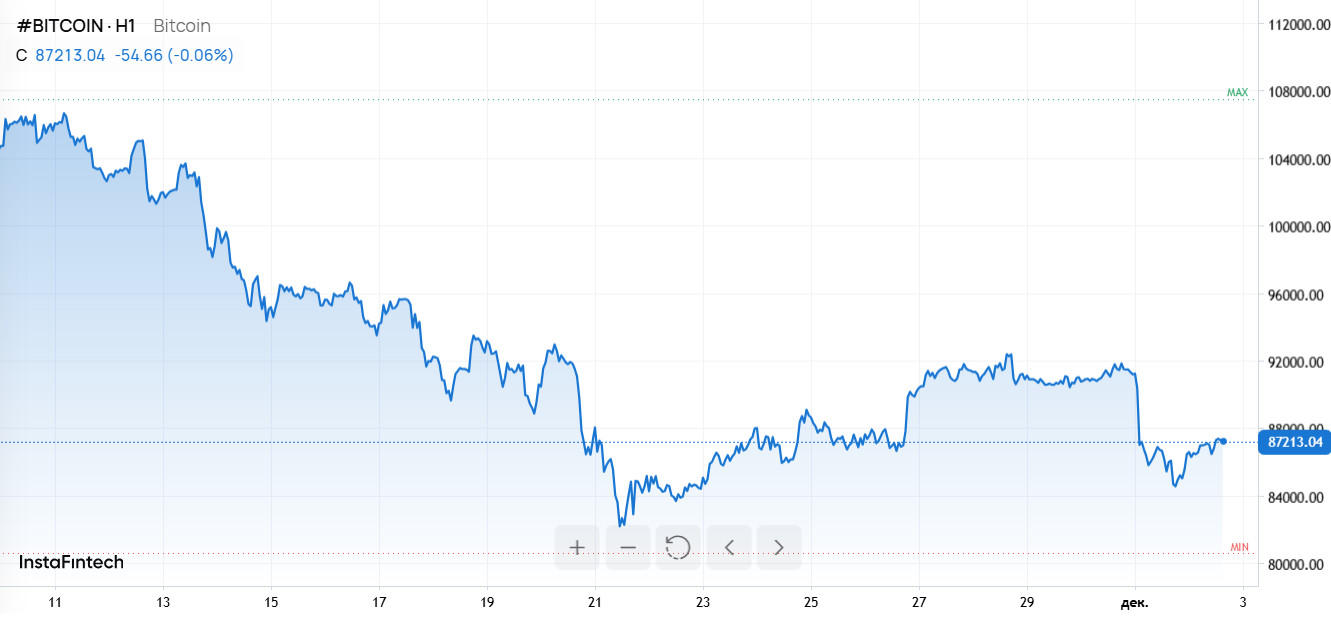

December 1st became a black day for the cryptocurrency market: at the start of the Asian trading session, Bitcoin sharply dropped below the $88,000 mark, erasing all weekly gains and sending the market into freefall. The price crash triggered a mass liquidation of leveraged positions amounting to around $400 million within just one hour. Thousands of traders worldwide suffered losses, particularly holders of long positions, which accounted for 90% of the liquidated bets.

Causes of the collapse and consequences

According to Bloomberg, during the Sunday crash (which has unofficially been dubbed this on crypto forums), Bitcoin lost up to 4.3% of its value, falling to $87,000. Over the weekend, the asset had shown relative stability, trading around $91,500. However, a surge in selling volume, according to analysts at Kobeissi Letter, triggered a domino effect: the rapid decline activated stop orders and margin liquidations, exacerbating the crash.

November marked the worst month for Bitcoin in the past five years—as the cryptocurrency lost 17.5% in 2025, which was even worse than the decline in February (-17.39%).

Investors exiting ETFs

US-listed Bitcoin ETFs experienced record capital outflows in November, amounting to between $3.48 billion and $3.79 billion. This unprecedented blow to these instruments has occurred since their launch in January 2024. The flagship iShares Bitcoin Trust from BlackRock was particularly hard hit, with investors pulling out $2.47 billion, accounting for 63% of total outflows among similar products.

Additional bearish factors

External aspects are also weighing on the market. Specifically, the decentralized finance platform Yearn Finance reported a fund leak from its yETH liquidity pool: following an exploit involving "infinite minting," approximately $3 million in Ethereum was moved through crypto mixers. Although the attack was limited to a specific product, this incident heightened mistrust in the market.

The international macroeconomic situation is also not conducive to the rise of cryptocurrencies. The yield on 2-year Japanese government bonds reached 1.01%—the highest level since 2008—prompting appreciation of the yen and renewing fears about potential tightening of monetary policy by the Bank of Japan. These events intensified investors' desire to shift away from risk assets.

Major altcoins followed Bitcoin's decline: Ethereum dropped by 6%, falling below $2,900, while Solana, Dogecoin, and XRP each lost over 4%. The total market capitalization of cryptocurrencies plummeted from $4.3 trillion to $3 trillion over the month.

What this means for traders and how to profit

Despite the pessimistic outlook, the current volatility presents interesting opportunities for traders. First and foremost, short-term speculation on sharp price swings can yield substantial profits, especially in conditions of increased liquidity and trading volume. Engaging in options or futures trading for a decline in Bitcoin's price can be an effective strategy for hedging risks or active trading.

Besides, investors who believe in the long-term growth of cryptocurrencies may view the current downturn as an opportunity for a "discounted entry"—widespread fear often presents rare chances to buy strong assets at a reduced price.

Regardless of how the situation unfolds, professional traders must remain composed and adapt their strategies to the changing environment: now more than ever, risk management, analysis, and an understanding of the influence of global factors on the market are crucial.