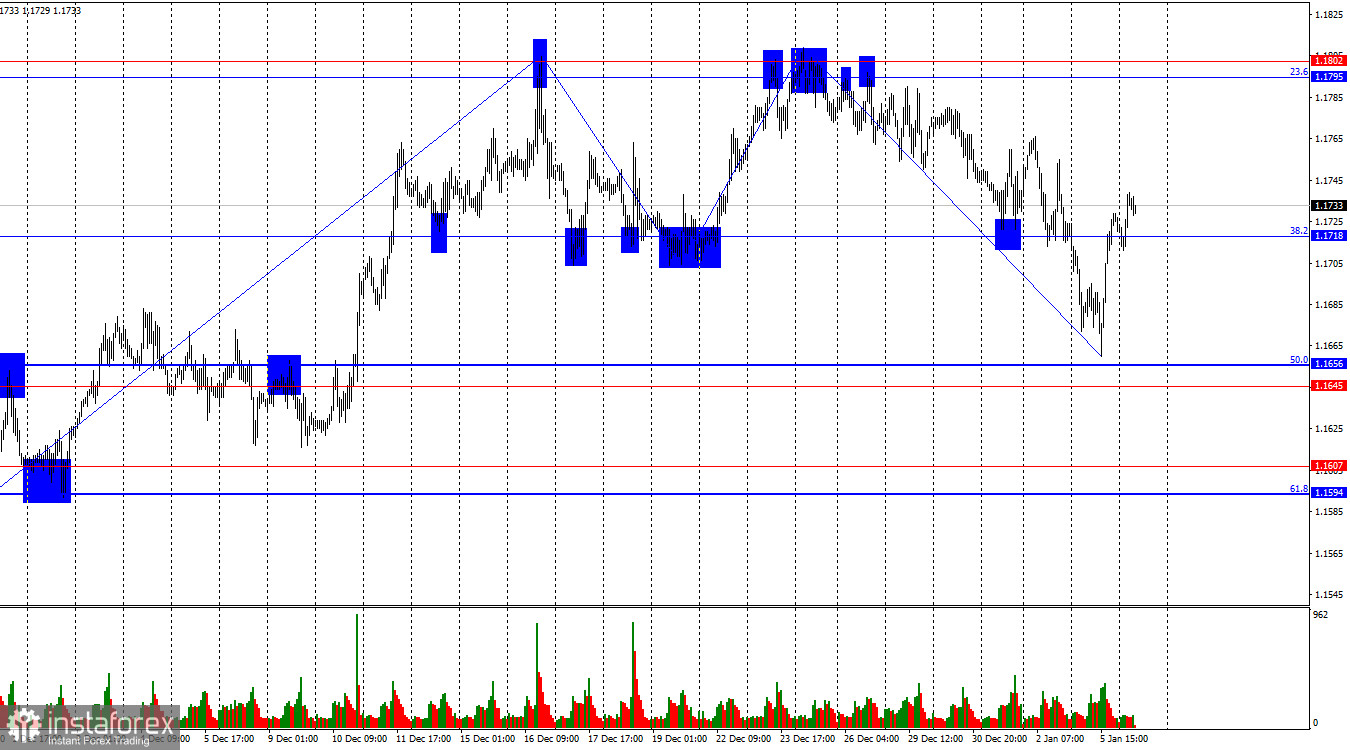

On Monday, the EUR/USD pair held below the 38.2% retracement level at 1.1718 and fell almost to the support level at 1.1645–1.1656. There was no rebound from this zone, but a reversal in favor of the euro was achieved. As of Tuesday morning, the pair closed above 1.1718, allowing for the potential continuation of growth toward the next resistance zone at 1.1795–1.1802.

The wave situation on the hourly chart remains simple. The last completed upward wave did not break the peak of the previous wave, while the new downward wave broke the previous low. Thus, the trend has shifted to "bearish." In my view, the decline will not be long, but a break of the current "bearish" trend is now required to anticipate a new rise in the euro. According to the current chart, such a break would occur above the resistance level at 1.1795–1.1802 or after two consecutive "bullish" waves.

On Monday, traders rushed to react to the Venezuela situation. Since Maduro's arrest indicated a confrontation between Venezuela and the US, and conciliatory rhetoric from both sides was unconvincing, traders began buying the dollar, which still has the status of a safe-haven asset. However, this unexpected advantage for the US currency quickly faded. In the afternoon, the ISM Manufacturing Index for December was released in the US, showing a modest 0.1-point increase followed by another 0.3-point decline. Bearish traders had not anticipated this development, so they began retreating, and dollar purchases ended as abruptly as they had started. In my view, the market has already factored in Maduro's arrest and the subsequent events related to it. From now on, economic statistics in the US take center stage. Today's calendar is empty, but in the remaining three days of the week, important data will be plentiful—and almost every report will significantly impact the dollar.

