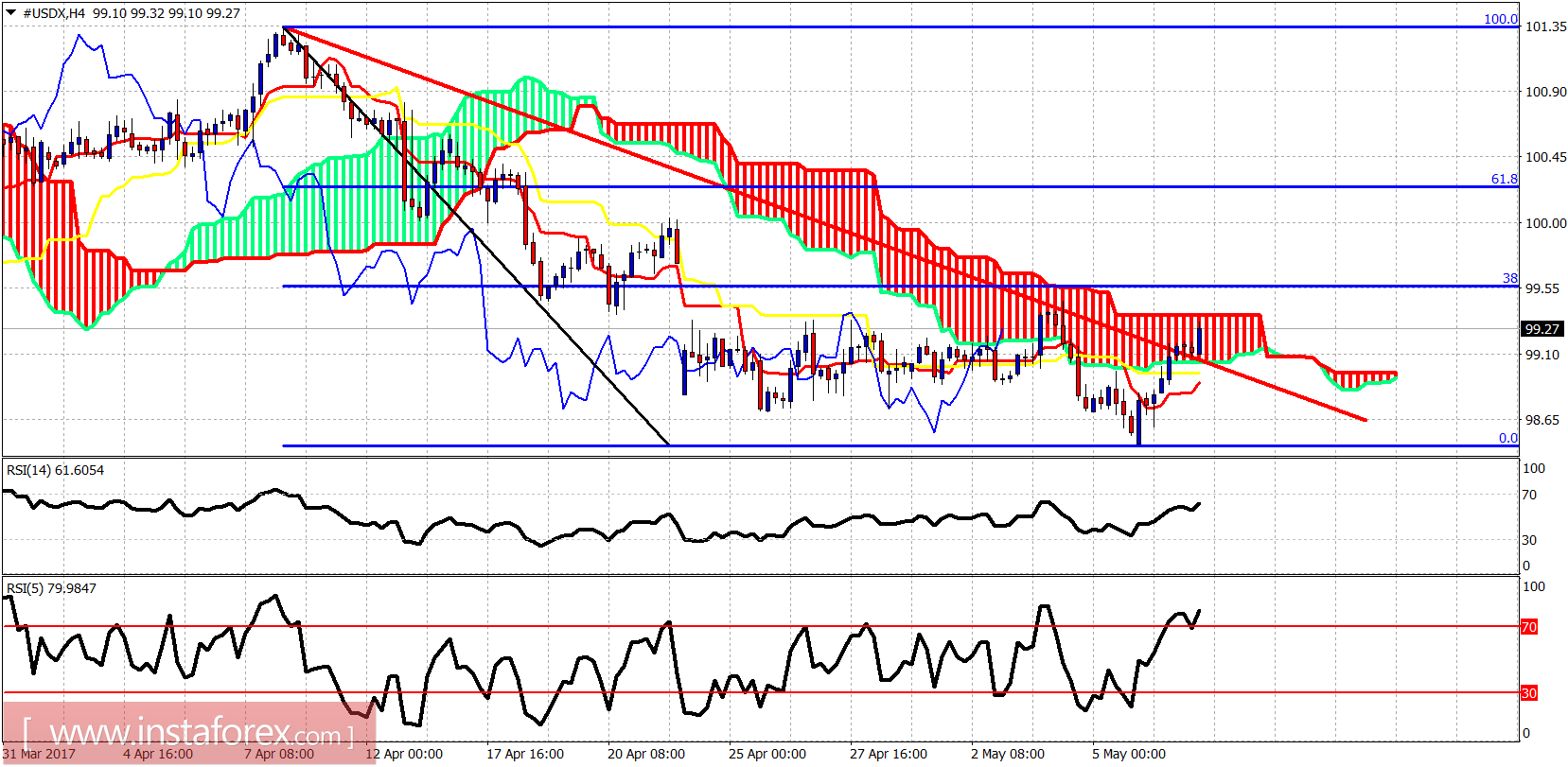

The Dollar index is bouncing as we expected from our last post. Price is now trying to break above the 4-hour Kumo resistance and move towards the first Fibonacci retracement level of importance at 99.60.

Red line - resistance

The Dollar index has broken above the red trend line resistance. Trend is neutral in the 4-hour chart as price is inside the 4-hour Kumo. Important short-term resistance is at 99.37 and 99.60. The upper cloud boundary and the 38% Fibonacci retracement are the levels to watch.

