The review of the news background from the UK will be quite brief. Over the next five days, two reports will be released in Britain that cannot be considered capable of influencing market sentiment in the slightest. These are the business activity indices for the services and manufacturing sectors for November. However, I would like to remind you that preliminary estimates for these indices were published two weeks ago, and we will only see the final estimates in the upcoming week. They don't particularly interest me.

The working scenario for the British pound also suggests an upward movement. If we are currently observing another corrective structure within the larger corrective structure, at least three waves up should still be formed. Formally, these waves have already been built. Since the third wave has a peak above the peak of the first wave, this structure could theoretically finish at any moment. Recently, we have only seen the formation of corrective wave sets, and any corrective structure can continuously take on increasingly complex shapes. Therefore, it is likely that the pound will continue to rise as long as the euro currency is also rising. However, regarding the euro, three upward waves have not been formed yet, so the structure does not have the minimally convincing appearance required.

If the news background in the Eurozone is positive while in the U.S. it is negative, then both instruments may continue to rise above the minimally acceptable levels. Nothing is preventing the pound from forming either a strong three-wave or a complex five-wave structure. Alternatively, it could begin forming a new upward section of the trend. However, this could be hindered by the U.S. news background, which we will discuss in the next review.

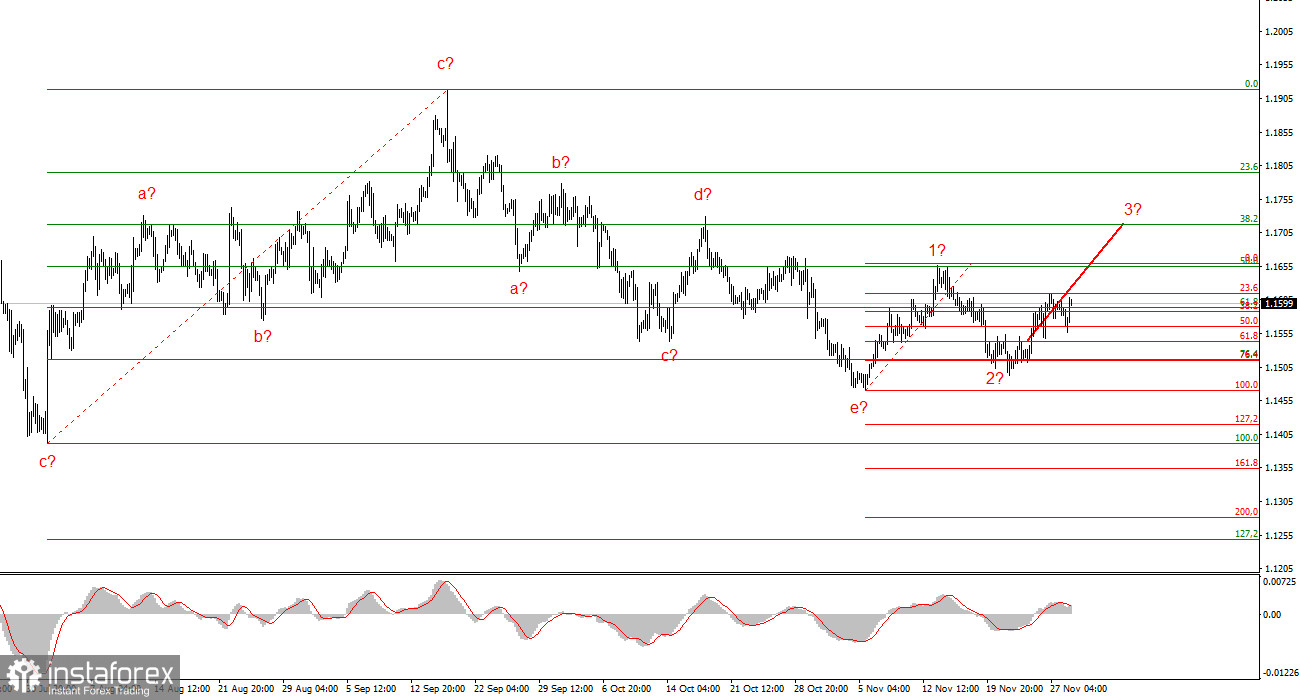

Wave Analysis of EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the decline of the American currency in the future. The targets for the current section of the trend may extend all the way to the 25 level. At this time, the formation of an upward wave set may continue. I expect that, given the current positions, the third wave of this set will continue to form, which could be either (c) or (3). At this moment, I remain in buys with targets around the range of 1.1670 – 1.1720.

Wave Analysis of GBP/USD:

The wave structure of the GBP/USD instrument has changed. We are still dealing with an upward, impulsive section of the trend, but its internal wave structure has become complex. The downward correction structure a-b-c-d-e in (c) at (4) appears to be quite complete. If this is indeed the case, I expect the main section of the trend to resume building with initial targets around the 38 and 40 levels. In the short term, one can expect the formation of wave (3) or (c) with targets around the marks of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% according to Fibonacci.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are hard to trade because they often trigger changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Don't forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.