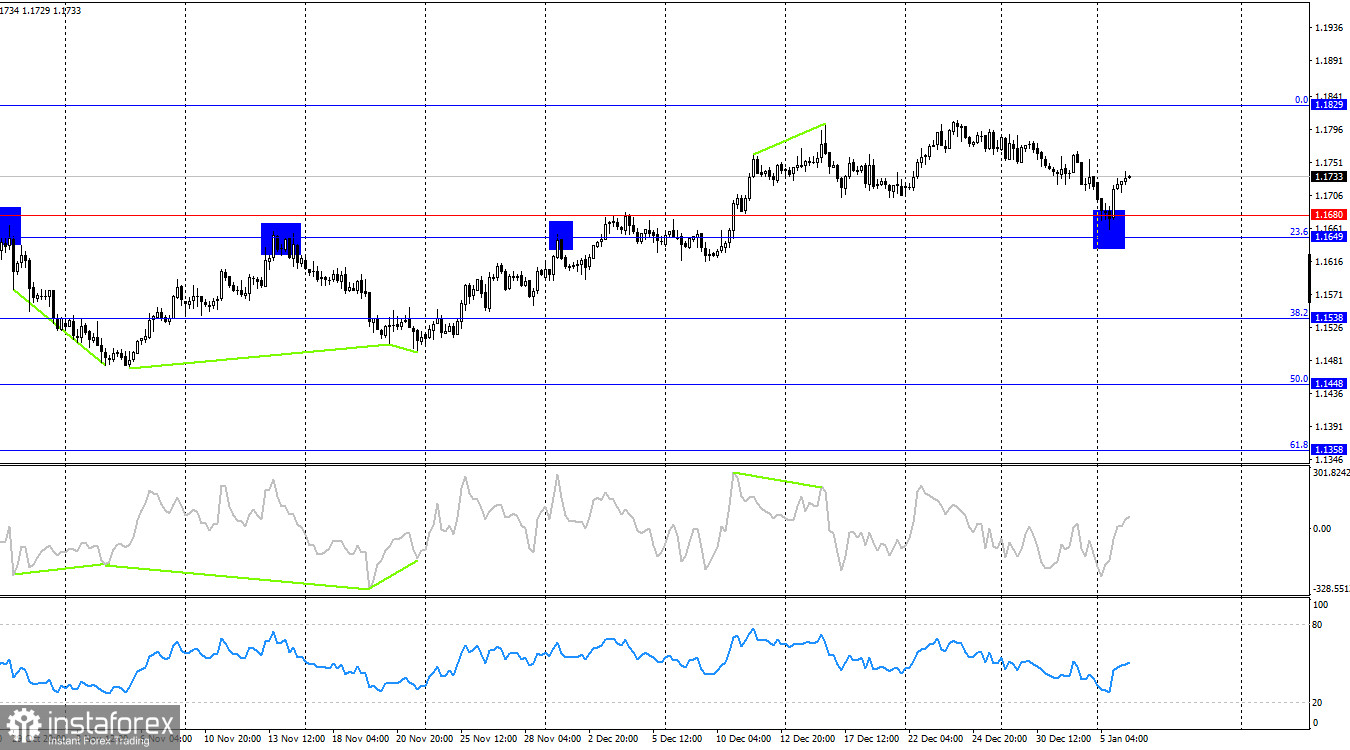

On the 4-hour chart, the pair rebounded from the support level at 1.1649–1.1680, reversing in favor of the euro. Thus, the upward movement could continue toward the 0.0% retracement level at 1.1829. Holding below the 1.1649–1.1680 support zone would increase the likelihood of further declines toward the next 38.2% Fibonacci level at 1.1538. No emerging divergences are observed on any indicators today.