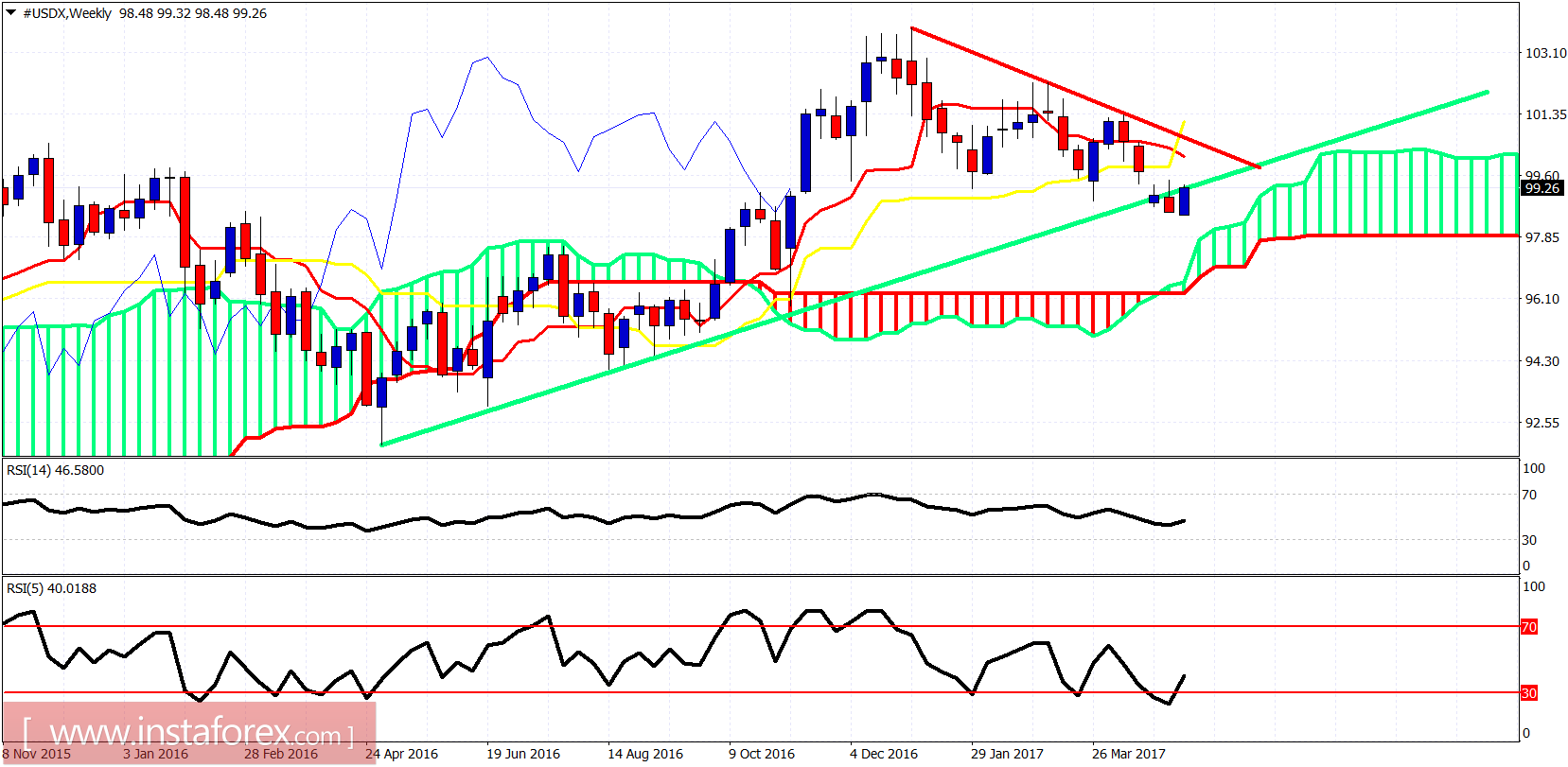

Green line - support

The Dollar index has broken below the green long-term trend line support and is now trying to get back inside. The bounce was justified and awaited since last week. Resistance is at 100.20 (tenkan-sen) and at 100.60 (red trend line). Support is at 97.50 at the weekly upper Kumo boundary.