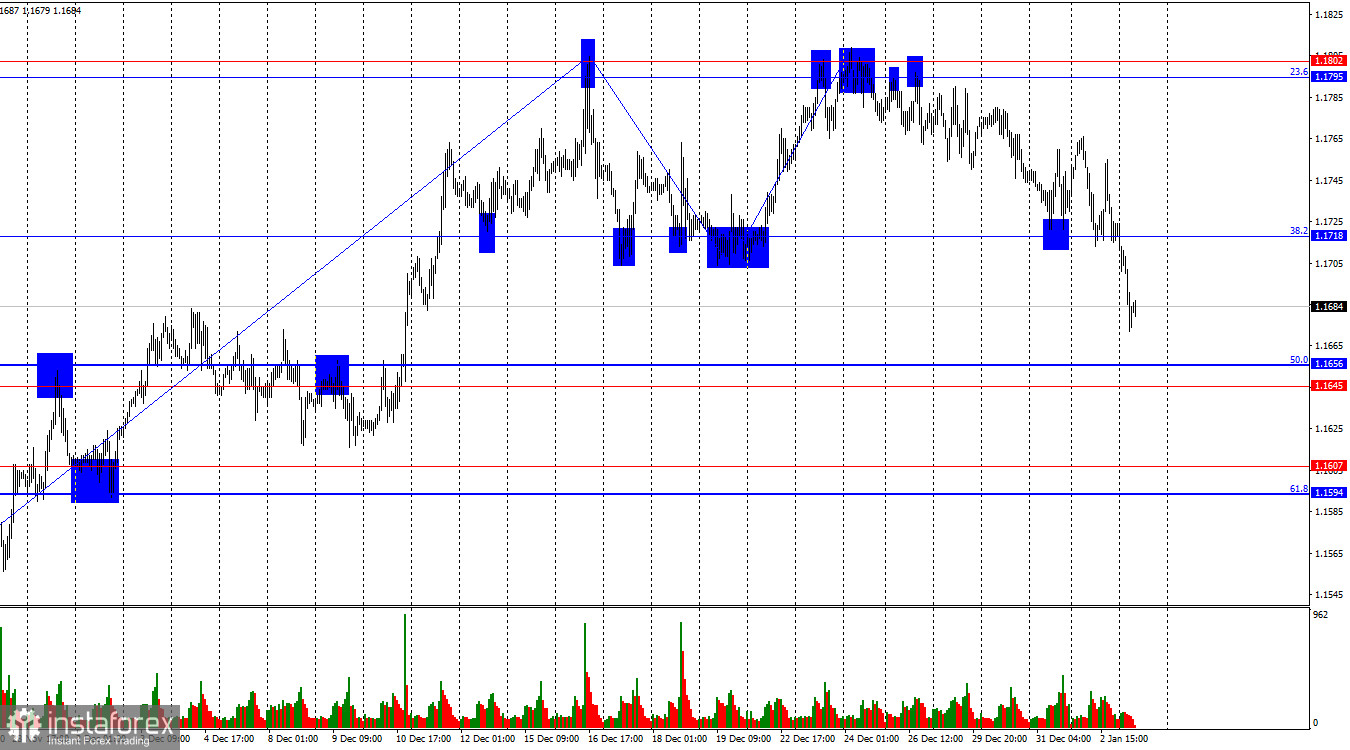

On Friday, the EUR/USD pair once again rebounded from the 38.2% retracement level at 1.1718 and showed a modest rise, but overnight on Monday it consolidated below 1.1718. As a result, the decline may continue toward the support level of 1.1645–1.1656. A rebound from this zone would favor the European currency and a modest rise toward the 1.1718 level. A consolidation below this zone would increase the likelihood of further decline toward the next support zone at 1.1594–1.1607.

The wave picture on the hourly chart remains straightforward. The last completed upward wave failed to break the peak of the previous wave, while the new downward wave broke the previous low. Thus, the trend has shifted to "bearish." In my view, the decline will not be prolonged, but a break of the now "bearish" trend is required before expecting a new rise in the euro. Based on the current chart structure, such a break would occur above the resistance zone of 1.1795–1.1802.

