Analysis of Trades and Tips for Trading the Euro

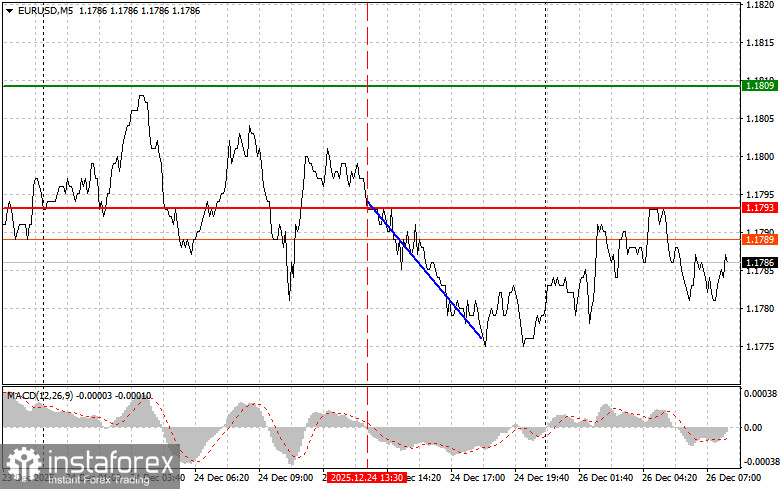

The price test at 1.1793 coincided with the MACD indicator just beginning to move down from the zero mark, confirming the correct entry point for selling euros. As a result, the pair declined by 20 pips.

On Wednesday, the lack of data ahead of the Christmas holidays affected volatility in the currency market. Trading took place within a narrow range but exhibited sharp fluctuations due to low liquidity.

Today is likely to proceed as yesterday did. Buyer activity in the EUR/USD pair during the post-Christmas period and ahead of the upcoming weekend is unlikely to be high. Against this backdrop, low liquidity increases the market's sensitivity to sudden fluctuations. In the absence of significant macroeconomic factors, the focus will primarily be on technical indicators. However, one must understand that the prevailing tendency ahead of the New Year is a wait-and-see approach, so I wouldn't expect strong directional movements.

Regarding the intraday strategy, I will rely more on the implementation of scenarios No. 1 and No. 2.

Buying Scenarios

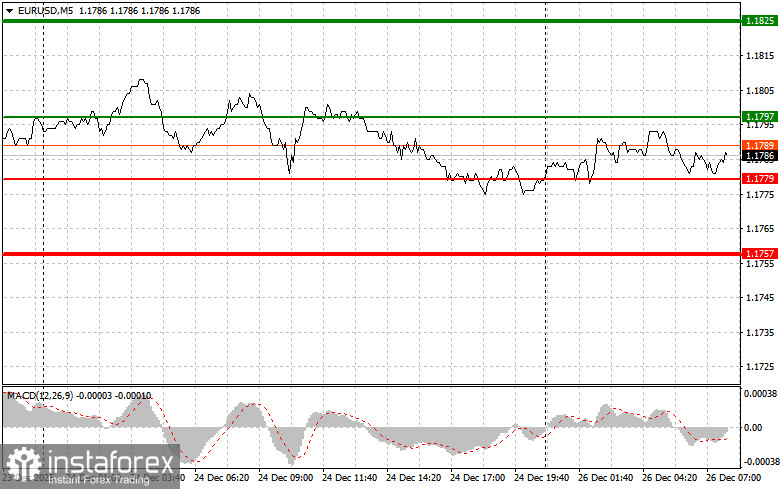

Scenario No. 1: Today, I plan to buy euros at a price around 1.1797 (green line on the chart), with a target of reaching 1.1825. At the 1.1825 level, I plan to exit the market and sell euros back, expecting a move of 30-35 pips from the entry point. Expecting the euro to rise can only be done within the framework of the trend. Important! Before buying on a breakout, ensure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario No. 2: I also plan to buy euros today if there are two consecutive tests of the price 1.1779 when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. One can expect a rise to the opposite levels of 1.1797 and 1.1825.

Selling Scenarios

Scenario No. 1: I plan to sell euros once the price reaches 1.1779 (red line on the chart). The target will be 1.1757, where I plan to exit the market and immediately buy back (expecting a 20-25-pip move in the opposite direction from that level). Some pressure on the pair may be noticeable in the first half of the day. Important! Before selling on the breakout, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario No. 2: I also plan to sell euros today if there are two consecutive tests of the price 1.1797 when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. One can expect a decline to the opposite levels of 1.1779 and 1.1757.

What is on the Chart:

- Thin green line – the entry price at which you can buy the trading instrument;

- Thick green line – the assumed price where you can set Take Profit or independently capture profits, as further growth above this level is unlikely;

- Thin red line – the entry price at which you can sell the trading instrument;

- Thick red line – the assumed price where you can set Take Profit or independently capture profits, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is important to navigate based on overbought and oversold zones.

Important Note:

Beginner Forex traders need to make decisions about entering the market very cautiously. Before major fundamental reports are released, it is best to remain out of the market to avoid getting caught in sharp fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, similar to the one presented above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.