All problems are in the head. Events help us remember them. For example, rumors about the appointment of Kevin Hassett as chairman of the Federal Reserve and the presentation of the British budget project reminded financial markets of the serious fiscal difficulties facing the U.S. It was enough for the "bulls" in XAU/USD to attempt to restore the upward trend.

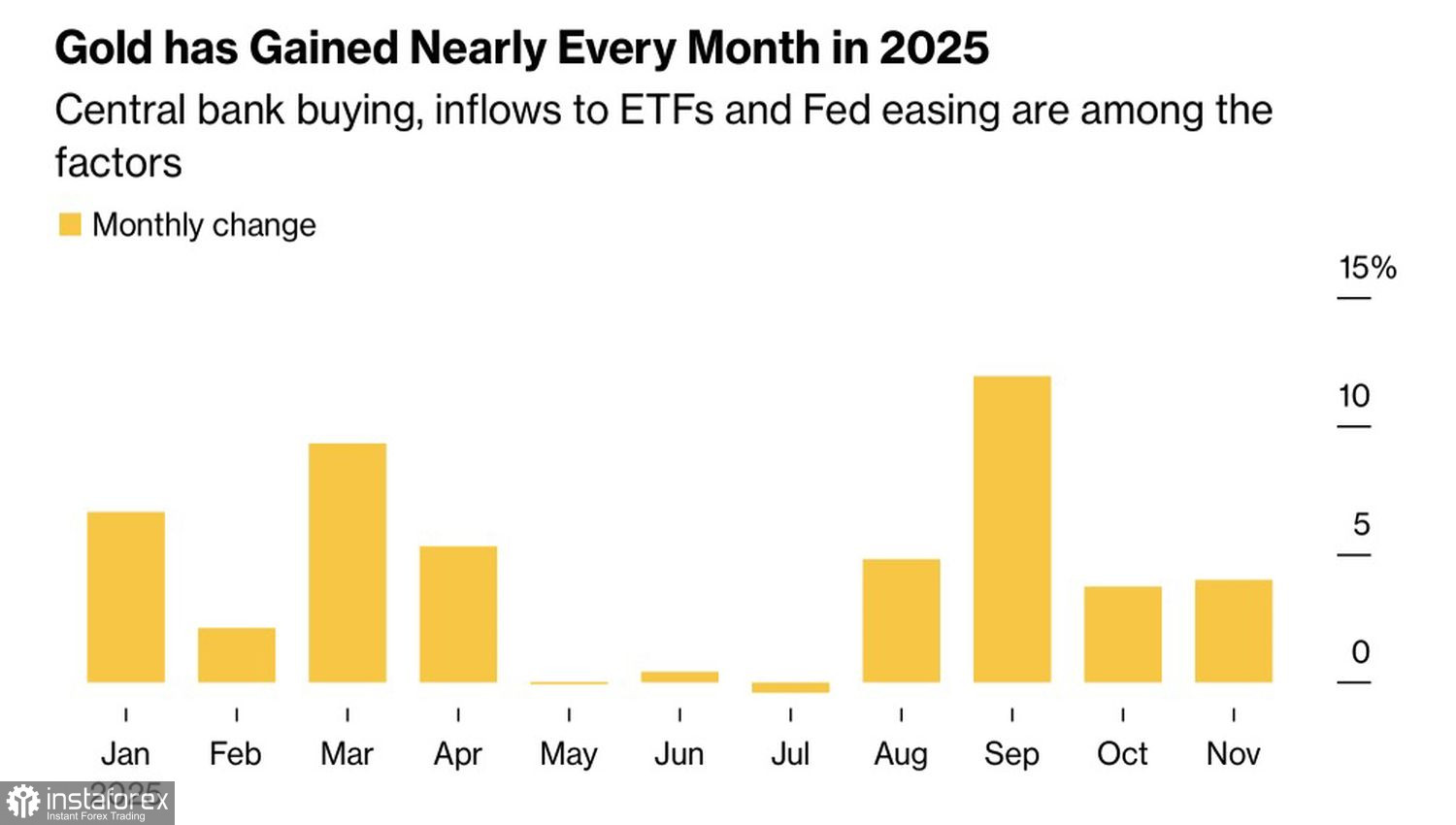

Gold has risen for the fourth consecutive month. Five out of the last six months, including November, closed in the green zone for the precious metal. It is heading towards the best annual result since 1979, thanks to the influx of capital into ETFs, central banks' demand for bullion, geopolitical factors, and expectations of the Federal Reserve lowering the federal funds rate. U.S. fiscal problems stand out as particularly significant.

Monthly Dynamics of Gold

Donald Trump's big and beautiful tax cut bill could increase government debt to 129% of GDP by 2034. The United States is already paying enormous interest on servicing this debt, reaching 17% of the budget size, more than defense spending. Debt servicing costs are extremely sensitive to rates. It is not surprising that the White House is demanding that the Fed aggressively lower them.

To achieve this, Trump is changing the composition of the FOMC. He managed to advance Stephen Miran there, who votes for a 50-basis-point cut in borrowing costs at every Committee meeting. Another one of the president's people will most likely be Kevin Hassett. He will take the position of Fed chairman, and central bank heads usually get what they want.