On Friday, the news background in both the U.S. and the European Union remained absent, but over the weekend Washington conducted a military operation in Venezuela, resulting in the capture of President Nicolas Maduro. Donald Trump had warned Maduro for several months about the consequences of his country's involvement in drug trafficking and terrorism, urging him to resign. The U.S. president had warned that if he refused, a military operation would be carried out to overthrow the current government. Maduro made no concessions and refused to leave office. At present, the Venezuelan president has been transported to New York, where he is expected to appear in court as early as today. The market reacted to this event with restrained dollar buying, but it was precisely these purchases that broke the bullish trend in EUR/USD. For bears to continue their attacks this week, a strong news background from the U.S. will be required, and we will soon be able to determine whether this is a genuine bearish trend or merely a random decline that will end very quickly.

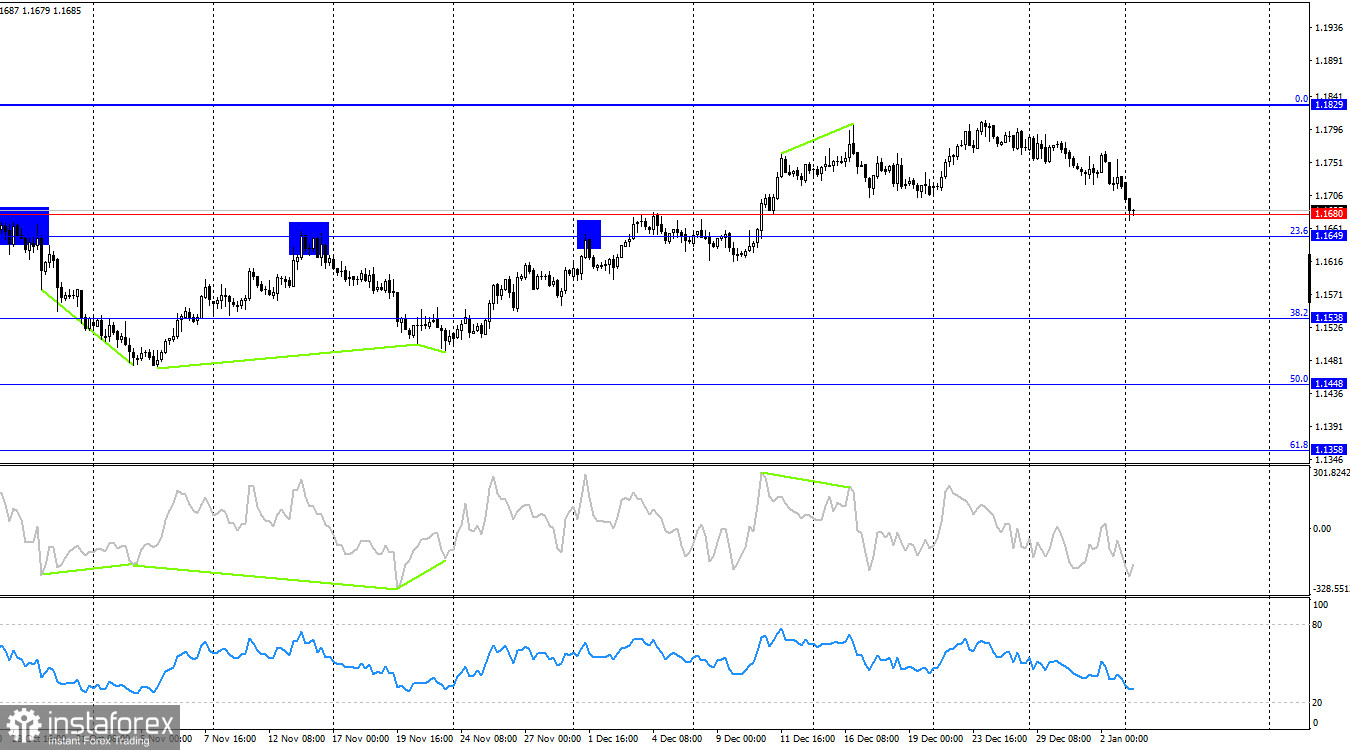

On the 4-hour chart, the pair has returned to the 1.1680 level. A rebound from this level would favor the EU currency and a resumption of growth toward the 0.0% retracement level at 1.1829. A consolidation below the support zone of 1.1649–1.1680 would increase the chances of continued decline toward the next Fibonacci level at 38.2%—1.1538. No emerging divergences are observed on any indicators today.

