Trade review and tips for trading the Japanese yen

The price test at 156.92 coincided with a period when the MACD indicator had moved well above the zero mark, limiting the pair's upside potential. For this reason, I did not buy the dollar.

The dollar's rise against the yen continued after U.S. actions in Venezuela and the capture of Nicolas Maduro. However, today's strong data showing the Japanese manufacturing PMI rising to around the 50 level limited USD/JPY's upside. Breaking the psychologically important 50 mark signals a shift of Japanese industry from contraction to expansion, which supports the yen and reduces the dollar's appeal as an object for purchases against the Japanese currency. Investors initially positioned for further USD/JPY strength may reconsider their positions amid improvements in Japan's economic prospects and the likelihood of additional rate hikes. Nevertheless, concerns remain about the scale and sustainability of Japan's recovery; despite the positive PMI, questions persist about whether the Japanese economy can reliably accelerate amid global economic uncertainty and potential trade conflicts.

As for the intraday strategy, I will mostly rely on executing scenarios No. 1 and No. 2.

Buy scenarios

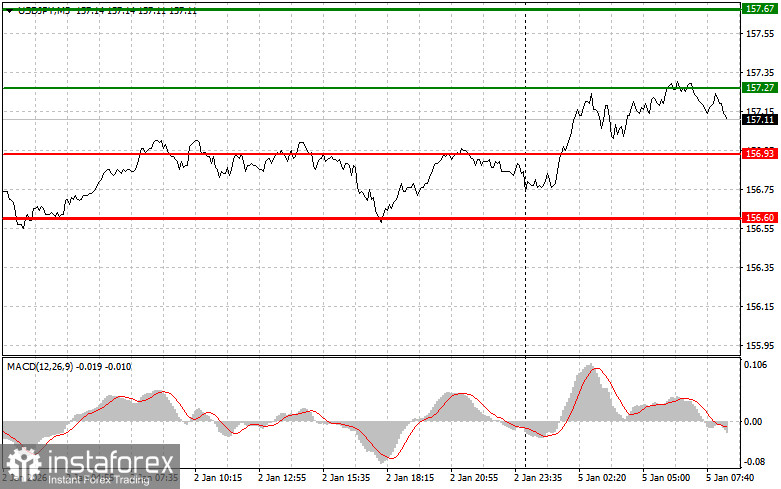

Scenario No. 1: I plan to buy USD/JPY today when the entry point around 157.27 (green line on the chart) is reached, with a target of 157.67 (thicker green line on the chart). Around 157.67, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip reversal from that level). It is best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure the MACD indicator is above zero and just beginning to rise.

Scenario No. 2: I also plan to buy USD/JPY today in case of two consecutive tests of 156.93 when the MACD is in the oversold area. This will limit the pair's downside potential and trigger an upward reversal. One can expect a rise to the opposite levels, 157.27 and 157.67.

Sell scenarios

Scenario No. 1: I plan to sell USD/JPY today only after a break below 156.93 (red line on the chart), which should trigger a rapid decline in the pair. Sellers' key target will be 156.60, where I plan to exit shorts and immediately open longs in the opposite direction (expecting a 20–25 pip reversal from that level). It is better to sell as high as possible. Important! Before selling, ensure the MACD indicator is below zero and just beginning to fall.

Scenario No. 2: I also plan to sell USD/JPY today in case of two consecutive tests of 157.27 when the MACD is in the overbought area. This will limit the pair's upside potential and cause a reversal downward. Expect a decline to the opposite levels, 156.93 and 156.60.

What is on the chart:

- Thin green line — entry price at which you can buy the instrument;

- Thick green line — estimated price where you can place Take Profit or personally lock in profit, since further upside above this level is unlikely;

- Thin red line — entry price at which you can sell the instrument;

- Thick red line — estimated price where you can place Take Profit or personally lock in profit, since further decline below this level is unlikely;

- MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important. Beginner Forex traders must be very cautious when making entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that successful trading requires a clear trading plan, as outlined above. Spontaneous trading decisions based solely on the current market situation are, from the outset, a losing strategy for an intraday trader.