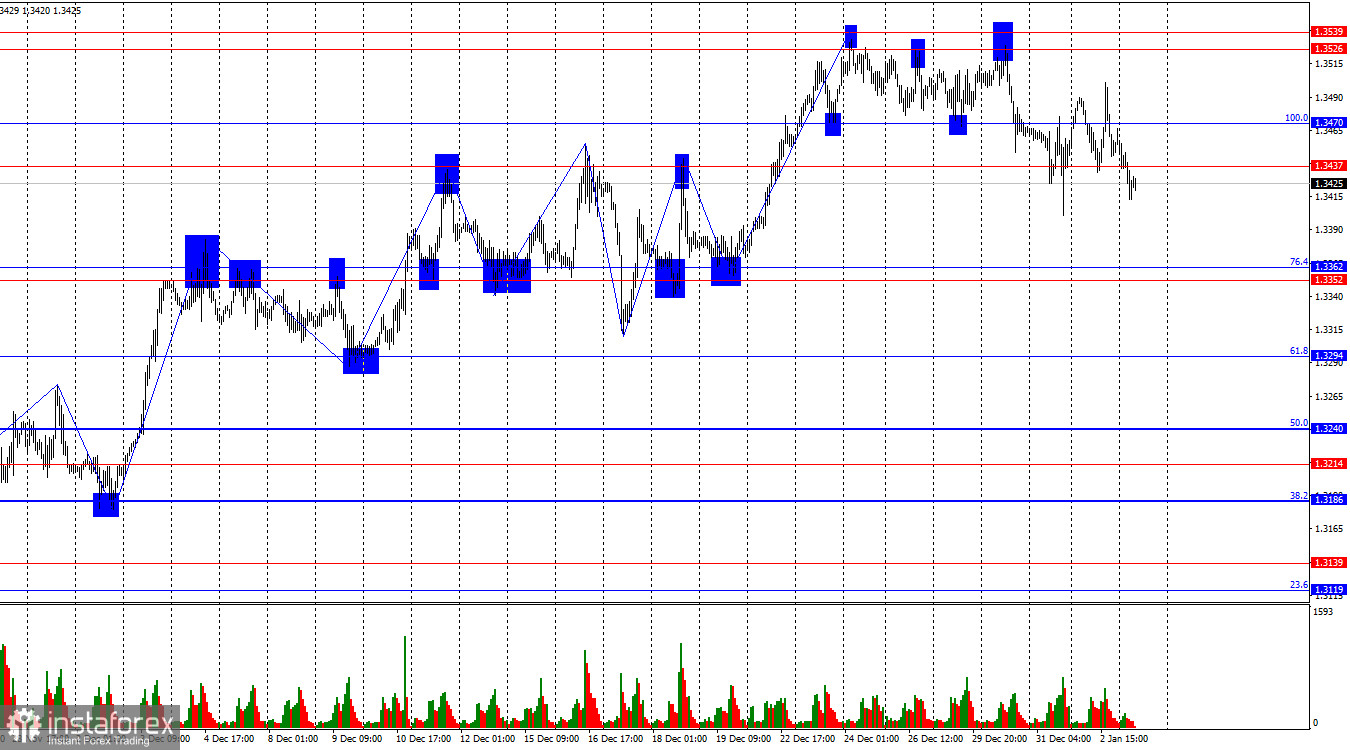

On the hourly chart, the GBP/USD pair traded without a clear direction on Friday. During the day, there were two closes above the 100.0% retracement level at 1.3470, and on Monday morning the price consolidated below the 1.3437 level. Thus, at the moment, a decline toward the support level of 1.3352–1.3362 appears more likely. A consolidation above 1.3470 would once again favor the British pound and a resumption of growth toward the 1.3526–1.3539 level and higher.

The wave structure remains "bullish." The last completed upward wave broke the previous peak, while the current downward wave has not yet broken the previous low. The news background for the pound has been weak in recent weeks, but the news background in the United States also leaves much to be desired. At the beginning of the new year, the bulls pulled back slightly, but the trend remains intact, and traders are awaiting economic data. A break of the "bullish" trend would occur below the 1.3352–1.3362 level.

