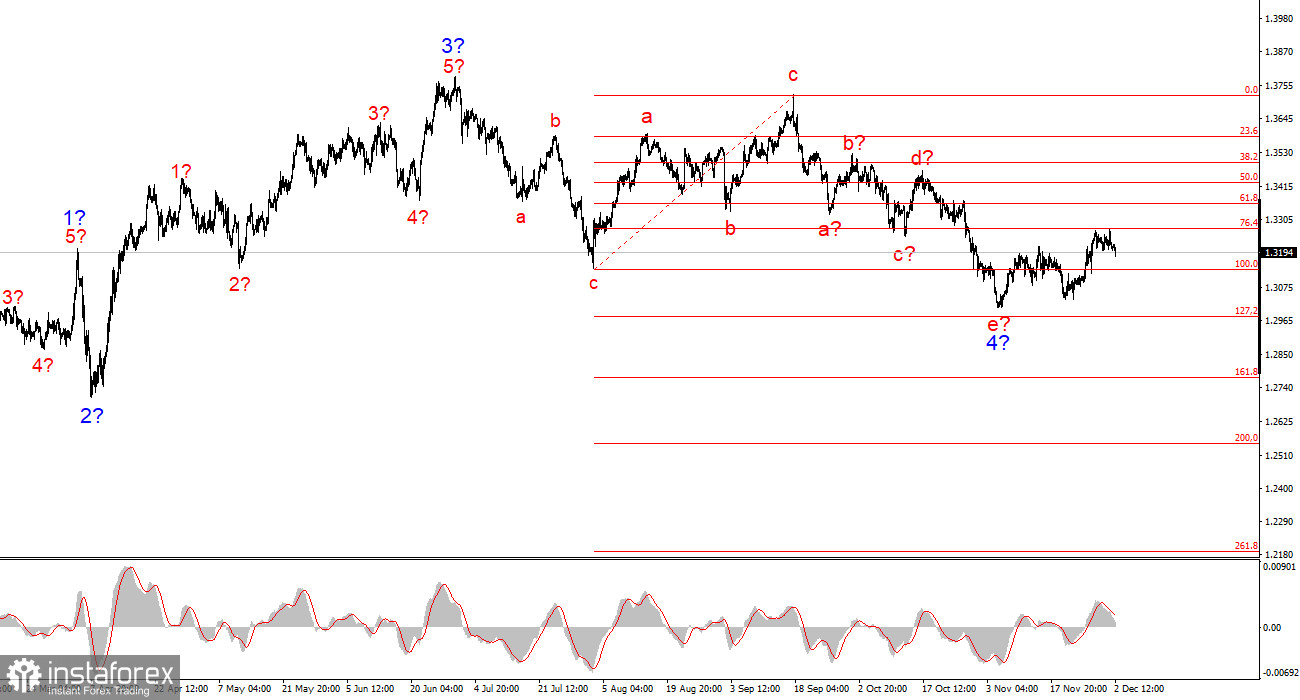

For GBP/USD, the wave pattern still suggests the formation of an upward trend segment (bottom chart), but over the past few weeks it has become complicated and stretched out (top chart). The trend segment that began on July 1 can be considered wave 4—or any large corrective wave—since it has a corrective rather than impulsive internal structure. The same applies to its internal sub-waves. Therefore, despite the pound's prolonged decline, I still believe the upward trend remains intact.

The downward wave structure that began on September 17 has taken the form of a five-wave a-b-c-d-e pattern and may now be complete. If that's the case, the pair is currently forming a new upward wave sequence.

Of course, any wave structure can get more complicated and extend at any time. Even the presumed wave 4, which has been forming for nearly five months, could turn into a five-wave pattern—meaning we'd be stuck in a correction for several more months. But at the moment, the chances favor the development of a new upward wave sequence. If that's accurate, the first two waves of this segment are already complete, and we are now watching the formation of wave 3 or wave c.

The GBP/USD pair fell by 15 basis points during the first half of Tuesday, and the more interesting moves will likely show up during the U.S. session. In general, the pound has been moving in a way that's honestly unpleasant to look at for several days in a row. The amplitude is tiny, and there's no clear directional movement. The smallest wave structure points to an upward wave sequence, but market participants—especially buyers—are so inactive that the pair can't even manage a 50–100-point move.

There's no news background on Tuesday, but Jerome Powell's speech took place overnight. It's difficult to guess what to expect from the Fed Chair in the current situation, when the labor market, unemployment, and inflation reports remain "frozen." We saw the reports for September, but who cares about those in early December, just a week before the next FOMC meeting? Last week there was still some hope that the new Nonfarm Payrolls and unemployment data for November would be released on time, but the event calendar for this week doesn't list them. So they'll come out later, once the Bureau of Labor Statistics gathers all the necessary information. How the Fed will make a rate decision on December 10 without this data remains unclear. There's a lot more uncertainty in the currency market now than traders can reasonably handle.

General Conclusions

The wave pattern for GBP/USD has changed. We're still dealing with an upward, impulsive trend segment, but its internal structure has become more complex. The downward corrective a-b-c-d-e pattern inside wave 4 looks complete. If that's truly the case, I expect the main trend to resume with initial targets near the 1.38 and 1.40 levels. In the short term, we can expect the formation of wave 3 or c with targets around 1.3280 and 1.3360, which correspond to the 76.4% and 61.8% Fibonacci levels. These are the minimal targets in case the market decides to complicate wave 4 even further.

The larger-scale wave structure looks almost perfect, even though wave 4 went above the peak of wave 1. But remember: perfect wave structures exist only in textbooks. Reality is much messier. At the moment, I don't see any reason to consider alternative scenarios to the upward trend.

My Core Analysis Principles:

- Wave structures should be simple and clear. Complicated ones are tough to trade and often change.

- If you're not confident about what's happening in the market, it's better not to enter it.

- There can never be 100% certainty about market direction. Always use Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.