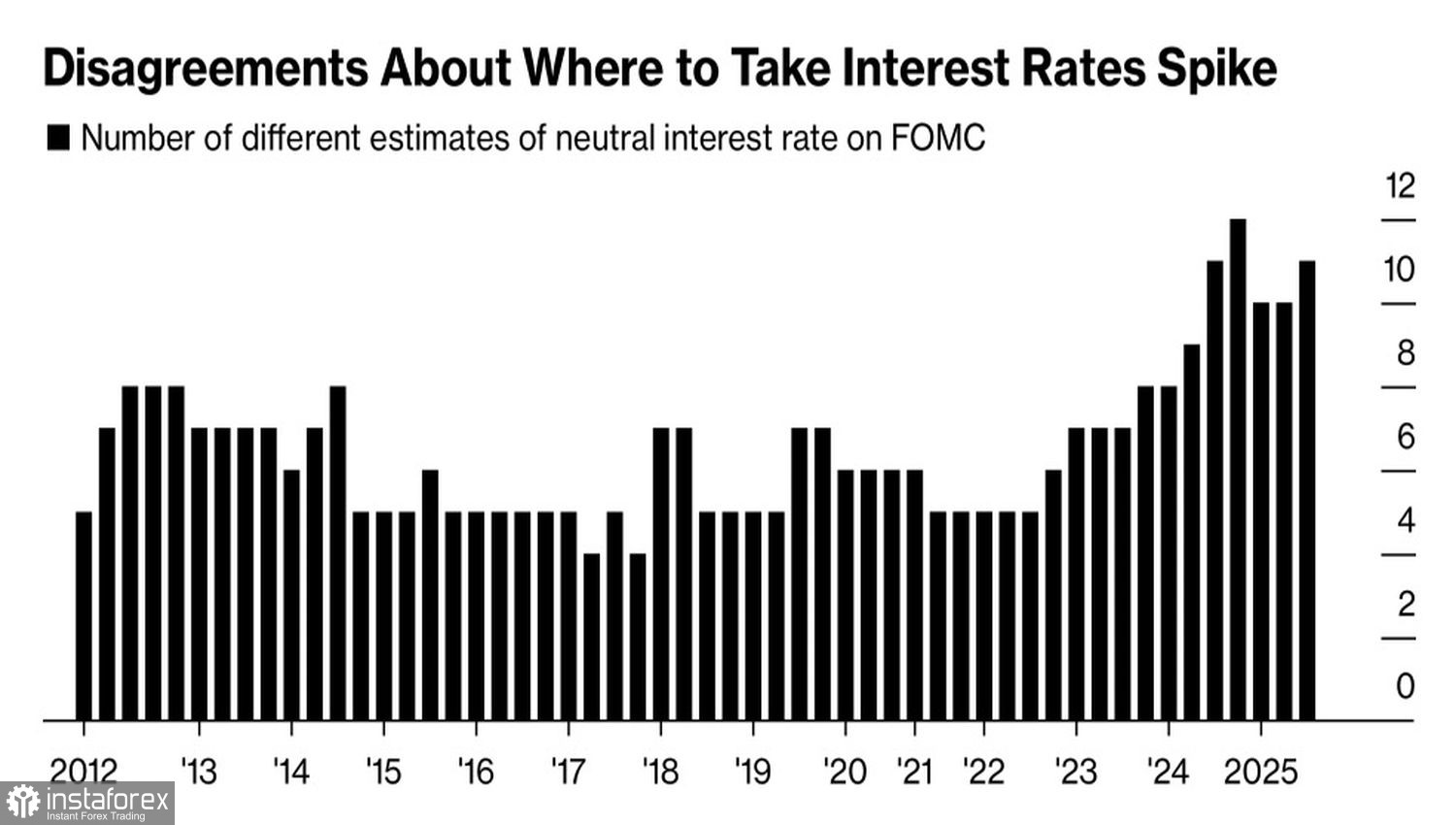

Trump is employing the principle of "divide and conquer." It has been a long time since we have seen the FOMC so divided as it is now. The "doves" are targeting a loosening of monetary policy against the backdrop of a freezing labor market, while the "hawks" are concerned about inflation.

Dynamics of Dissenters in the FOMC Composition

At the same time, expectations of a "dovish" shift in Fed thinking could accelerate inflationary expectations and raise Treasury bond yields. All this will occur in the medium term. For now, both debt rates and the U.S. dollar are falling. As a result, there is a tailwind for gold, which the precious metal is actively utilizing.

Moreover, talks between American officials in Moscow concluded without results. The peace plan adjusted by Europe and Ukraine did not appeal to Russia. Geopolitical risk has not disappeared, and this circumstance continues to support the bulls in XAU/USD. If peace approaches, central banks' demand for bullion could significantly decrease, which would negatively impact gold.

Technically, on the daily chart of the precious metal, the quotes have broken out of the triangle, allowing for long positions to be opened on a breakout above $4180 per ounce. A new high following the pin bar around $4233 will create the possibility of increasing positions. Conversely, a drop in gold below $4160 will be a reason for selling.