Trade review for Friday:

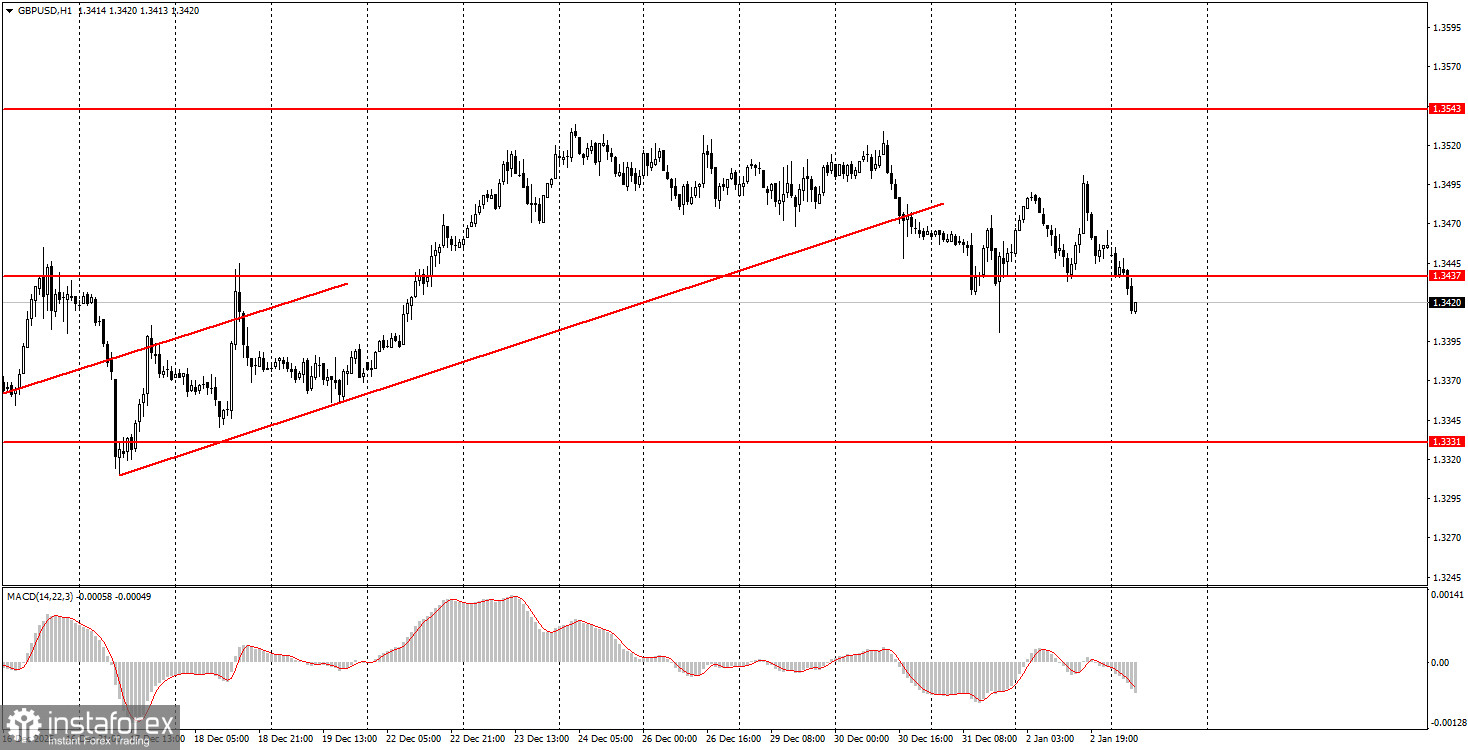

1H chart of the GBP/USD pair

The GBP/USD pair mainly traded sideways on Friday, unlike the EUR/USD pair. The British pound also breached the ascending trendline, so one can speak of a bearish trend change for GBP/USD as well. However, in recent days, the euro has been falling while the pound has stood still. Even Maduro's arrest did not trigger a serious strengthening of the dollar against the pound. Thus, we remain of the view that the dollar can show growth only within corrections — local or global. This week, the U.S. will publish a relatively large amount of important macroeconomic information, so the "dollar story" may end very quickly. We also believe that U.S. intervention and Donald Trump's personal involvement in other countries' politics are more of a negative factor for the dollar than a positive one. At present, we still do not see what would prompt the market to buy the dollar for a prolonged period.

