The only predictable trait of Trump is his unpredictability. Many economists note the complete absence of strategy or tactics in the actions and statements of the American president. Essentially, the leader of the White House operates like a true businessman: trying to push for better terms for himself, and if that doesn't work, he backs down. This is the approach Trump takes with all countries around the world. If he can gain additional income or improve trade conditions without making any concessions, why wouldn't he do it?

In addition, many political analysts point out a certain "narcissism" in the U.S. president. In other words, some of Trump's actions are not even aimed at achieving direct benefits for the U.S., but rather serve to bolster Trump's status as a "world ruler." The leader of the White House wants not only to govern America but to oversee the entire world. Many are willing to accept this scenario as long as relations with the largest economy are not spoiled. However, China, Russia, Brazil, and even Indonesia do not share this view and are fully aware that behind one set of claims, demands, and ultimatums will follow another. Trump pressures opponents until they relent. I personally would not be surprised if, in a couple of years, Trump announces a new "universal injustice" against the U.S. and starts imposing new tariffs and sanctions. And so it would continue indefinitely.

From all of the above, it follows that protectionist policies with America are now serious and long-term. This is no longer just a figure of speech but a concrete strategy of the White House. The dollar will continue to suffer under this policy because that suffering is extremely beneficial to Trump. The more the dollar is sold off, the cheaper it becomes. The cheaper the dollar, the easier it is to sell American goods, raw materials, oil, and gas abroad. However, at the same time, Trump also demands that the whole world not even consider abandoning the dollar as the "world currency for transactions," "safe haven," and "reserve currency." As I mentioned earlier, Trump wants the whole world to function according to his wishes. Therefore, I do not doubt that the American currency will continue its decline.

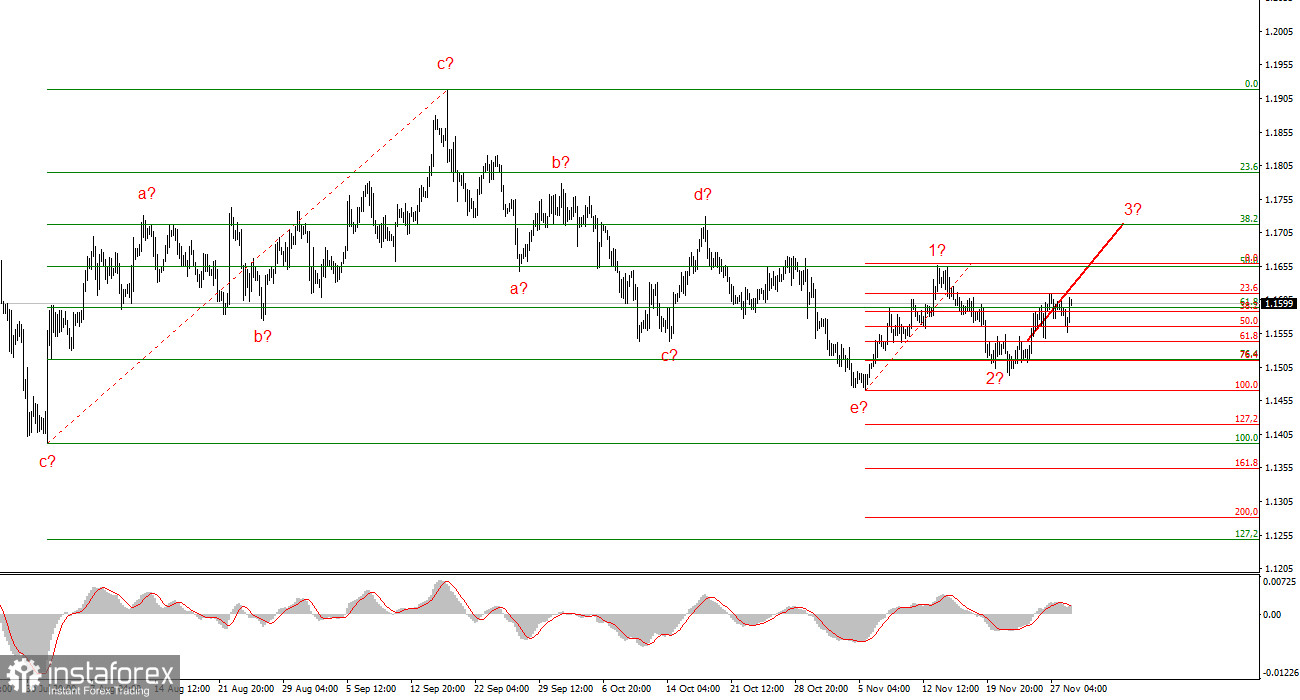

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the decline of the American currency in the future. The targets for the current trend section may extend to the 25th level. At this time, the construction of an upward wave set may continue. I expect that, given the current positions, the third wave of this set will continue to form, which could be either (c) or (3). At this time, I remain in buys with targets in the range of 1.1670–1.1720.

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive section of the trend, but its internal wave structure has become complex. The downward correction structure a-b-c-d-e in (c) at (4) appears to be quite complete. If this is indeed the case, I expect the main section of the trend to resume building with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave (3) or (c) with targets around the levels of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% of the Fibonacci.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to trade because they often trigger changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.