Based on the previous analysis, it follows that in almost any case, Donald Trump will choose a candidate who can assure him of complete obedience or on whom Trump has leverage. Thus, it became clear last summer that it would definitely be someone from the inner circle of the White House leader. On Tuesday, reports indicated with high probability that Kevin Hassett, currently serving as the president's economic advisor, will become the new Fed chair. Hassett has repeatedly stated that he believes it is necessary to lower the interest rate to well below 3%. However, we may never know whose idea this was: Trump's or Hassett's.

Regardless of who becomes the new head of the FOMC, he will follow all directives from the White House. This is so obvious that, in my opinion, the news did not warrant any special attention. Demand for the U.S. dollar began to decrease, but even without Hassett's appointment (which has not yet occurred), the dollar should decline under pressure from Trump's policies. In my view, the market was waiting for another "trigger" to confidently resume the sell-off of the American currency.

I would also remind you that the Fed chair does not make decisions regarding rates unilaterally. The FOMC must make decisions based on majority opinion, but the chair of the committee has the right to influence the views of other officials. This sounds a bit risky in theory, but in practice, no one can dictate to FOMC officials how to vote on rates.

Therefore, the essence of the monetary policy question for 2026 comes down to what leverage Hassett will use against the so-called "hawks" of the committee and what pressure Trump will exert through Hassett on these same "hawks." Currently, there are only four "doves" within the FOMC, factoring in Hassett: Stephen Miran, Michelle Bowman, and Christopher Waller. Consequently, their votes will not be enough to lower rates at every meeting. Will Hassett be able to sway at least two more officials to his side? We will find out in 2026. However, Trump's pressure on the Fed will persist until rates are reduced to around 2% or so.

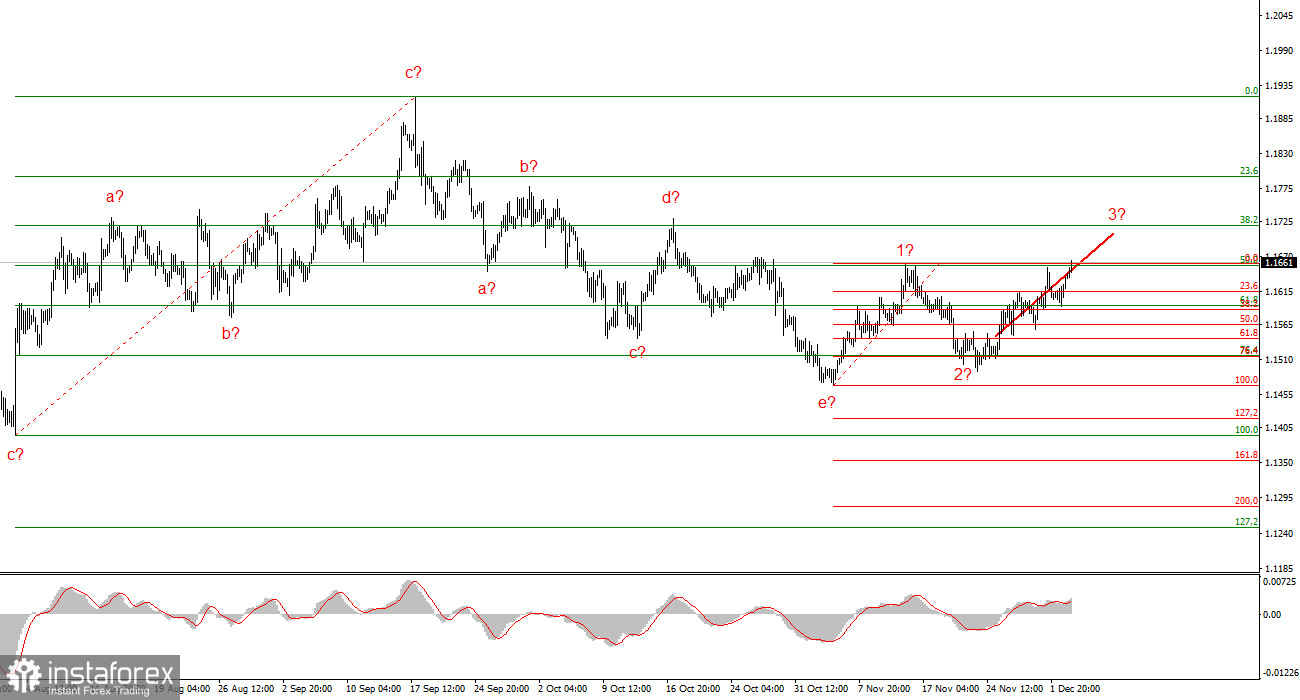

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The market has paused in recent months, but the policies of Donald Trump and the Fed remain significant factors in the future decline of the U.S. currency. The targets for the current trend segment could reach the 25 figure. At this time, the upward wave formation may continue. I expect that from the current positions, the third wave of this sequence will continue to build, which may manifest as either 'c' or '3'. I am currently holding long positions with targets in the range of 1.1670 – 1.1720.

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument has changed. We are still dealing with an upward impulsive segment of the trend, but its internal wave structure has become complex. The downward corrective structure a-b-c-d-e in 'c' at wave 4 appears to be quite complete. If this is indeed the case, I expect the primary trend segment to resume building with initial targets around the 38 and 40 figures. In the short term, one can expect the formation of wave 3 or 'c' with targets around the marks of 1.3280 and 1.3360, which correspond to 76.4% and 61.8% Fibonacci levels. These are the minimum targets if the market decides to complicate the global wave 4 further.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often carry changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There can never be 100% certainty in the direction of movement. Always remember to use protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.