Analysis of Trades and Trading Tips for the British Pound

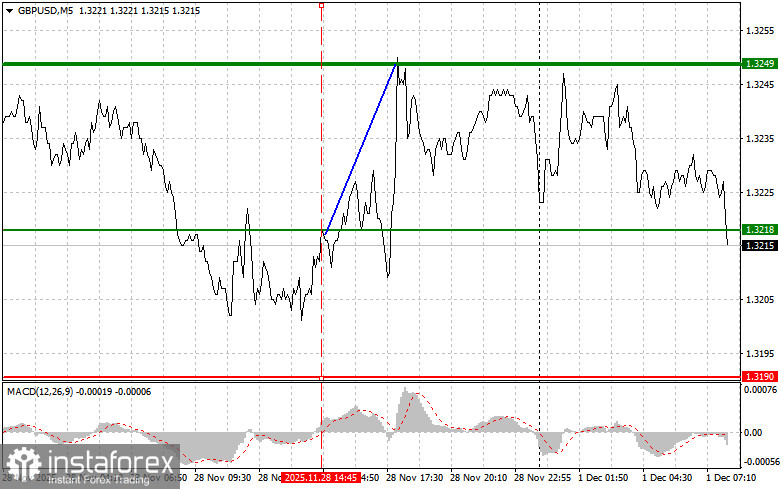

The price test at 1.3218 occurred when the MACD indicator was just starting to move upward from the zero mark, confirming a good entry point for buying the pound, which led to a 30-pip rise.

Today, attention will focus on the release of several economic indicators from the UK: the manufacturing PMI, the number of approved mortgage applications, and data on changes in the M4 money supply.

The PMI index traditionally serves as a key indicator of the health of the UK manufacturing sector. Given the current economic situation, forecasts for this indicator are cautiously pessimistic. A deterioration in PMI values might fuel concerns about a slowdown in economic growth, which is likely to weigh on the British pound. Information on approved mortgages will provide insight into the state of the UK housing market. A decrease in the number of approvals may signal a slowdown in activity in the construction sector and an overall decline in economic activity. This indicator generally has less impact on currency trading than the PMI, but complements the overall economic picture. Meanwhile, the dynamics of the M4 money supply are closely linked to the Bank of England's monetary policy. An increase in M4 could stimulate inflation.

Moving forward, I will rely more on the implementation of Scenarios 1 and 2.

Buy Scenarios

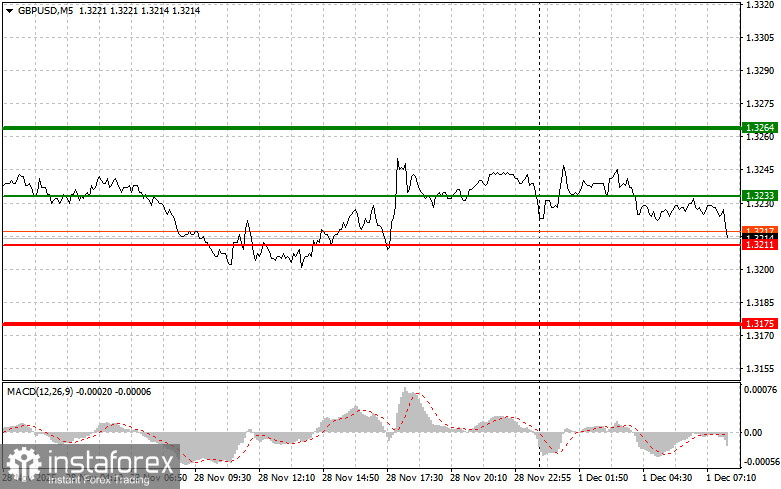

Scenario 1: I plan to buy the pound today upon reaching an entry point around 1.3233 (green line on the chart), with a target at 1.3264 (thicker green line on the chart). At the level of 1.3264, I intend to exit the market and sell immediately on the rebound, aiming for a 30-35-pip move from the entry point. A strong rise in the pound can only be expected after good data. Important! Before buying, ensure that the MACD indicator is above the zero mark and just starting to rise from it.

Scenario 2: I also plan to buy the pound today if the price tests 1.3211 twice in a row while the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. One can expect growth to opposing levels of 1.3233 and 1.3264.

Sell Scenarios

Scenario 1: I plan to sell the pound today after updating the level to 1.3211 (red line on the chart), which will trigger a quick decline in the pair. The key target for sellers will be the 1.3175 level, where I intend to exit my short positions and also buy immediately on the rebound (expecting a 20-25-pip move in the opposite direction from that level). Sellers of the pound will manifest themselves in the case of weak data. Important! Before selling, ensure that the MACD indicator is below the zero mark and just starting to decline from it.

Scenario 2: I also plan to sell the pound today if the price tests 1.3233 twice in a row, when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. One can expect a decline to opposing levels of 1.3211 and 1.3175.

Chart Explanation:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price for placing Take Profit or taking profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price for placing Take Profit or taking profits, as further decline below this level is unlikely.

- MACD Indicator: It is important to be guided by the overbought and oversold areas when entering the market.

Important Note:

Beginner traders in the Forex market need to exercise caution when making entry decisions. It is best to stay out of the market before important fundamental reports are released to avoid sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without placing stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember, successful trading requires a clear trading plan, similar to the example provided above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.