Trade Review and Trading Advice for the Japanese Yen

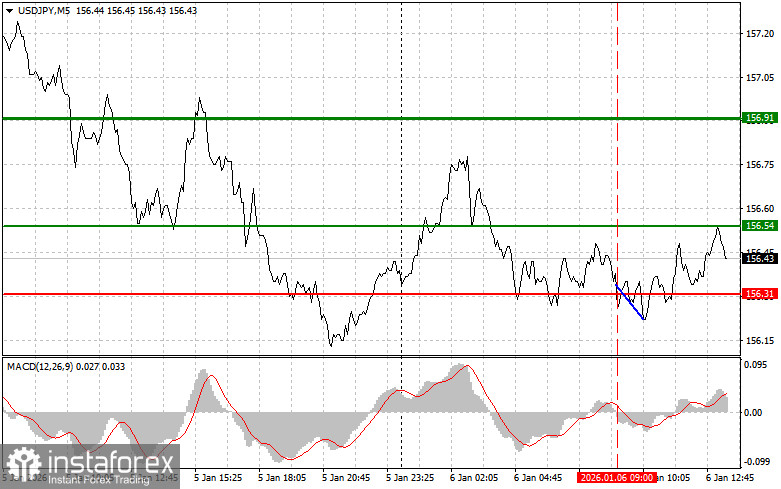

A test of the 156.31 price level occurred at a moment when the MACD indicator was just beginning to move downward from the zero line, which confirmed a valid entry point for selling the dollar. As a result, the pair declined by only 10 points.

In the second half of the day, attention will be focused on the release of the US Services PMI and the Composite PMI, as well as a speech by FOMC member Thomas Barkin. His remarks regarding a pause in the rate-cutting cycle in January this year could have a significant impact on the dollar against the yen.

Markets will carefully analyze the PMI figures in an attempt to detect signals about the state of the US economy. Sustained growth in the services sector, confirmed by strong index readings, would strengthen the dollar, implying less need for aggressive monetary easing. Conversely, weak data could spark speculation about an early resumption of rate cuts, putting pressure on the US currency. However, the greatest interest lies in Thomas Barkin's speech. His comments on the January pause and the outlook for further Federal Reserve policy could become a catalyst for significant volatility in the currency market. If Barkin expresses concern about the need for additional measures to stimulate the economy, this could reinforce expectations of rate cuts and weaken the dollar against the yen. On the other hand, a hawkish tone in Barkin's rhetoric, emphasizing the risks of persistently high inflation or the resilience of the US economy, would support the dollar and trigger its strengthening against the yen.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

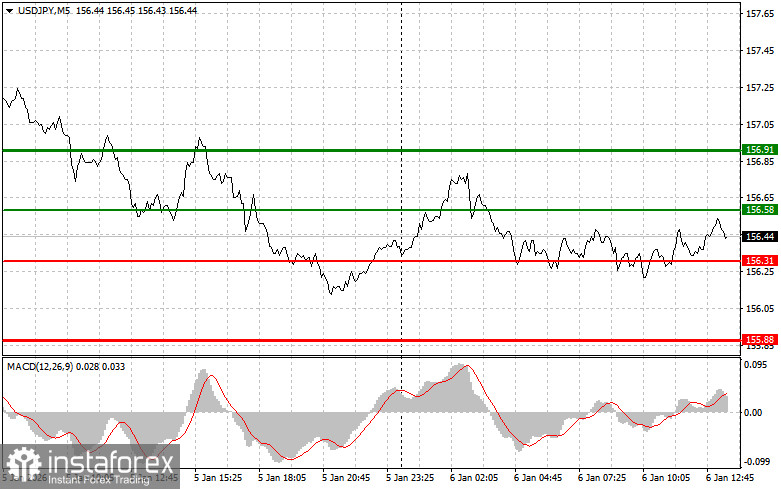

Scenario No. 1: I plan to buy USD/JPY today upon reaching the entry point around 156.58 (green line on the chart), targeting a rise toward 156.91 (thicker green line on the chart). Around 156.91, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 point move from that level. A rise in the pair can be expected in continuation of the trend.Important! Before buying, make sure the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy USD/JPY today in the event of two consecutive tests of the 156.31 level while the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a bullish market reversal. Growth toward the opposite levels of 156.58 and 156.91 can be expected.

Sell Signal

Scenario No. 1: I plan to sell USD/JPY today after a breakout below the 156.31 level (red line on the chart), which would lead to a rapid decline in the pair. The key target for sellers will be the 155.88 level, where I plan to exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 point move from that level. Pressure on the pair may return today if US economic data are weak.Important! Before selling, make sure the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 156.58 level while the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a bearish market reversal. A decline toward the opposite levels of 156.31 and 155.88 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – projected price where Take Profit orders can be placed or profits can be manually secured, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – projected price where Take Profit orders can be placed or profits can be manually secured, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to focus on overbought and oversold zones.

Important. Beginner Forex traders should be extremely cautious when making market entry decisions. Before the release of important fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.