Yesterday, stock indices closed with gains. The S&P 500 rose by 0.25%, while the Nasdaq 100 increased by 0.59%. The Dow Jones Industrial Average strengthened by 0.39%.

On Wednesday, Asian indices traded within narrow ranges, reflecting Wall Street's dynamics as investors remained cautious ahead of the release of several key economic data points from the United States.

The MSCI All Country World Index offset early gains of 0.3%, as Chinese stocks traded on the Hong Kong Stock Exchange showed their worst performance in recent times. European futures indicated a slightly positive market opening, while futures on the S&P 500 rose by 0.2%.

Activity in the cryptocurrency market remained robust. Bitcoin surged for the second session, approaching $94,000, marking a continued rebound after Monday's sell-off. On the currency markets, the Indian rupee fell below the key psychological level of 90 per dollar.

The restrained dynamics in the stock market highlighted how unstable sentiment remains ahead of the decisions by the Federal Reserve and the Bank of Japan on interest rates, which will be made next week. Today, the US is set to publish the ADP report on private sector employment for November, along with the import price index and industrial production data for September.

Particular attention is being paid to the ADP report, which is often seen as a precursor to the official employment data released by the US Department of Labor. However, I remind you that there will be no labor market report this Friday. Strong private sector employment figures may bolster confidence in the resilience of the economy, while weak data could raise concerns about slowing economic growth. This, in turn, could influence the Fed's decisions regarding further rate cuts. Regarding industrial production data, it will provide insights into the health of the manufacturing sector, a key indicator of overall economic activity. A decline in industrial production may indicate waning demand and potential supply chain issues. The import price index is also important, as it can give insight into inflationary pressures coming from abroad.

"The sky certainly isn't clear enough for a broad-based rally," Melbourne-based Vantage Markets said. "The upcoming, decision-shaping US PCE print and a heavy slate of central bank meetings are keeping traders on edge. With so many pivotal signals still ahead, investors are favoring a more conservative stance rather than chasing risk at this stage."

As I mentioned earlier, the Indian rupee weakened amid ongoing delays in concluding a crucial trade agreement with the US, negatively impacting sentiment. Silver fell after its previous record rise, as traders made speculative bets on continued supply shortages and declining interest rates in the US. The price of gold remained relatively unchanged, and WTI oil prices stayed stable.

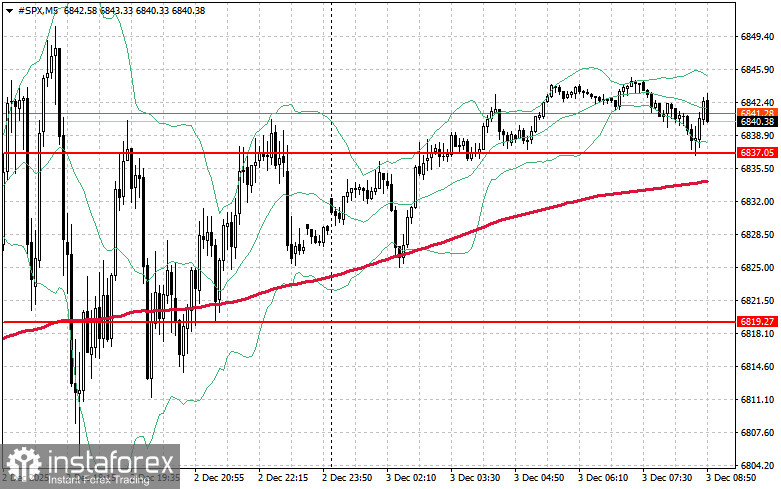

Regarding the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance level of $6,854. This would help the index gain ground and pave the way for a potential rally to a new level of $6,874. Another priority for bulls will be to maintain control over the $6,896 mark, which would strengthen buyer positions. In the event of a downturn amid reduced risk appetite, buyers must assert themselves around $6,837. A break below this level would quickly push the trading instrument back to $6,819 and open the way to $6,801.