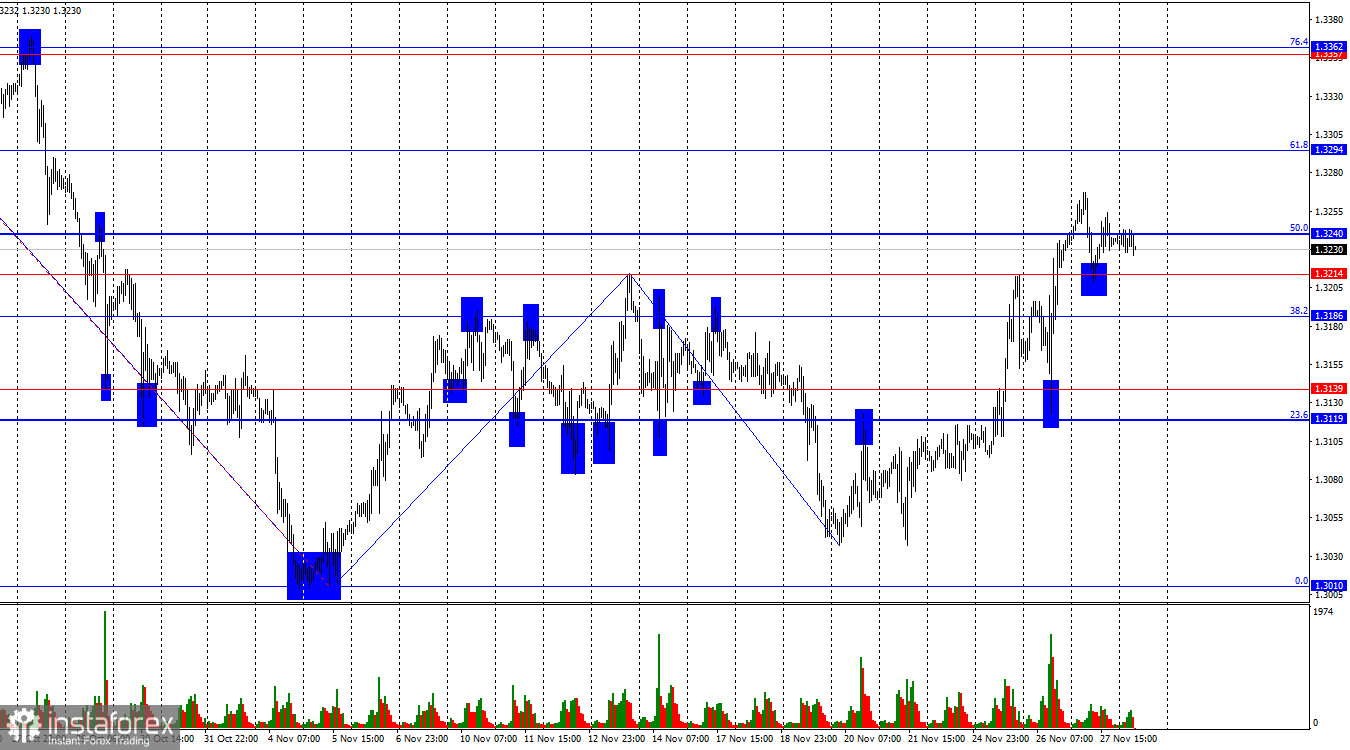

On the hourly chart, the GBP/USD pair bounced yesterday from the 1.3214 level but failed to continue rising. For most of the day, traders observed horizontal movement. Today, a new rebound from the 1.3214 and 1.3186 levels will work in favor of the pound and a resumption of growth toward the 1.3240 and 1.3294 levels. A fixation of the pair's rate below 1.3214 will allow expectations for continued decline toward 1.3186 and 1.3139.

The wave situation has turned "bullish." The last downward wave did not break the previous low, and the new upward wave broke the previous high. Thus, the trend is officially "bullish" now. The news background for the pound has been weak in recent weeks, but the bears have fully priced it in, and the news background in the U.S. also leaves much to be desired.

There was no news background on Thursday, and traders fully priced in the U.K. budget for next year, published on Wednesday. I remind you that the pound received market support, but yesterday trader activity sharply decreased, especially in the second half of the day. In the U.S., Thursday was Thanksgiving Day, so banking and stock exchanges were closed. Today, the news background is also absent, so I do not expect strong market fluctuations. Next week is difficult to call highly important, as the most important reports that are usually published in the first week of each month have been moved to a later date this time. I'm referring to Nonfarm Payrolls and the unemployment rate. However, there will still be important data — the ISM business activity indices and the ADP report. There will not be much data, and the most important ones will be released later. The next FOMC meeting will take place on December 10, and it is extremely important that all labor market, unemployment, and inflation statistics are released before this date.