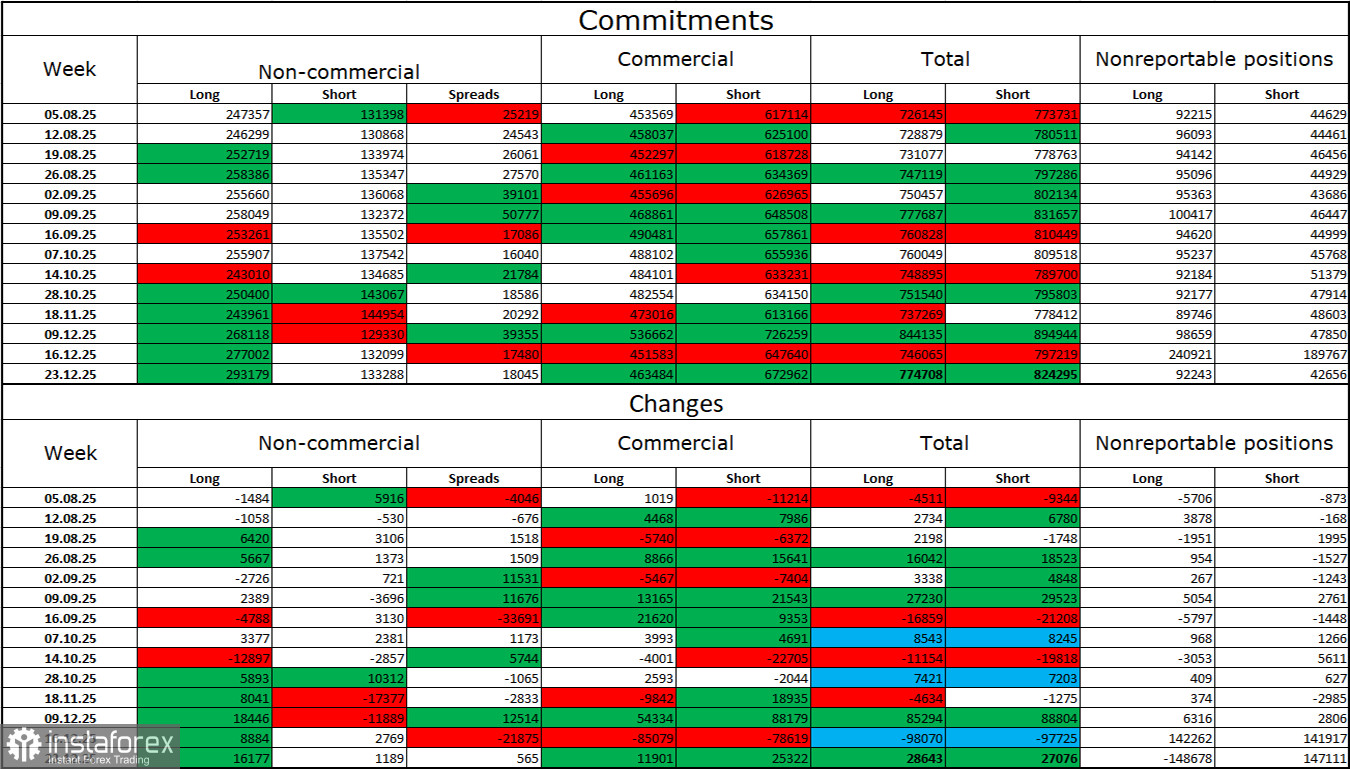

Commitments of Traders (COT) Report:

During the latest reporting week, professional players opened 16,177 long positions and 1,189 short positions. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and his policies, and continues to strengthen over time. The total number of long positions held by speculators now stands at 293,000, while short positions amount to 133,000—more than a twofold advantage for the bulls.

For thirty-three consecutive weeks, large players were reducing short positions and increasing long ones. Then the shutdown began, and now we see the same picture again: professional traders continue to build up long positions. Donald Trump's policies remain the most significant factor for traders, as they create numerous problems that will have long-term and structural consequences for the United States—for example, the deterioration of the labor market. Traders fear a loss of Federal Reserve independence in 2026 under pressure from Trump, against the backdrop of Jerome Powell's resignation in May.

Economic Calendar for the U.S. and the Eurozone:

- U.S. – ISM Manufacturing PMI (15:00 UTC)

On January 5, the economic calendar contains one important event. The impact of the news background on market sentiment on Monday will be felt in the second half of the day.

EUR/USD Forecast and Trading Tips:

Selling the pair was possible after a rebound from the 1.1795–1.1802 level on the hourly chart, with a target at 1.1718. The target was reached on Friday. A close below the 1.1718 level made it possible to open new short positions with a target at 1.1656. Buy positions can be opened today on a rebound from the 1.1645–1.1656 level, with a target at 1.1718.

The Fibonacci grids are drawn from 1.1392 to 1.1919 on the hourly chart and from 1.1066 to 1.1829 on the 4-hour chart.