Analysis of Trades and Trading Tips for the Japanese Yen

The price test at 156.25 coincided with a period when the MACD indicator had moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the dollar.

Today, the yen rose sharply against the U.S. dollar. The head of the Bank of Japan, Kazuo Ueda, gave a clear hint that his board may soon raise interest rates, emphasizing the possibility of such a decision at the December Bank of Japan meeting. The central bank will consider the pros and cons of raising the key interest rate and will make appropriate decisions after analyzing the state of the economy, inflation, and financial markets, both domestically and abroad, Ueda stated on Monday. Any increase would mean a correction of the easing level, as the real interest rate remains very low, he added.

This statement came as a surprise to the market, which had been confident until the last moment in the BoJ's monetary policy remaining unchanged until the end of the year. Traders began buying the yen actively, anticipating higher returns on Japanese assets. The reaction was immediate, leading to a significant strengthening of the Japanese yen against the U.S. dollar. However, it is essential to remember that a decision on raising rates has not yet been made, and the BoJ's December meeting will be a key moment for understanding the yen's prospects. Much will depend on incoming macroeconomic data, particularly inflation and GDP growth figures.

Moving forward, I will rely more on the implementation of Scenarios 1 and 2.

Buy Scenarios

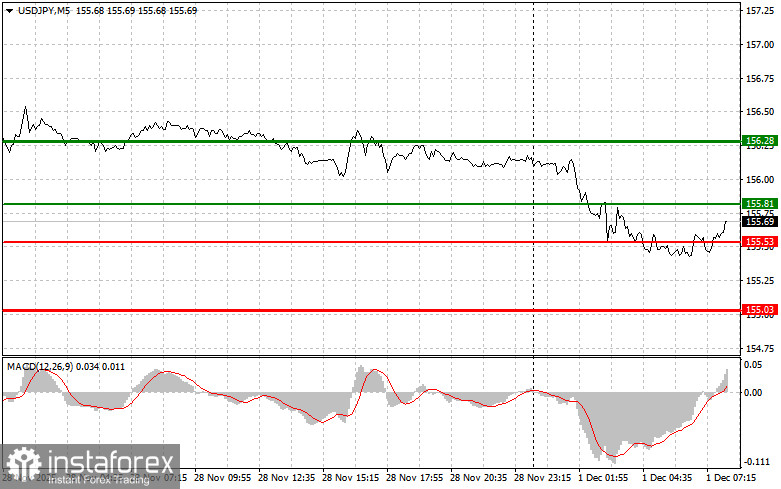

Scenario 1: I plan to buy USD/JPY today at an entry point around 155.81 (green line on the chart), with a target at 156.28 (thicker green line on the chart). At around 156.28, I intend to exit the long positions and sell immediately on the rebound (expecting a movement of 30-35 pips in the opposite direction from the entry point). It is best to return to buying the pair on corrections and significant pullbacks in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the price 155.53 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. One can expect growth to opposing levels of 155.81 and 156.28.

Sell Scenarios

Scenario 1: I plan to sell USD/JPY today only after updating the 155.53 level (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 155.03 level, where I intend to exit my shorts and buy immediately on the rebound (expecting a 20-25-pip move in the opposite direction from that level). It is better to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price 155.81 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. One can expect a decline to opposing levels of 155.53 and 155.03.

Chart Explanation:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price for placing Take Profit or taking profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price for placing Take Profit or taking profits, as further decline below this level is unlikely.

- MACD Indicator: It is important to be guided by the overbought and oversold areas when entering the market.

Important Note:

Beginner traders in the Forex market need to exercise caution when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, successful trading requires a clear trading plan, similar to the example provided above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.