The price of Bitcoin has surpassed $93,000, then pulled back slightly. Ether also recovered to around $3,200, but then quickly retraced to $3,150.

It is important to understand that active purchases in the crypto market at the start of the year should be supported by equally active actions from large players via spot ETFs. But more importantly, we must get rid of those active sales that limited Bitcoin's upward potential throughout December last year.

Prospects for further growth depend on many factors, including the macroeconomic environment, regulatory changes, and overall market conditions. Institutional investors, previously cautious, may now step up operations, attracted by the potential for high returns and portfolio diversification.

However, risks should not be forgotten. Volatility remains a key characteristic of the crypto market, and sharp price swings are quite possible.

Regulatory developments by the U.S. government and financial authorities will separately have a positive effect on investor sentiment.

Regarding intraday strategy in the crypto market, I will continue to act on large pullbacks in Bitcoin and Ether, expecting the long-term bull market to continue, as it has not disappeared.

Regarding short-term trading, the strategy and conditions are described below.

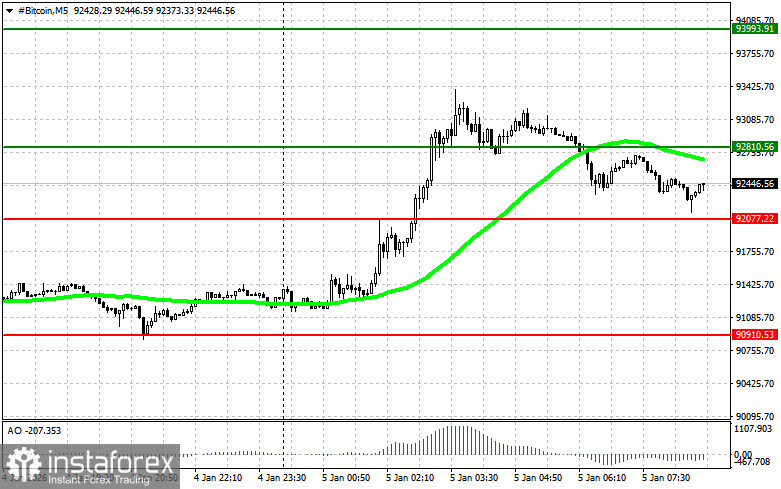

Bitcoin

Buy scenario

Scenario No. 1: I will buy Bitcoin today at an entry point around $92,800, aiming to rise to $39,900. Around $93,900, I will exit the purchases and sell immediately on the rebound. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No.2: Bitcoin can be bought from the lower boundary of $92,000 if there is no market reaction to a break of that level to the downside, expecting a rebound to $92,800 and $93,900.

Sell scenario

Scenario No.1: I will sell Bitcoin today at an entry point around $92,000, with a target to fall to $90,900. Around $90,900, I will exit the sales and buy immediately on the rebound. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No.2: Bitcoin can be sold at the upper boundary of of $92,800 if there is no market reaction to its breakout to the upside, with a move back to $92,000 and $90,900.

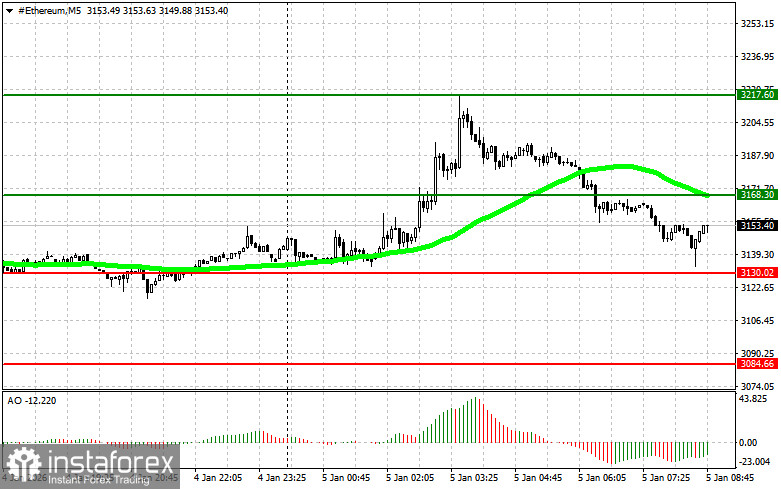

Ethereum

Buy scenario

Scenario No.1: I will buy Ether today at an entry point around $3,168, with a target to rise to $3,217. Around $3,217, I will exit the purchases and sell immediately on the rebound. Before buying on a breakout, make sure the 50-day moving average is below the current price and the Awesome Oscillator is above zero.

Scenario No.2: Ether can be bought from the lower boundary of $3,130 if there is no market reaction to its breakout to the downside, expecting a rebound to $3,168 and $3,217.

Sell scenario.

Scenario No. 1: I will sell Ether today at an entry point around $3,130, with a target to fall to $3,084. Around $3,084, I will exit the sales and buy immediately on the rebound. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is below zero.

Scenario No.2: Ether can be sold from the upper boundary of $3,168 if there is no market reaction to its breakout to the upside, expecting a move back to $3,130 and $3,084.