Review of macroeconomic reports:

Few macroeconomic releases are scheduled for Monday. To be precise, only one — the ISM manufacturing index for the U.S. This report is important and is published once a month. Experts expect the index to remain below the 50.0 level, below which any reading is considered negative. However, a rise in the indicator above the forecast value of 48.3 could provide additional support to the U.S. dollar.

Review of fundamental events:

No fundamental events are scheduled for Monday. Governments and central banks have not yet returned from the Christmas and New Year holidays, so news will start arriving later. However, the market currently has a topical theme — the arrest of Nicolas Maduro and Trump's plans regarding establishing order in Greenland and Cuba. In general, we already saw a reaction to these events and plans overnight, so Donald Trump's foreign policy may influence the dollar's exchange rate in the near term. Everything will depend on what further actions the American president takes.

General conclusions:

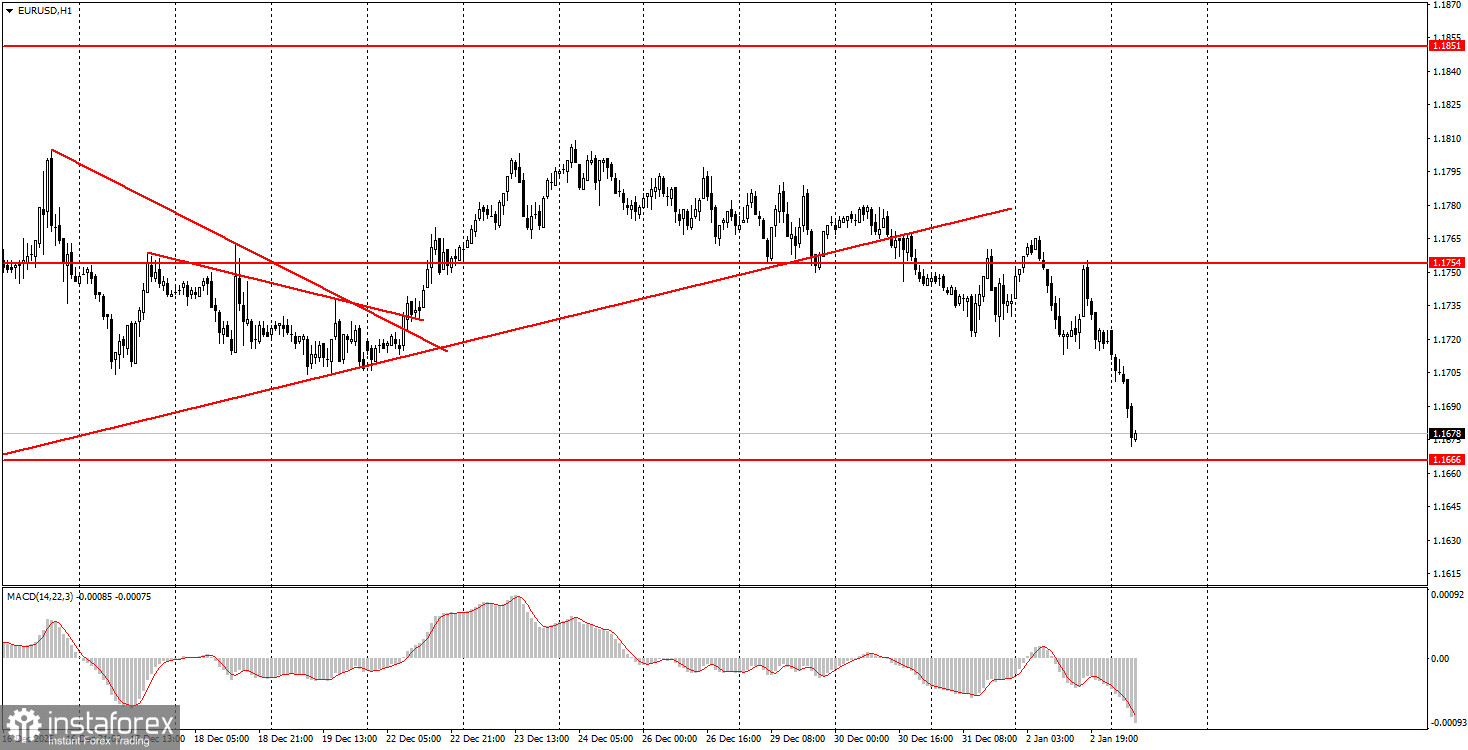

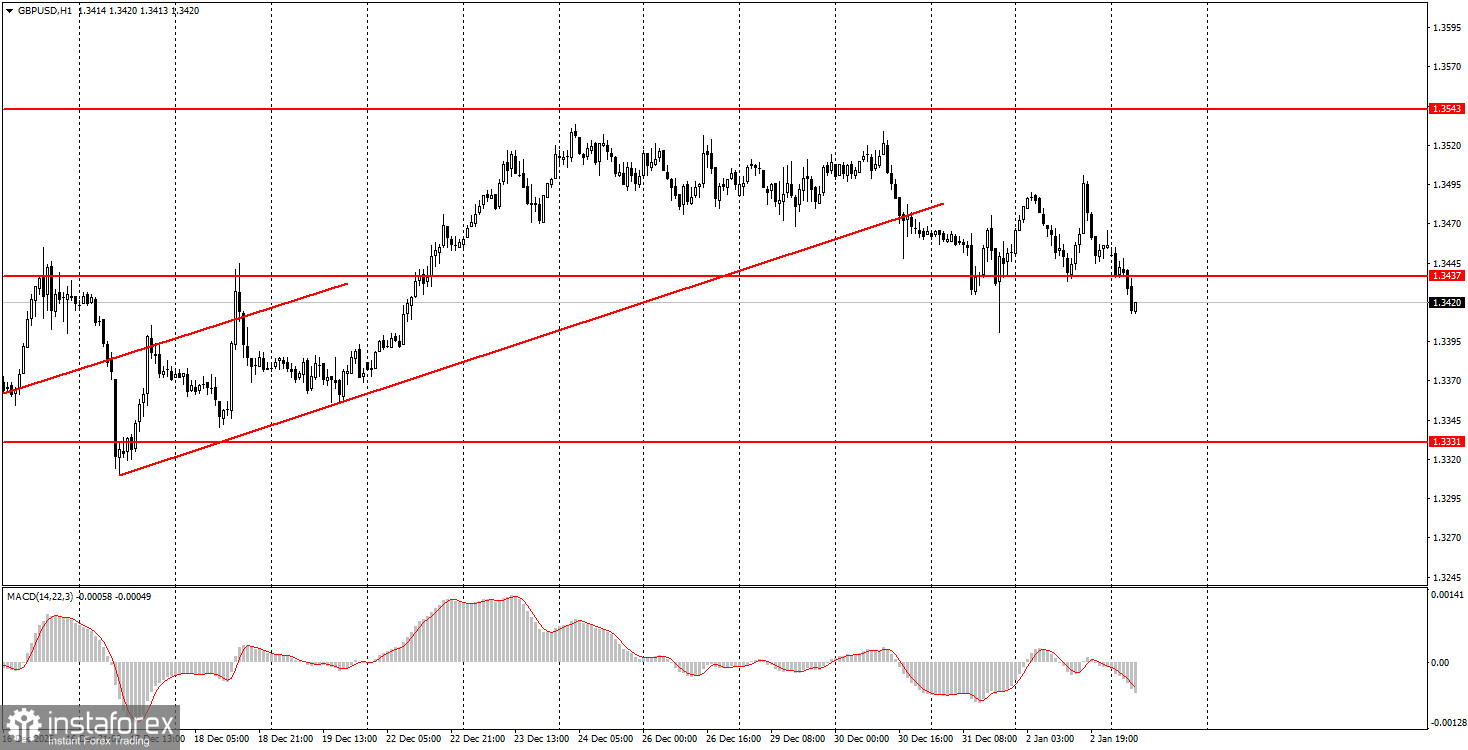

During the first trading day of the week, both currency pairs may fall, as uptrends have been broken. However, throughout the current week, the dollar will have a hard time due to a large number of macroeconomic data that are unfavorable for it — on business activity, the labor market, and unemployment. For the euro, traders have a good trading area at 1.1655–1.1666, and for the pound, the 1.3437–1.3446 area.

Main rules of the trading system:

- Signal strength is judged by the time required to form the signal (rebound or breakout). The less time required, the stronger the signal.

- If two or more trades near a level were opened on false signals, then all subsequent signals from that level should be ignored.

- In a flat, any pair can generate many false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened in the time window between the start of the European session and the middle of the American session, after which all trades should be closed manually.

- On the hourly TF, MACD signals should preferably be traded only with good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too close to each other (5 to 20 pips), they should be considered an area of support or resistance.

- After a 15–20-pip move in the correct direction, set the Stop Loss to breakeven.

What is on the charts:

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit levels can be placed near them.

Red lines — channels or trendlines that display the current tendency and show the preferred trading direction.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always contained in the news calendar) can strongly affect the currency pair's movement. Therefore, during their release, trading should be performed as cautiously as possible, or one should exit the market to avoid a sharp reversal of price against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and money management are the keys to long-term success in trading.