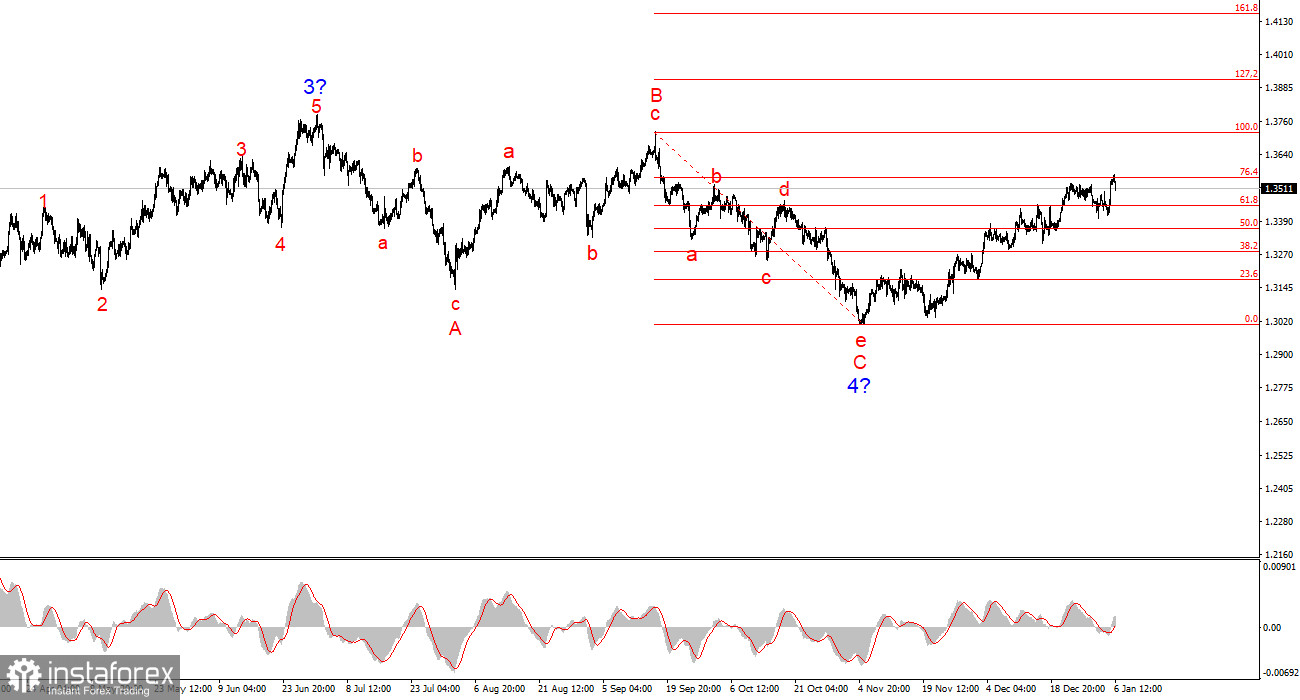

For GBP/USD, the wave count continues to indicate the formation of an upward trend segment (bottom chart), but over the past six months it has taken on a complex corrective form (top chart). The trend segment that began on July 1 can be considered Wave 4, or any global corrective wave, as it clearly has a corrective rather than an impulsive internal structure. The same applies to its internal sub-waves. The downward wave structure that began on September 17 has taken on a five-wave a–b–c–d–e form and has been completed. The instrument is now in the process of forming a new bullish wave sequence.

Of course, any wave structure can become more complex at any time and extend further. Even the presumed Wave 4 may still evolve into a five-wave structure, in which case we could observe a correction for several more months. Therefore, the market is currently at a bifurcation point: either Wave 4 has been completed and a prolonged rise of the pound will follow within Wave 5, or a new corrective wave sequence will begin with a decline below the 1.3000 level.

The GBP/USD pair fell slightly on Tuesday, but more serious changes may occur by the end of the day. First of all, I would like to draw attention to the internal structure of the presumed Wave 3 or C, which began forming on November 20. Can it be classified as a three-wave or a five-wave structure? The internal waves are relatively small, especially the corrective ones. Typically, such a wave structure indicates a prolonged price movement (in our case, growth), where the internal structure is of secondary importance. For now, this is just a hypothesis, as the wave structure of EUR/USD looks much more convincing. However, the euro may move into the formation of the fifth wave of the current trend segment this week. In that case, both the euro and the pound would continue to rise, with this scenario depending on the US labor market and unemployment data.

By and large, market participants ignored the arrest of Nicolas Maduro on Saturday, which is very positive for the pound's outlook. If the market ignores factors that support the dollar (even if only formally), it means it is inclined toward buying. According to the global wave count, the pound has begun forming Wave 5. If this assumption is correct, then any increase in prices is welcome. The dollar could receive support only from a tightening of the Federal Reserve's monetary stance, but for now the FOMC is closely monitoring the labor market. If the "cooling" continues, interest rates will have to be cut regardless of policymakers' preferences. If inflation continues to slow as well, this would be another reason to conduct several rounds of monetary easing in 2026.

General Conclusions

The wave picture for GBP/USD has changed. The downward corrective structure a–b–c–d–e within Wave C of Wave 4 appears complete, as does Wave 4 itself. If this is indeed the case, I expect the main trend segment to resume its development with initial targets around the 1.3800 and 1.4000 levels.

In the short term, I expected the formation of Wave 3 or C with targets near 1.3280 and 1.3360, corresponding to the 76.4% and 61.8% Fibonacci levels. These targets have been reached. Wave 3 or C has presumably completed its formation, so in the near future a downward wave or a corrective wave sequence may develop.

The higher-timeframe wave count looks almost ideal, even though Wave 4 moved beyond the high of Wave 1. However, I would like to remind readers that ideal wave counts exist only in textbooks; in practice, everything is far more complex. At the moment, I see no reason to consider alternative scenarios to the bullish trend segment.

Core Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often lead to changes.

- If there is no confidence in what is happening in the market, it is better to stay out.

- There is no and can never be 100% certainty about price direction. Do not forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.