Analysis of Trades and Trading Tips for the Japanese Yen

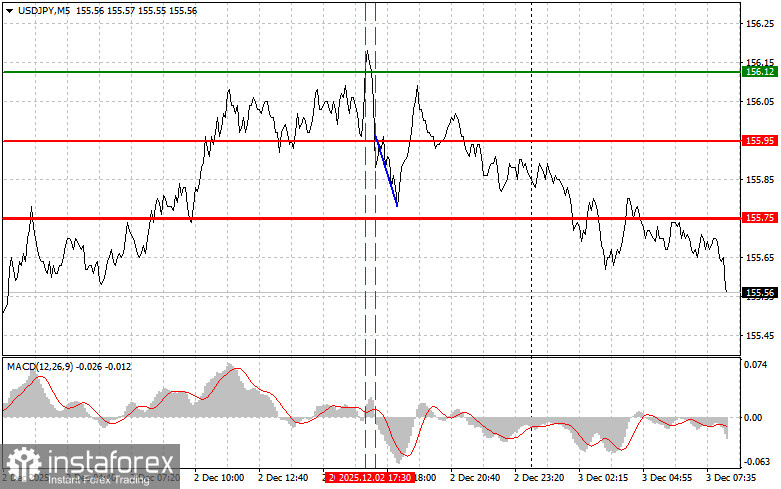

The test of the 155.95 price coincided with a moment when the MACD indicator was just beginning to turn downward from the zero mark, confirming a good entry point to sell the dollar. As a result, the pair decreased by slightly more than 15 pips.

Positive news of a sharp increase in the Economic Optimism Index from RCM/TIPP in the United States prompted a new wave of dollar strength against the Japanese yen; however, it did not spark a broader bullish trend.

Today, data on the Services PMI in Japan was released, which increased to 53.2 points, surpassing economists' forecasts and strengthening the yen against the U.S. dollar. The composite PMI index met economists' expectations. The rise in the Services PMI in Japan indicates a recovery in domestic demand and an improvement in business sentiment among service providers. The results exceeding analysts' expectations suggest stronger-than-anticipated economic growth, which naturally bolsters the national currency. Investors view this news as a signal for possible tightening of monetary policy by the Bank of Japan in the future, further boosting demand for the yen. Overall, the published PMI index data provide a positive signal for the Japanese economy and indicate potential for further growth. However, the sustainability of this growth will depend on numerous factors, including geopolitical conditions, global economic dynamics, and the BoJ's ongoing policies.

As for the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buying Scenarios

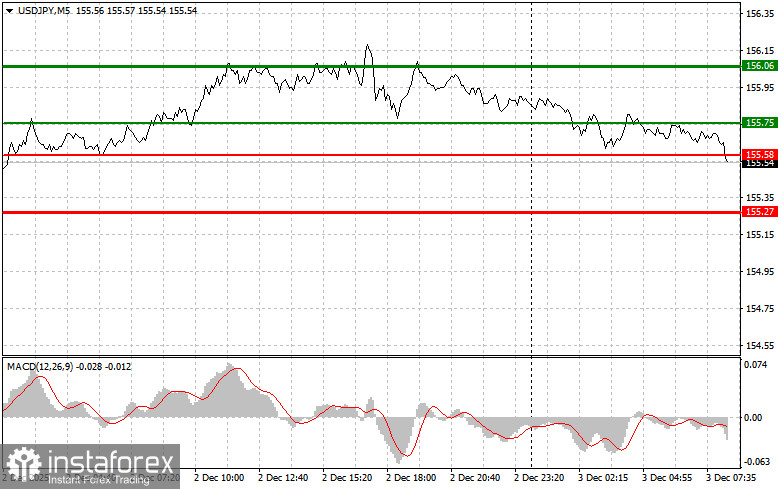

Scenario #1: I plan to buy USD/JPY today when the price reaches the entry point around 155.75 (green line on the chart), targeting a move to 156.06 (thicker green line on the chart). I intend to exit my long positions at 156.06 and open shorts in the opposite direction, aiming for a movement of 30-35 pips from the entry point. It is best to return to buying the pair during corrections and significant declines in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the price 155.58 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. One can expect growth toward the opposite levels of 155.75 and 156.06.

Selling Scenarios

Scenario #1: I plan to sell USD/JPY today only after it reaches 155.58 (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 155.27 level, where I intend to exit my shorts and also buy immediately in the opposite direction, aiming for a move of 20-25 pips from that level. It is best to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today if there are two consecutive tests of the price 155.75 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. One can expect a decline toward the opposite levels of 155.58 and 155.27.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.