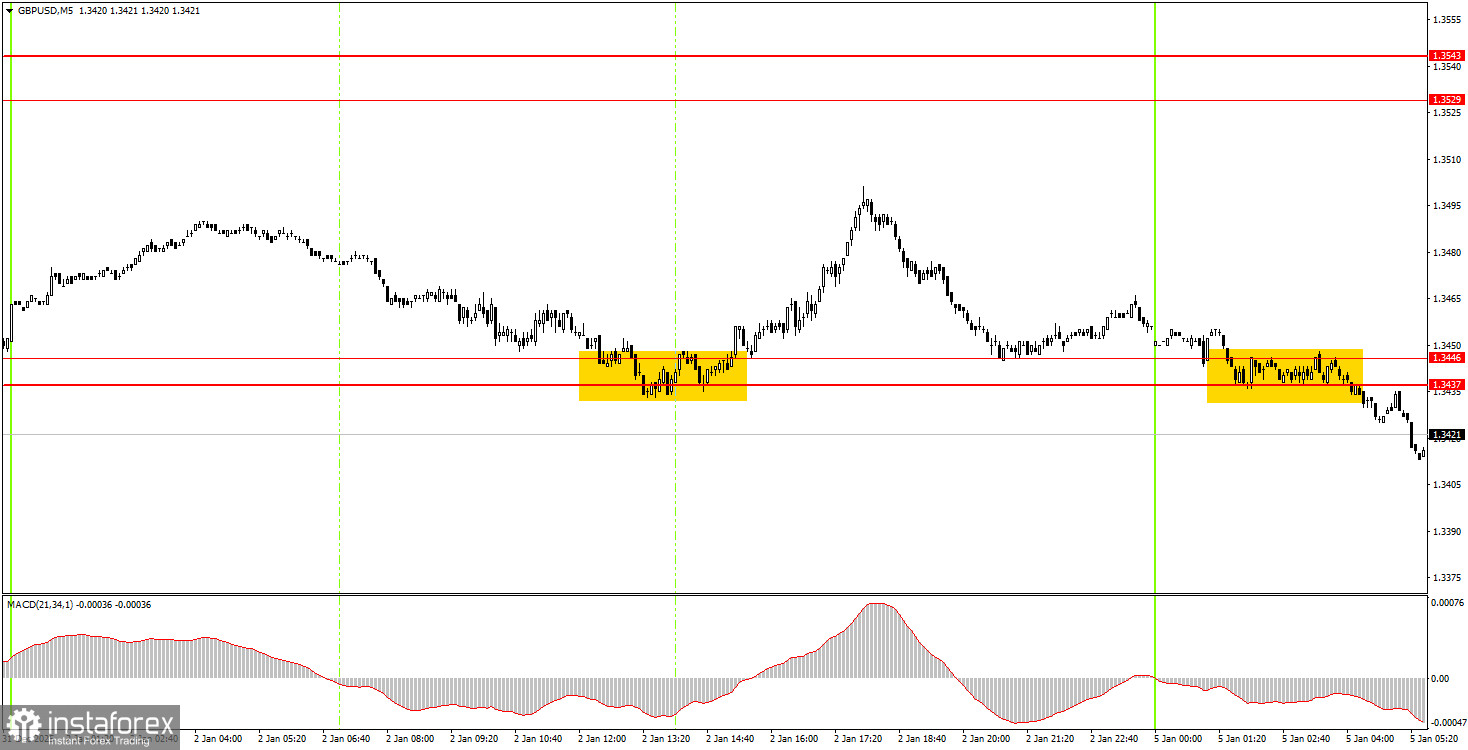

5M chart of the GBP/USD pair

On the 5-minute timeframe, the British pound formed a decent buy trade signal on Friday. At the start of the U.S. session, the price bounced from the 1.3437–1.3446 area, then moved up about 45 pips. Recall that volatility in recent weeks and months has been relatively low, so expecting the nearest target of 1.3529–1.3543 to be reached was unrealistic. Tonight, the pair closed below the 1.3437–1.3446 area, suggesting short positions are worth considering.

How to trade on Monday:

On the hourly timeframe, the GBP/USD pair closed below the trendline, so formally, technical analysis points to a downward trend. However, there are no global grounds for medium-term dollar strength, so we expect movement only to the north. Overall, we also expect the resumption of the 2025 global uptrend, which could take the pair to the 1.4000 mark within the next couple of months.

On Monday, beginner traders can consider new long positions if the price closes above the 1.3437–1.3446 area, with a target of 1.3529–1.3543. Short positions became relevant after the close below the 1.3437–1.3446 area with a target of 1.3319–1.3331.

On the 5-minute timeframe, you can trade using the levels 1.2913, 1.2980–1.2993, 1.3043, 1.3096–1.3107, 1.3203–1.3212, 1.3259–1.3267, 1.3319–1.3331, 1.3437–1.3446, 1.3529–1.3543, 1.3574–1.3590. No major events are scheduled in the UK on Monday, while the U.S. will publish the ISM manufacturing index, which is considered a "major report."

Main rules of the trading system:

- Signal strength is judged by the time required for the signal (rebound or breakout) to form. The less time required, the stronger the signal.

- If two or more trades near a level were opened on false signals, then all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened during the period between the start of the European session and the middle of the American session; after that, all trades must be closed manually.

- On the hourly timeframe, MACD signals should be traded only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are located too close to each other (5 to 20 pips), they should be considered an area of support or resistance.

- After a 20-pip move in the correct direction, set Stop Loss to breakeven.

What is on the chart:

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that display the current tendency and show the preferred trading direction.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect the currency pair's movement. Therefore, during their release, it is recommended to trade as cautiously as possible or exit the market to avoid a sharp reversal of price against the prior move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and sound money management are the keys to long-term success in trading.