Bitcoin, trading around $91,000-$92,000, maintains a positive outlook and has good potential for further correction. However, given the weekend conditions in the U.S. and low trading volume, it is unlikely that major players will make their presence felt until the beginning of next week. Ethereum has also clearly established its position above $3,000.

According to a report from Glassnode, the breakthrough of supply clusters from large buyers is a key condition for restoring momentum to a new peak. The chart clearly shows that the nearest clusters are at $93,000–$96,000, a breakthrough of which will open the way to the $100,000–$108,000 range, where active seller resistance is expected.

It seems that the $108,000 mark will be pivotal in breaking the current bearish market, which has not gone away. At the first normal pressure from large players, the decline of both Bitcoin and Ethereum may resume with even greater force than before.

Regarding intraday strategies for the cryptocurrency market, I will continue to act on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of the bullish market in the mid-term, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

Bitcoin

Buy Scenario

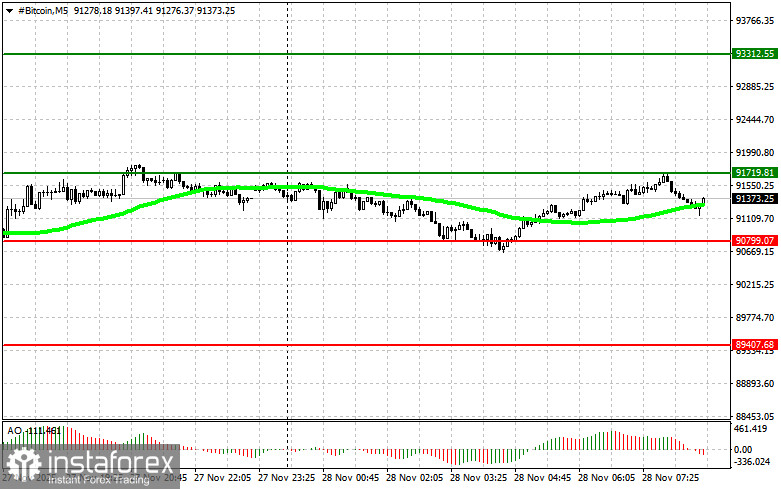

Scenario 1: I will buy Bitcoin today upon reaching the entry point around $91,700, with a target price of $93,300. Near $93,300, I will exit the buys and sell immediately on the rebound. Before buying on a breakout, I need to ensure the 50-day moving average is below the current price and the Awesome Indicator is above zero.

Scenario 2: I can buy Bitcoin at the lower boundary of $90,800 if there is no market reaction to its breakout in the opposite direction of the levels at $91,700 and $93,300.

Sell Scenario

Scenario 1: I will sell Bitcoin today upon reaching the entry point around $90,800, with a target decline to $89,400. Near $89,400, I will exit the sales and buy immediately on the rebound. Before selling on the breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome Indicator is below zero.

Scenario 2: I can sell Bitcoin at the upper boundary of $91,700 if there is no market reaction to its breakout in the opposite direction of the levels at $90,800 and $89,400.

Ethereum

Buy Scenario

Scenario 1: I will buy Ethereum today upon reaching the entry point around $3,030, with a target price of $3,080. Near $3,080, I will exit the buys and sell immediately on the rebound. Before buying on a breakout, I need to ensure the 50-day moving average is below the current price and the Awesome Indicator is above zero.

Scenario 2: I can buy Ethereum at the lower boundary of $2,995 if there is no market reaction to its breakout in the opposite direction of the levels at $3,030 and $3,080.

Sell Scenario

Scenario 1: I will sell Ethereum today upon reaching the entry point around $2,995, with a target decline to $2,943. Near $2,943, I will exit the sales and buy immediately on the rebound. Before selling on the breakout, I need to ensure that the 50-day moving average is above the current price and that the Awesome Indicator is below zero.

Scenario 2: I can sell Ethereum at the upper boundary of $3,030 if there is no market reaction to its breakout in the opposite direction of the levels at $2,995 and $2,943.