On the 4-hour chart, the pair has consolidated above the descending trend channel and above the 1.3118–1.3140 level. Thus, the upward movement may continue toward the 1.3339 level, and the bulls may work on forming a trend. No emerging divergences are observed today on any indicator. A rebound from the 1.3339 level will work in favor of the dollar and a slight decline of the pair.

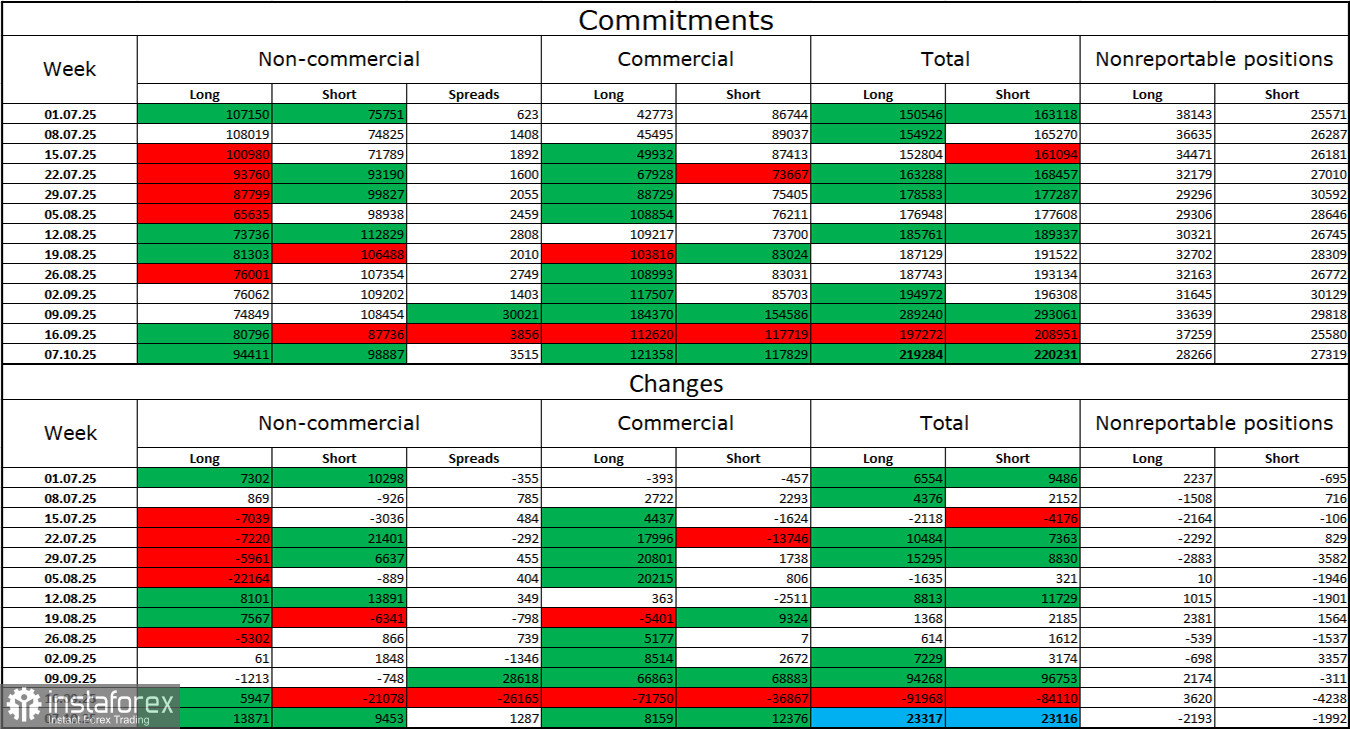

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became more "bullish" in the last reporting week, but that reporting week was one and a half months ago — October 7. The number of long positions held by speculators increased by 13,871, while short positions increased by 9,453. The gap between long and short positions is currently as follows: 94 thousand vs. 98 thousand. Virtually complete parity.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency is in demand, but I believe this is temporary. Donald Trump's policies have led to a sharp decline in the labor market, and the Federal Reserve is forced to ease monetary policy to stop rising unemployment and stimulate job creation. Therefore, if the Bank of England may cut the rate one more time, the FOMC may continue easing throughout 2026. The dollar weakened significantly in 2025, and 2026 may be no better for it.

News calendar for the U.S. and the U.K.:

On November 28, the economic calendar contains no noteworthy entries. The news background will have no influence on market sentiment on Friday.

GBP/USD Forecast and Trader Recommendations:

Selling the pair is possible today if quotes consolidate below 1.3214 on the hourly chart, with targets at 1.3186 and 1.3139. Long positions may be opened if the price consolidates above 1.3240 on the hourly chart, or on a rebound from 1.3214 and 1.3186, with targets at 1.3240 and 1.3294.

The Fibonacci grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.