The news background on Friday was essentially absent, and the arrest of Venezuelan President Nicolas Maduro on Saturday had little impact on the dollar's exchange rate or on trader sentiment. In this context, it was even surprising to see a decline in the EUR/USD pair. Rising risk-off sentiment has not been canceled, but in my view, Maduro's arrest is not a geopolitical conflict or a full-scale war. There is nothing to react to here, even though the event is very important and historic. Traders quickly shifted their focus back to economic data. Today, the first of the significant reports this week will be released—the U.S. ISM Manufacturing PMI for December. This index has been below the 50.0 level since February of last year, that is, since Donald Trump became President of the United States. I do not expect business activity to have increased significantly in December. This week, the Nonfarm Payrolls, ADP, JOLTS, and unemployment rate reports will also be released. Thus, the dollar faces another test of strength.

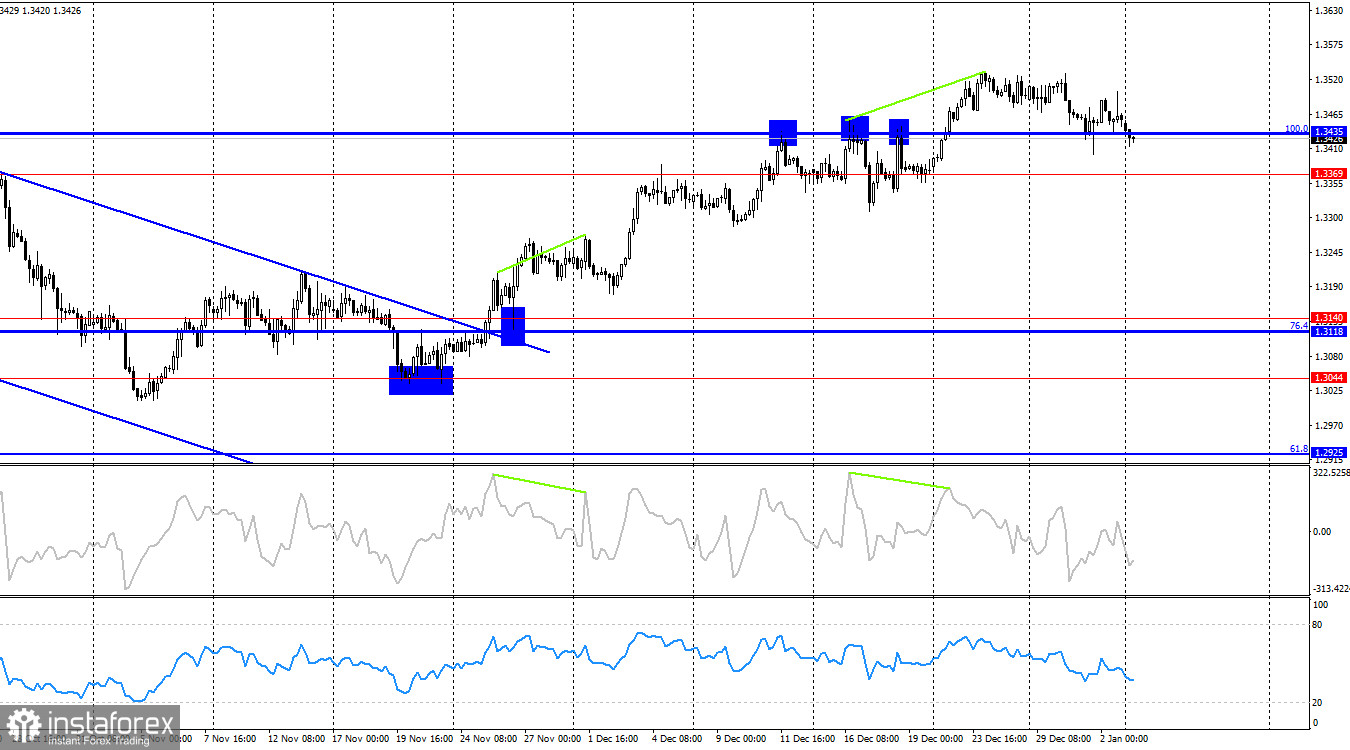

On the 4-hour chart, the pair has returned to the support level of 1.3369–1.3435. A rebound from this zone would favor a resumption of growth toward the next Fibonacci level at 127.2%—1.3795. A "bearish" divergence has formed on the CCI indicator, which triggered a reversal in favor of the U.S. dollar and a decline toward the 1.3369–1.3435 support level. A consolidation below the 1.3369–1.3435 level would allow expectations of a continued decline in the pound.

