The European currency will strive to advance further in the upcoming week. I want to remind you that situations often arise where the news background conflicts with wave analysis (or other types of analysis). In such cases, the stronger factor prevails. In my opinion, wave analysis is stronger right now, but some reports from the U.S. and the Eurozone could negatively affect the movement. In upcoming reviews, we will examine events that might cause the instruments' movements to deviate from desired behavior.

There will be several events in the Eurozone. It will all start with business activity indices in the manufacturing sector on Monday, followed by an inflation report on Tuesday, service sector business activity indices and a speech by Christine Lagarde on Wednesday, a retail trade report on Thursday, and third-quarter GDP data on Friday. The state of the European economy is currently not the best, so I doubt that all these reports will support the euro. However, slightly weaker GDP growth than 0.2% quarter-on-quarter could lead to a decline. A slightly weaker inflation rate than 2.2% year-on-year could also cause a drop, not to mention the important American reports that will also be released.

Therefore, in the upcoming week, many movements will depend on the news background. It is unlikely that the entire news background will support the dollar, as there are currently many problems in America, so everything will depend on luck and the strength of the wave analysis. I remind you that if an increase is expected, it doesn't necessarily mean a rapid surge at the speed of light. It may be a very gradual, unhurried movement at a turtle's pace. By the way, in recent months, such movements have been the most frequently observed in the market. Therefore, if the news background is favorable, the euro may rise quickly to its target levels. However, it is unlikely to count on such a scenario.

Wave Analysis of EUR/USD:

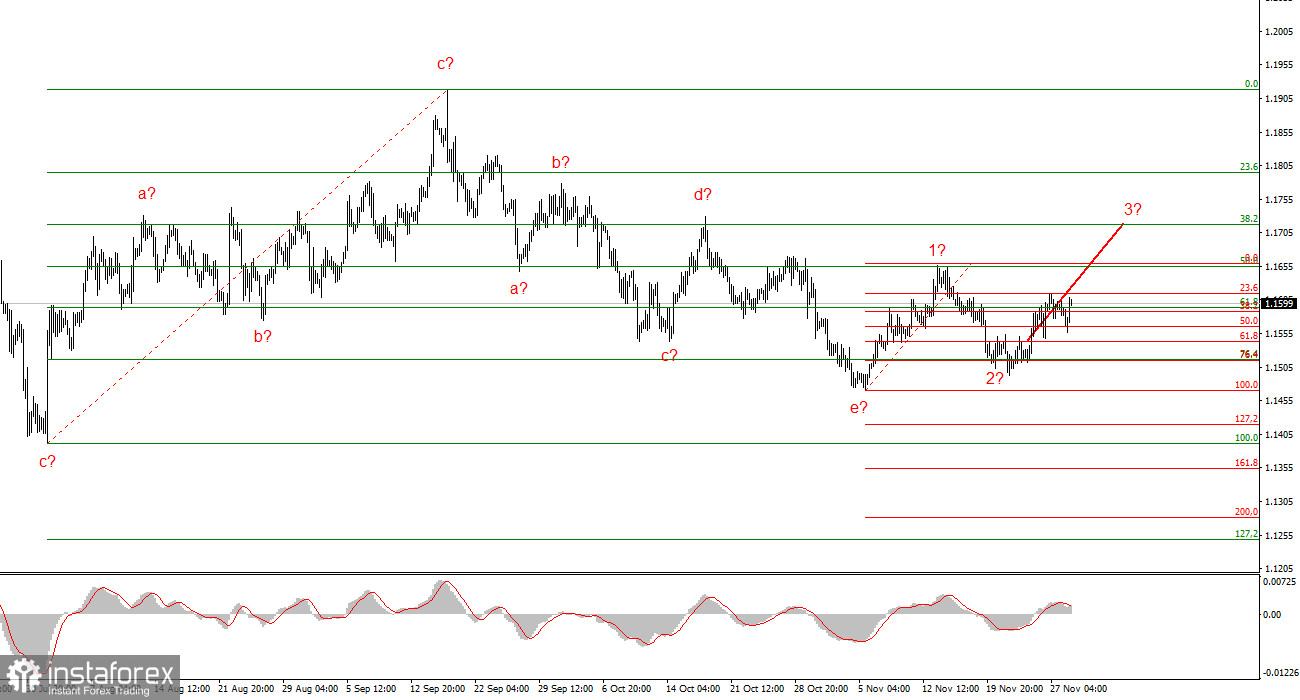

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the decline of the American currency in the future. The targets for the current section of the trend may extend all the way to the 25 level. At this time, the formation of an upward wave set may continue. I expect that, given the current positions, the third wave of this set will continue to form, which could be either (c) or (3). At this moment, I remain in buys with targets around the range of 1.1670 – 1.1720.

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive section of the trend, but its internal wave structure has become complex. The downward correction structure a-b-c-d-e in (c) at (4) appears to be quite complete. If this is indeed the case, I expect the main section of the trend to resume building with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave (3) or (c) with targets around the marks of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% according to Fibonacci.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to trade because they often trigger changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.