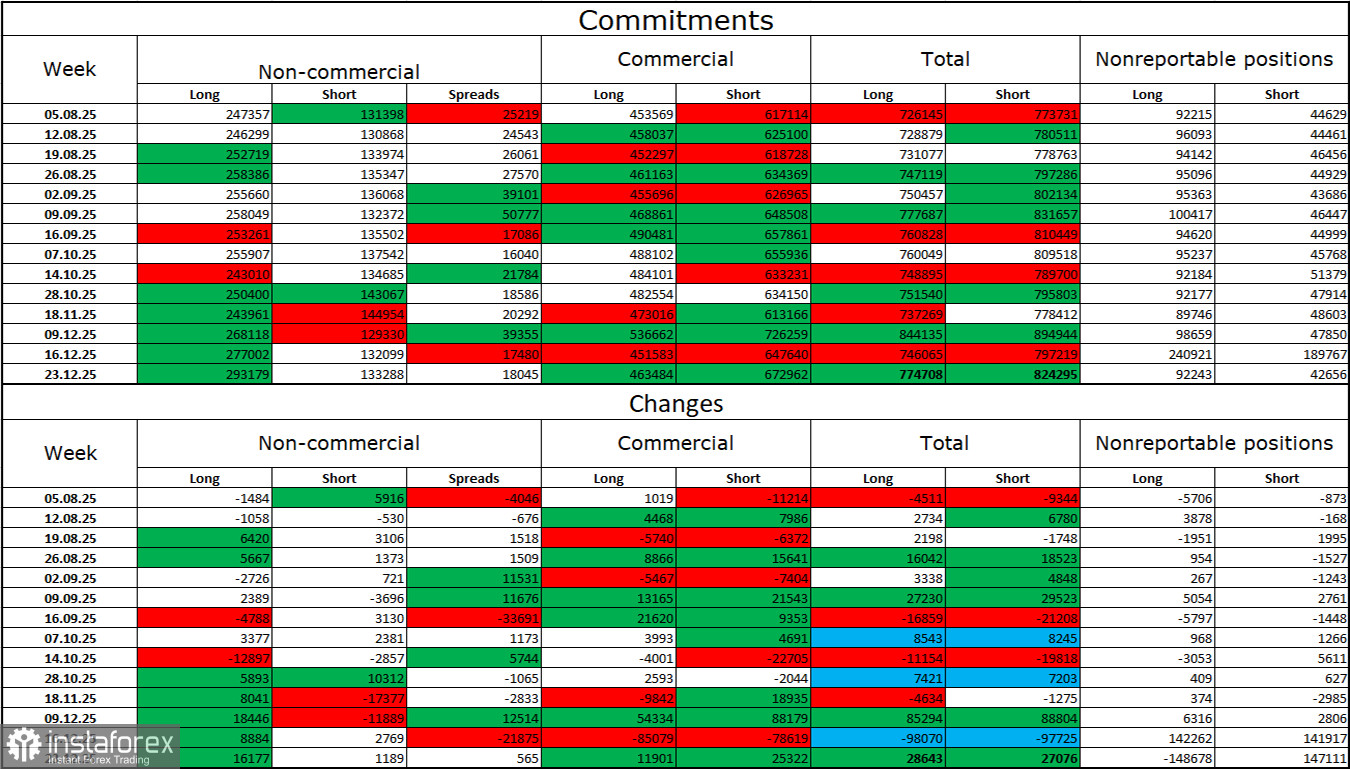

Commitments of Traders (COT) Report:

Over the last reporting week, professional traders opened 16,177 long positions and 1,189 short positions. The sentiment of the "Non-commercial" group remains bullish, largely due to Donald Trump and his policies, and it continues to strengthen over time. The total number of long positions held by speculators now stands at 293,000, while short positions total 133,000—more than a twofold advantage for the bulls.

For thirty-three consecutive weeks, major players have been closing short positions and increasing longs. Then a "shutdown" occurred, and now we see the same pattern: professional traders continue to accumulate long positions. Donald Trump's policies remain the most influential factor for traders, as they create many long-term structural challenges for the US—for example, worsening conditions in the labor market. Traders fear the Fed's loss of independence in 2026 under Trump's pressure and with Jerome Powell's resignation in May.

US and EU News Calendar:

EU – Germany Consumer Price Index (13:00 UTC).

On January 6, the economic calendar contains only one minor entry. The impact of the information background on market sentiment on Tuesday will be very weak.

EUR/USD Forecast and Trader Advice:

Selling the pair was possible on a rebound from the 1.1795–1.1802 level on the hourly chart, targeting 1.1718. That target was reached on Friday. Closing below 1.1718 allowed for new short positions targeting 1.1656, but yesterday the price missed that target by just 4 points. Long positions could be opened when the pair closed above 1.1718, with targets of 1.1795–1.1802.

Fibonacci levels are plotted from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.