Brazil has also taken the path of confrontation with Washington. Perhaps less openly and more cautiously, but confrontational. Brazil understands that America is somewhat dependent on it, as it exports numerous food products. In the U.S., prices are rising, and the greatest dissatisfaction among American voters stems from rising food prices. It is evident that increases in the prices of cars, furniture, and various metals concern only those Americans who consume (directly or indirectly) these categories of goods. However, everyone consumes food without exception. The cost of living in America is rising, and simultaneously, Trump is increasingly tightening the screws in the areas of subsidies, grants, and assistance to low-income citizens.

Since the vast majority of the electorate is not the wealthiest individuals, such a price rise could lead the Republican Party to lose spectacularly in the next elections. Undoubtedly, both Trump and Bessent have repeatedly stated that price increases will be imperceptible due to strong economic growth. However, in most cases, economic growth pertains to American millionaires and billionaires, not the working class.

Trump's political ratings continue to decline. And if Trump's ratings are falling, the entire Republican Party's ratings are falling as well. Next year, there will be special elections for Congress, and the Republicans could lose one of the chambers. It will then become more difficult for Trump to make independent decisions. Currently, when both chambers are "Republican," problems have arisen only when passing the budget for the next year, as it required support from not 50% of senators but 60%. In all other cases, a simple majority sufficed.

Given this, Trump urgently needs to regain voters' trust, which will be quite challenging amid protests and demonstrations against him across the country. The examples of Brazil and China have shown the world that it is possible to stand up to the U.S., but for that, at least some trump cards are needed. Or the support of other geopolitical giants. When there is a "big brother" behind you, Washington's threats sound less intimidating. Therefore, as I said earlier, the weak will sign deals with Trump on oppressive terms, while the strong will resist.

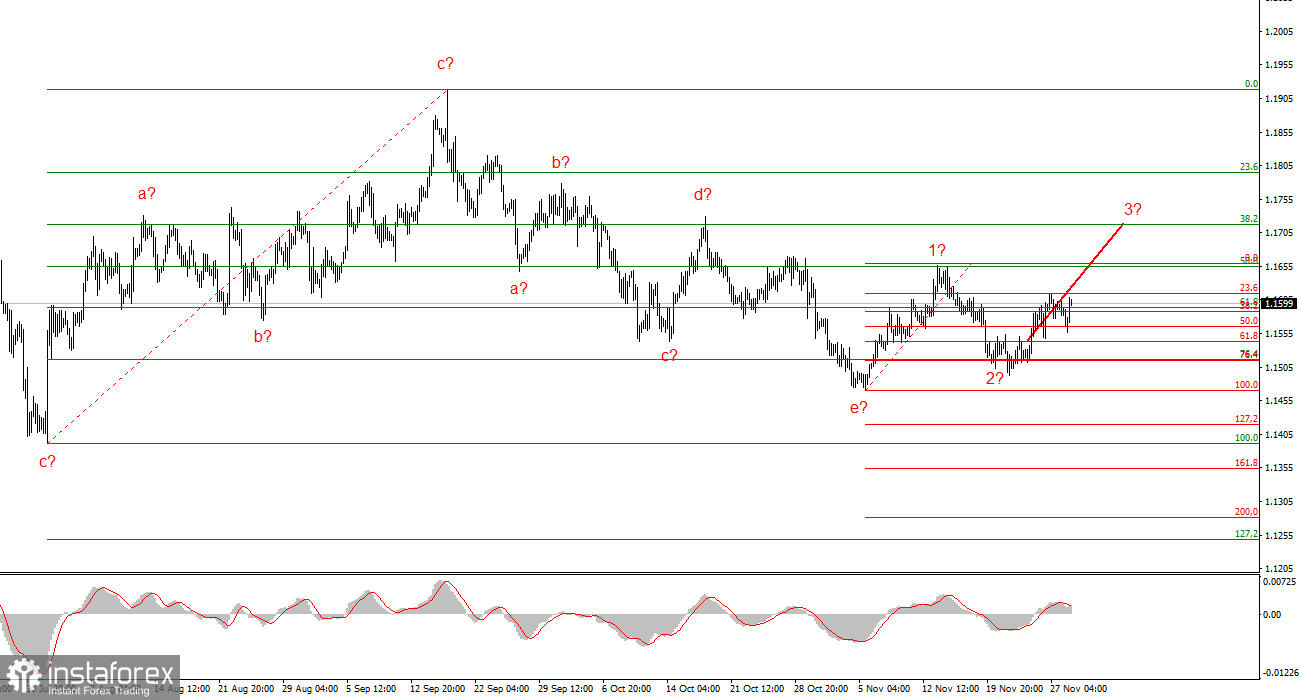

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the decline of the American currency in the future. The targets for the current trend section may extend to the 25th level. At this time, the construction of an upward wave set may continue. I expect that, given the current positions, the third wave of this set will continue to form, which could be either (c) or (3). At this time, I remain in buys with targets in the range of 1.1670–1.1720.

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive section of the trend, but its internal wave structure has become complex. The downward correction structure a-b-c-d-e in (c) at (4) appears to be quite complete. If this is indeed the case, I expect the main section of the trend to resume building with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave (3) or (c) with targets around the levels of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of the Fibonacci.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to trade because they often trigger changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.