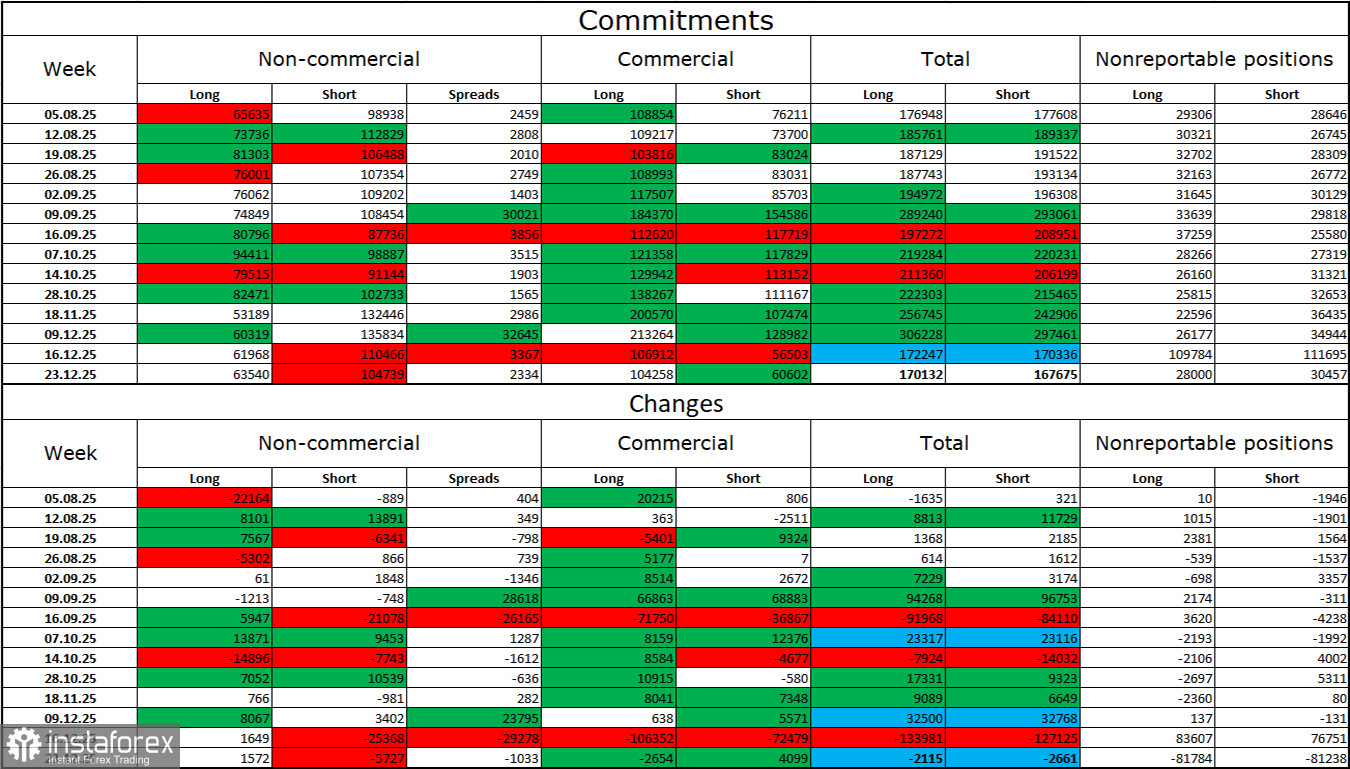

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more bullish over the latest reporting week. The number of long positions held by speculators increased by 1,572, while the number of short positions decreased by 5,727. The gap between the number of long and short positions currently stands at approximately 63,000 versus 105,000. Bears have dominated in recent months, but the pound seems to have exhausted its downward potential. At the same time, the situation with euro contracts is the exact opposite. I still do not believe in a bearish trend for the pound.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency may occasionally enjoy demand in the market, but not in the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Federal Reserve has been forced to ease monetary policy to halt the rise in unemployment and stimulate job creation. For 2026, the FOMC does not plan significant monetary easing, but at present no one can be certain that the Fed's stance will not shift to a more "dovish" one during the year.

Economic Calendar for the U.S. and the U.K.:

- U.S. – ISM Manufacturing PMI (15:00 UTC)

On January 5, the economic calendar contains one event that can be considered important and significant. The impact of the news background on market sentiment on Monday will be felt in the second half of the day.

GBP/USD Forecast and Trading Tips:

Selling the pair was possible after a rebound from the 1.3526–1.3539 level on the hourly chart, with a target at 1.3470. The target has been reached. I would not rush into new sell positions, as the trend remains bullish. I would recommend buying upon a consolidation above the 1.3437–1.3470 level, with a target at 1.3526–1.3539.

The Fibonacci grids are drawn from 1.3470 to 1.3010 on the hourly chart and from 1.3431 to 1.2104 on the 4-hour chart.