On Tuesday, Donald Trump announced that he has nearly decided on a candidate for the new Chair of the Federal Reserve. It is important to remember that Jerome Powell's term will expire in May 2026, and, under U.S. law, he cannot serve a second term. The President of the United States selects the new chair, and Congress must then approve the appointment. Given that Republicans control both chambers of Congress, there is no doubt that whoever Trump chooses will become the new FOMC director.

Last summer, Donald Trump insisted on Jerome Powell's early removal. A campaign was launched to remove the current Fed chair from office. Trump wanted the FOMC to begin lowering interest rates as quickly as possible, which is why he decided to resurrect archived documents from 2021. These documents contained allegations that Powell had significantly inflated the budget for the repair of Fed buildings, which became grounds for a possible dismissal. However, no U.S. court found Powell guilty, and it was later revealed that Congress had approved the budget. Trump argued that Powell had overstated the reconstruction costs; however, where is Powell's fault in this? I don't think that the Fed chair was temporarily acting as a foreman. Ultimately, Trump was unable to dismiss Powell and had to accept the reality of waiting until May 2026.

In general, once it became clear where the American president was heading (specifically towards substantial monetary policy easing), it also became evident that the only requirement for the new head of the FOMC would be complete loyalty to Trump's ideas and directives. It should be noted that the Fed is an independent body that does not execute orders from the president or Congress. Therefore, Trump cannot influence monetary policy, despite his desires. He can only do so by appointing "his person" to lead the organization. Ironically, Powell was also appointed to his position by Trump during his first presidential term. Since Trump was unable to influence Fed monetary policy through Powell either eight years ago or now, the choice of the next head must be very deliberate.

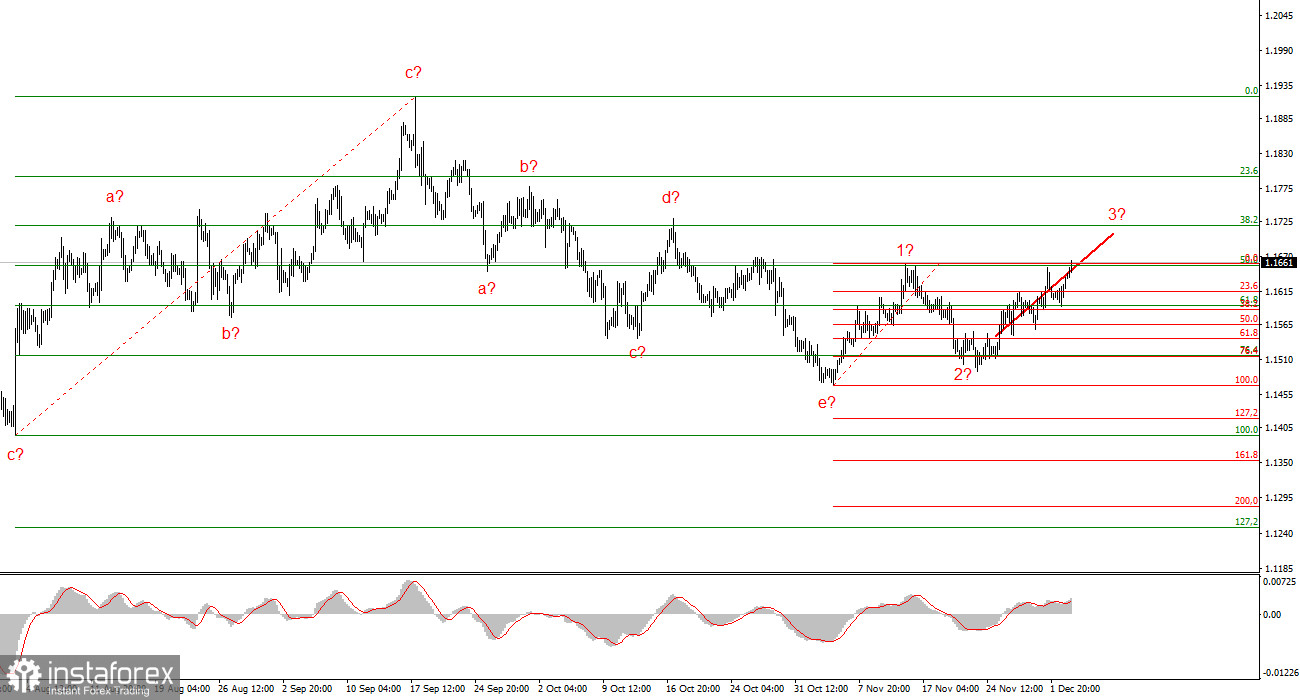

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The market has paused in recent months, but the policies of Donald Trump and the Fed remain significant factors in the future decline of the U.S. currency. The targets for the current trend segment could reach the 25 figure. At this time, the upward wave formation may continue. I expect that from the current positions, the third wave of this sequence will continue to build, which may manifest as either 'c' or '3'. I am currently holding long positions with targets in the range of 1.1670 – 1.1720.

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We are still dealing with an upward impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in 'c' at wave 4 appears to be quite complete. If this is indeed the case, I expect the primary trend segment to resume building with initial targets around the 38 and 40 figures. In the short term, one can expect the formation of wave 3 or 'c' with targets around the marks of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% Fibonacci levels. These are the minimum targets if the market decides to complicate the global wave 4 further.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often carry changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.