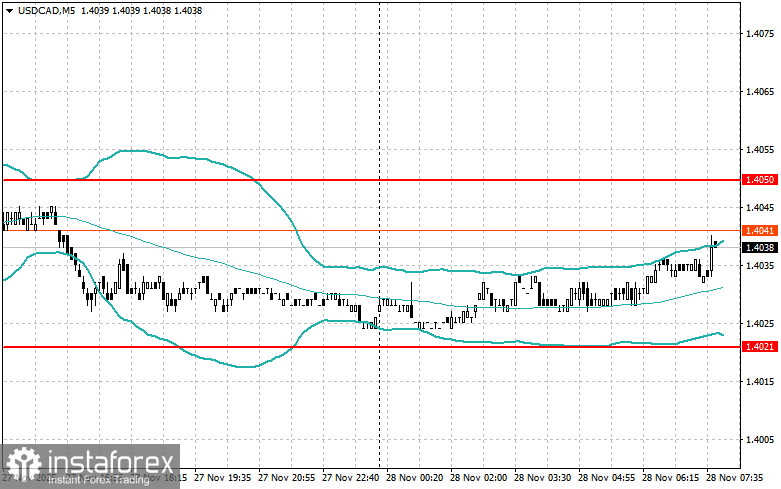

For the USD/CAD Pair

I will look for shorts after an unsuccessful breakout above 1.4050 on a return below this level.

I will look for longs after an unsuccessful breakout below 1.4021 on a return to this level.